2021 Economic Outlook: Vaccines Boosting Recovery

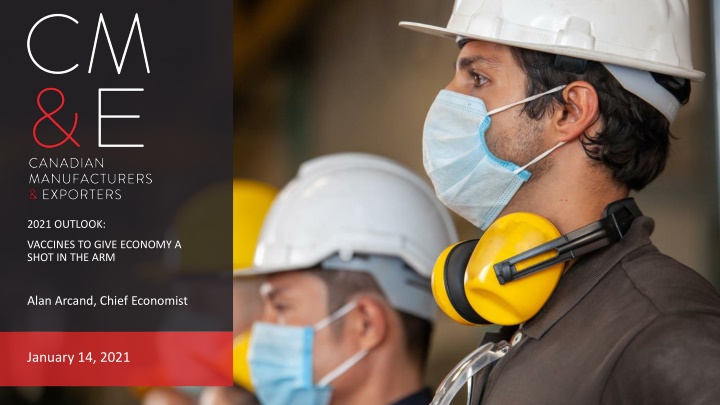

As the vaccine rollout gains momentum, Canada's economy is poised for a rebound. Household savings increase, spending shifts to goods, and real GDP shows signs of recovery. However, uneven progress is evident across sectors, highlighting the need for continued vigilance and targeted interventions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

2021 OUTLOOK: VACCINES TO GIVE ECONOMY A SHOT IN THE ARM Alan Arcand, Chief Economist January 14, 2021

AGENDA 2021 Manufacturing Outlook Industry Strategy Council Report 2021 MANUFACTURING OUTLOOK

COVID-19 CASES SPIKING IN CANADA New cases per million (7-day average) World Canada 300 250 200 150 100 50 0 SOURCE: OUR WORLD IN DATA.

VACCINATIONS RAMPING UP SLOWLY COVID-19 vaccination as a share of the population, first dose (January 13) ISR ARE GIB BHR GBR USA DNK ITA ISL SVN This chart shows Canada s vaccination rate relative to 24 other countries. ESP LTU CAN EST HUN POL DEU HRV As o January 13, Canada had vaccinated 1.11% of its population. IRL ROU SWE SVK AUT PRT CYP We need to reach a vaccination rate of at least 60-70% to achieve herd immunity. 0 5 10 15 20 25 Source: Our World in Data.

HOUSEHOLDS INCREASE SAVINGS AND SHIFT SPENDING FROM SERVICES TO GOODS Canada (1995Q1 2020Q3) Household saving rate (%) Share of household spending on goods (%) 30 48 25 47 20 46 15 45 10 44 5 43 0 42 95 97 99 01 03 05 07 09 11 13 15 17 20 95 97 99 01 03 05 07 09 11 13 15 17 20 SOURCES: CME; STATISTICS CANADA (TABLES 36-10-0112-01 & 36-10-0104-01).

CHANGE IN REAL GDP IN 2020 Canada (billions $, seasonally adjusted, 2020Q3 less 2019Q4) Real GDP -111.0 Consumer spending on goods 25.8 Consumer spending on services -82.1 The rebound has been led by consumer spending on goods and residential investment. Non-residential investment -24.5 Residential investment 14.7 In contrast, consumer spending on services remains depressed. Non-residential business investment has also been slow to recover. Government spending 0.1 Net exports of goods -20.7 Net exports of services 20.1 Sources: CME; Statistics Canada (Table 36-10-0477-01).

RECOVERY PROGRESSING UNEVENLY Real GDP (Canada, %, February to October) Agriculture Finance & insurance Retail trade Real estate Wholesale trade Public administration Information & culture Utilities Professional extent of recovery Education extent of decline Manufacturing Health care Construction Management Other services Administrative & support Mining Transportation & warehousing Accommodation & food Arts & entertainment 0% 20% 40% 60% 80% 100% 120% 140% SOURCES: CME; STATISTICS CANADA (TABLE 36-10-0434-01).

MANUFACTURING TO SEE PARTIAL RECOVERY Canada (real manufacturing GDP, per cent) 10.0 5.0 While manufacturing is recovering more quickly than other sectors, its annual drop will still be steeper. 0.0 -5.0 -10.0 Output is forecast to plunge by 9.0% in 2020, before posting a partially recovery of 6.1% in 2021. -15.0 08 09 10 11 12 13 14 15 16 17 18 19 20e 21f 22f Sources: CME; Statistics Canada.

MANUFACTURING INVESTMENT IN CANADA LAGGING THE US Real non-residential investment (2004=100) US Canada 160 140 Since 2004, US manufacturing investment has increased at 6 times the rate of Canada s. 120 100 Put another way, while manufacturing investment in the US rose by 52% between 2005 and 2019, it only increased by 8.5% in Canada. 80 60 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 Sources: Statistics Canada (Table 36-10-0096-01); US Bureau of Economic Analysis; CME.

INDUSTRY STRATEGY COUNCIL REPORT - Lays out Canada s economic challenges - Weak investment, poor productivity growth, and deteriorating global competitiveness - Recommendations are based on five pillars, one of which is to develop a made-in-Canada industrial strategy 2021 MANUFACTURING OUTLOOK

EXAMPLES OF SPECIFIC RECOMMENDATIONS Address labour and skills shortages through diversity and inclusion, training and upskilling, and modernizing the temporary foreign worker program Improve Canada s innovation ecosystem by de-risking and encouraging industries to adopt and create technology, by strengthening our IP strategy, and by reforming key government programs Increase and establish new incentives and programs to boost investment in innovation and commercialization and to accelerate technology creation, adoption and digitization Modernize, harmonize, and simplify Canada s regulatory system Accelerate investments in Canada s digital and physical infrastructure, including in strategic trade- enabling infrastructure Strategically use procurement to support Canadian businesses by stimulating demand and creating markets for new products Do a better job of promoting the Canada brand domestically and internationally 2021 MANUFACTURING OUTLOOK

QUESTIONS What are your thoughts and opinions on the Industry Strategy Report? Do you think governments should be laissez-faire or interventionist? What policy reforms would you recommend to boost business investment? What policy recommendations would you make to the government so it strikes the right balance between the environment and the economy? 2021 MANUFACTURING OUTLOOK

Alan Arcand Chief Economist alan.arcand@cme-mec.ca @AlanArcand