1031 Exchanges for Real Estate Investment Success

Discover the ins and outs of 1031 exchanges in real estate investing, including benefits, rules, and limitations to make informed decisions. Learn how to defer capital gains, swap properties, and work with qualified intermediaries for successful exchanges.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

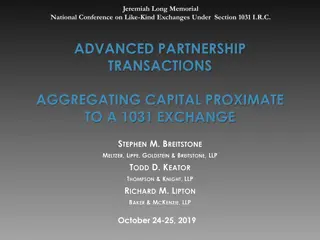

1031 Exchanges January 2023

WHAT IS A 1031 EXCHANGE?

1 Real Estate Investing Tool

2 Allows for Capital Gains to be Deferred

3 Swap one investment property for another

MUST BE THROUGH A QUALIFIED INTERMEDIARY

QI FACILITATES THE EXCHANGE

HAS TO BE A LIKE-KIND EXCHANGE

HAS TO BE ACKNOWLEDGED IN THE CONTRACT

WHAT ARE THE LIMITS?

1 Three-Property Rule

2 Sold within 45 days and conclude within 180

3 The 200% Rule

4 The 95% Rule