2023 Budget Implementation Analysis

Discover the journey of the 2023 budget implementation, from a 6.8 MCHF deficit to a balanced budget. Explore the key factors leading to the deficit, the efforts made to overcome it, and the measures taken to reduce expenses. Stay informed about revenue forecasts, expense breakdown, and anticipated results for the year.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

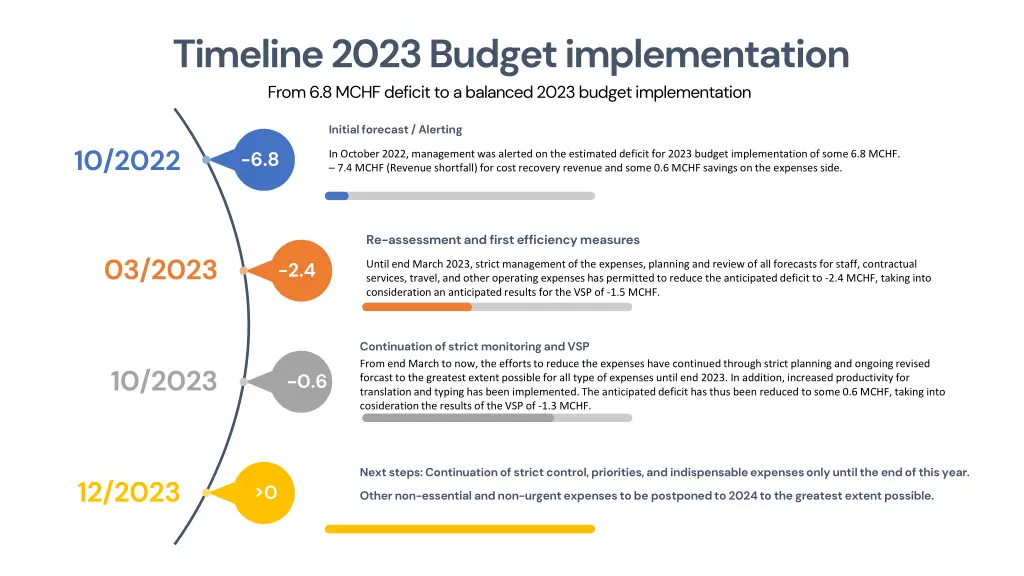

Timeline 2023 Budget implementation From 6.8 MCHF deficit to a balanced 2023 budget implementation Initial forecast / Alerting 10/2022 -6.8 In October 2022, management was alerted on the estimated deficit for 2023 budget implementation of some 6.8 MCHF. 7.4 MCHF (Revenue shortfall) for cost recovery revenue and some 0.6 MCHF savings on the expenses side. Re-assessment and first efficiency measures 03/2023 -2.4 Until end March 2023, strict management of the expenses, planning and review of all forecasts for staff, contractual services, travel, and other operating expenses has permitted to reduce the anticipated deficit to -2.4 MCHF, taking into consideration an anticipated results for the VSP of -1.5 MCHF. Continuation of strict monitoring and VSP From end March to now, the efforts to reduce the expenses have continued through strict planning and ongoing revised forcast to the greatest extent possible for all type of expenses until end 2023. In addition, increased productivity for translation and typing has been implemented. The anticipated deficit has thus been reduced to some 0.6 MCHF, taking into cosideration the results of the VSP of -1.3 MCHF. 10/2023 -0.6 Next steps: Continuation of strict control, priorities, and indispensable expenses only until the end of this year. 12/2023 >0 Other non-essential and non-urgent expenses to be postponed to 2024 to the greatest extent possible.

The context: Anticipated deficit key factors for 2023 There are 4 main factors that contributed to the anticipated deficit. The total impact amounts to more than 10.8 % of the budget With a 0.6 MCHF anticipated deficit, we have until now managed to absorb 18. million CHF out of these 18.6 MCHF Total Impact: 18.6 MCHF Revenue : No cost recovery from Telecom (Impact 1.5 MCHF) Revenue: Reduction in cost recovery revenue from SNF (Impact 7.6 MCHF) Expenses: 5% vacancy rate to be absorbed (Impact 6.2 MCHF). Salary scales increases including pension (Impact 2.4 MCHF) and electricity (impact 0.9MCHF)

2023 Budget implementation 5 October 2023 KCHF Budget 2023 163'861 163'861 Total End 2023 158'942 157'051 Expenses Revenue Voluntary separation programme ANTICIPATED 2023 RESULT 1'300 -591 0 KCHF Budget 2023 Commitments 05.Oct.23 Actuals 05.Oct.23 Forecast until End 2023 Total End 2023 Variance 2023 General Secretariat 90'307 16'743 65'567 5'456 87'766 2'541 Radiocommunication Sector 32'455 6'647 21'694 2'620 30'961 1'494 Telecommunication Standardization Sector 13'195 2'746 9'340 613 12'699 496 Telecommunication Development Sector 27'904 6'507 19'202 1'788 27'516 388 163'861 32'643 115'803 10'477 158'942 4'919 TOTAL EXPENSES

Revenue forecast for 2023 5 October 2023 ITU budget is revenue driven. The revenue rate is the percentage of budgeted revenue that is expected to materialize.Should this percentage be less than 100%, the authorization to spend the budgeted expenses should be limited to prevent possible deficit in the budget implementation. KCHF Revenue rate 95.84% Budget 2023 Forecast End 2023 Variance 2023 Assessed contributions 125'710 125'793 83 Cost recovery 36'500 28'307 -8'193 Revenue from interest 300 1'300 1'000 Other revenue 200 500 300 Payment into the ICT Fund Payment in the Building Fund Savings from budget implementation New Dehli area office - Contribution from India TOTAL -500 -750 1'734 667 -500 -750 1'734 667 0 0 0 0 163'861 157'051 -6'810

Cost recovery revenue forecast for 2023 5 October 2023 Budget 2023 Forecast End 2023 Variance 2023 Project support cost revenue 1'000 952 -48 Sales of publications revenue 15'500 16'650 1'150 International numbering resources cost recovery revenue 500 305 -195 Telecom 1'500 0 -1'500 Satellite network filings 18'000 10'400 -7'600 TOTAL 36'500 28'307 -8'193

Key risk factors Until end 2023 Until end 2023 Sales of publications within forecast 16.65 MCHF SNF revenue within forecast 10.4 MCHF Provision for cumulated Leaves Provision for repatriation