2020 Capital Market Committee Meeting Highlights

Discover the progress made during the 2020 Capital Market Committee webinar meeting, including efforts to consolidate multiple accounts and key resolutions to address challenges faced. Understand the steps taken, major progress achieved, and ongoing challenges in the capital market. Explore how stakeholders aim to enhance cooperation and awareness to improve market efficiency and investor engagement.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

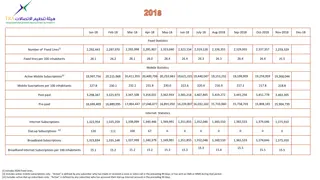

2020 CAPITAL MARKET COMMITTEE (WEBINAR) MEETING Thursday, 20thAugust, 2020 PRESENTATION BY MULTIPLE SUBSCRIPTIONS committee

Major Progress Since the last CMC Meeting Based on reports submitted by Registrars and Stockbrokers, from inception to second quarter 2020, a total of 45,733 multiple accounts have so far been consolidated involving 4.823 billion units of shares.

STEPS TAKEN The Committee met on Wednesday, 11th March, 2020 and considered the reports on mandated accounts as submitted by Registrars and Stockbrokers. Members were concerned about the declining trend as compliance with periodic submission of reports was very poor and number of consolidated accounts kept shrinking by the quarter. The Committee also deliberated on the following key issues among others: The need for cooperation between CSCS and NIBSS o n information validation; The case of Nigerian investors in the diaspora (with or without BVN) who have unclaimed dividend issues.

Key Resolutions That the CSCS should request SEC to engage NIBSS on the issue of getting access to Investor Account Numbers (including converting old accounts to NUBAN) as part of BVN Validation; That the CSCS should report consolidated accounts to SEC from inception of the exercise; That ICMR should request CSCS to give a formal confirmation that information transmitted were being validated; SEC to make case for Nigerian investors in the diaspora with unclaimed dividend issues at the Financial Services Regulation Coordinating Committee (FSRCC) meeting in April; That enlightenment campaigns especially through social media channels should be reinvigorated. However, the resolutions could not be implemented due to the lockdown necessitated by the covid-19 pandemic.

CHALLENGES The major challenge being encountered in the implementation of the Multiple Accounts Consolidation exercise is low awareness of the initiative among investors and other capital market stakeholders.