2009 Bond Refinancing Approval of Issuance

Overview of the 2009 bond refinancing approval of issuance resolution by Philip Leiber, Director of Finance & Administration. It details the financing team, structuring details, anticipated savings, and the purpose of the funds in tax-exempt and taxable bonds.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

2009 BOND REFINANCING- APPROVAL OF ISSUANCE RESOLUTION Philip Leiber, Director of Finance & Administration August 2, 2018

Financing Team Central Contra Costa Sanitary District Roger S. Bailey, General Manager Ann Sasaki, Deputy General Manager Philip Leiber, Director of Finance & Administration Jean-Marc Petit, Director of Engineering and Technical Services Thea Vassallo, Finance Manager Bond & Disclosure Counsel Jones Hall David Fama, Shareholder James Wawrzyniak Jr., Shareholder Financial Advisor PFM Financial Advisors LLC Sarah Hollenbeck, Managing Director Nicholas Jones, Senior Managing Consultant Underwriter Piper Jaffray Tom Innis, Managing Director Greg Swartz, Senior Vice President 2

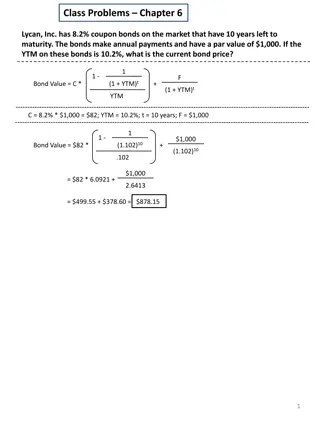

Overview of Financing 2018A: Approximately $15.3 million in tax-exempt Wastewater Revenue Refunding Bonds Proceeds used to refund $19.635 million outstanding 2009A Wastewater Revenue Certificates of Participation (Taxable Build America Bonds) 2009A Certificates subject to Extraordinary Optional Prepayment based on reduction of BAB subsidy under sequestration Final maturity: September 1, 2029 2018B: Approximately $4.3 million in taxable Wastewater Revenue Refunding Bonds Proceeds used to advance refund the outstanding $6.98 million 2009B Wastewater Revenue Certificates of Participation Final maturity: September 1, 2023 3

Structuring Details Generally the same debt amortization profile as the existing debt. One credit rating (S&P) for the refunding debt. Debt Service Reserve Fund (DSRF) on new debt with consideration of issues surrounding the priority and security of Ad Valorem Property Tax. Proceeding without a DSRF on the new bonds does not adversely affect legal arguments that could be raised in the event of potential State actions affecting Ad Valorem Property Tax. Therefore, no DSRF. Added optional Rate Stabilization Fund (RSF). No Central Contra Costa Sanitary District Facilities Financing Authority approvals are necessary. The manner in which the existing bonds will be retired: Series A - Extraordinary redemption, Series B - escrow and advance refund on a taxable basis. 4

Anticipated Savings Bond Year 2018A 2018B Total Savings Total cash flow savings estimated at $8.1 million 9/1/2019 $70,158 $638,758 $708,916 9/1/2020 476,404 652,419 1,128,823 9/1/2021 477,702 651,451 1,129,154 Equivalent to $2.4 million Net Present Value savings 9/1/2022 474,944 654,221 1,129,165 9/1/2023 476,482 650,384 1,126,866 9/1/2024 477,565 477,565 9/1/2025 478,226 478,226 2018A 2018B Total 9/1/2026 478,402 478,402 Cash Flow Savings NPV Savings ($) NPV Savings (% of refunded par) $4,831,952 $3,247,233 $8,079,185 9/1/2027 473,581 473,581 $2,270,212 $157,976 $2,428,188 9/1/2028 474,012 474,012 9/1/2029 474,475 474,475 11.56% 2.26% Total $4,831,952 $3,247,233 $8,079,185 *Preliminary, subject to change 5

Legal Structure Double Barrel Pledge First lien on all of the Tax Revenues and Net Revenues in addition to all of the moneys in the Debt Service Fund (DSF) Flow of Funds All Tax Revenues and Gross Revenues deposited to Wastewater System Fund immediately upon receipt The first step is Tax Revenues transferred to the DSF, as needed for debt service The second step is Net Revenues transferred to the DSF, as needed for debt service Rate covenant Produce Net Revenues (excluding capacity fees) which are sufficient in each Fiscal Year to provide Net Revenues which, together with the Tax Revenues, are at least equal to 125% of the aggregate principal and interest on the parity bonds Additional Bonds Test for Parity Bonds 125% MADS coverage from the Tax Revenues and the Net Revenues (excluding capacity fees) No DSRF Option to establish Rate Stabilization Fund 6

Bond Preliminary Official Statement-Risk Factors Demand and Usage (may differ from expectations) Expenses (may differ from plan) Property Taxes (assessed values, potential State actions) Future Parity Obligations (may be issued) No DSRF (may have RSF; other reserves) Natural Disasters (seismic, flooding, fire) Proposition 218 (future potential changes; very limited protests to date) Other: Limited recourse on default; limitations on remedies available/bankruptcy; Limited obligation; change in laws; loss of tax exemption. 27

Rating Agency Presentation-Conclusions Economic and regional outlook strong and is continuing to improve Essential wastewater service provider with large customer base Rates reasonable in comparison to peer utilities in the San Francisco Bay Region Double barrel pledge by the Tax Revenues and Net Revenues (including backing by Teeter Plan) Financial profile is strong with low debt levels, strong revenues, and solid debt service coverage Well run and well regarded utility with high levels of customer satisfaction 8

Financing Schedule Date Event Receive Rating Week of August 6 Post Preliminary Official Statement Week of August 13 Bond Pricing Week of September 10 Closing 9

Recommended Board Action- Approve Issuance Resolution that provides for: Authorization for the issuance of Refunding Bonds; Approval of Indenture (the legal contract specifying the important features of bonds-- maturity date, timing of interest payments, method of interest calculation, and security for the bonds, etc); Refinancing of the 2009 Certificates; Sale of Refunding Bonds via negotiated sale to Piper Jaffray under the terms of the Bond Purchase Contract; Approval of the preliminary Official Statement. Provides description of bonds to prospective investors. Includes: (a) description of the bonds and the legal documents governing them; (b) description of Central San; and (c) the most recently available audited financial statements of Central San; Approval of the Continuing Disclosure Certificate. Commits Central San to publish annually certain information to bondholders; Adoption of documents in substantially final form. The documents are in substantially final form, except for numbers which are subject to the results of the bond sale; and Authorizes the Board President, the General Manager, the Director of Finance and Administration, and any and all other officers of Central San to take any and all actions to consummate the transactions described. 10

Questions? 11