2025 Medicare Part D IRA Changes & Market Impact Overview

In 2025, Medicare Part D will see significant changes impacting coverage, out-of-pocket costs, drug pricing, and more. The coverage gap is set to be eliminated, with new provisions like an out-of-pocket spending cap and a prescription payment plan program coming into effect. Low-income subsidy expansion and a drug price negotiation program are also on the horizon. Get a detailed look at the upcoming changes and their implications in this comprehensive overview.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

2025 Medicare Part D IRA Changes & Market Impact Brittney Beeler, PharmD June 4, 2024

Impactful IRA Provisions COVERAGE GAP ELIMINATION 2025 Members move from the initial phase to the catastrophic phase when they reach the $2,000 max out-of-pocket. 01 05 INSULIN COST CAP 2023 Members pay no more than $35 for a month s supply of a covered insulin product. 06 02 OUT-OF-POCKET SPENDING CAP 2025 Members pay no more than $2,000 in out-of-pocket Part D drug costs for the year. VACCINE COST-SHARE ELIMINATION 2023 Part D adult vaccines recommended by the Advisory Committee on Immunization Practices covered at no cost. PRESCRIPTION PAYMENT PLAN PROGRAM 2025 Members have an option to pay out-of-pocket costs in monthly installments. Plans are waiting on final guidance. 07 03 INFLATION REBATE PROGRAM 2023 Drug companies pay a rebate if they raise prices of certain drugs faster than the rate of inflation. LOW-INCOME SUBSIDY EXPANSION 2024 Eligibility for full Medicare Part D LIS benefits expand and partial LIS benefits are eliminated. 04 08 DRUG PRICE NEGOTIATION PROGRAM 2026 Medicare negotiates a Maximum Fair Price for certain high- cost drugs without generic or biosimilar competition.

Lets break these down 05 06 07 COVERAGE GAP ELIMINATION 2025 Members move from the initial phase to the catastrophic phase when they reach the $2,000 max out-of-pocket. OUT-OF-POCKET SPENDING CAP 2025 Members pay no more than $2,000 in out-of-pocket Part D drug costs for the year. PRESCRIPTION PAYMENT PLAN PROGRAM 2025 Members have an option to pay out-of-pocket costs in monthly installments. Plans are waiting on final guidance. 08 LOW-INCOME SUBSIDY EXPANSION 2024 Eligibility for full Medicare Part D LIS benefits expand and partial LIS benefits are eliminated.

True or False The Coverage Gap will continue in 2025. FALSE

Coverage Gap Elimination Begins January 1, 2025 Redesigns Part D from a 4 phase to 3 phase benefit Coverage Gap Discount Program replaced with Manufacturer Discount Program Manufacturer discounts will begin to apply to applicable drugs in the initial coverage and catastrophic phases

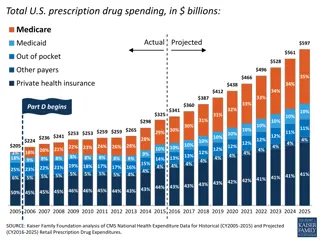

Annual Rx Maximum Out-of-Pocket (OOP) Begins January 1, 2025 The IRA adds an annual prescription drug OOP cap of $2,000 which can change yearly based on changes in drug costs. The OOP cap largely benefits members who move into catastrophic due to high-cost drugs like those for cancer and rheumatoid arthritis. In 2024, members can pay an average of $3,300 - $3,800 in OOP costs (up to $8,000 TrOOP) on prescription drugs covered under Part D.

2024 2025 DEDUCTIBLE DEDUCTIBLE 01 01 Members pay 100% of drug costs Members pay 100% of drug costs INITIAL COVERAGE 02 INITIAL COVERAGE Member pays 25% Plan pays 75% 02 Member pays 25% Limit $5,030 Plan pays 75% (generics) and 65% (brands) COVERAGE GAP Manufacturer pays 10% for brands Member pays 25% 03 Limit $2,000 OOP Plan pays 75% (generics) and 5% (brands) CATASTROPHIC Manufacturer pays 70% for brands 03 Limit $8,000 TrOOP (~$3,300 OOP) Member pays 0%, Plan pays 60% of drug costs, CATASTROPHIC Manufacturer pays 20% for brands, and 04 Medicare pays 20% (brands) and 40% (generics) Member pays 0%, Plan pays 20% of drug costs, and Medicare pays 80% of total drug costs

True or False Members reach their $2,000 OOP max through what they personally pay. FALSE

Changes to True Out-of-Pocket (TrOOP) Costs TrOOP are the payments that count towards a member s OOP threshold IRA amends costs that count towards TrOOP to: Include payments for previously excluded supplemental benefits Exclude payments made by manufacturer through discounts TrOOP continues to include payments made by members

Medicare Prescription Payment Plan (M3P) Members have an option to pay prescription drug out-of-pocket costs in monthly payments instead of at the pharmacy Part D plan pays the pharmacy at point of sale and bills member Members will need to follow the plan s enrollment process Plans are waiting on final Part 2 guidance

True or False The M3P program is likely to be the best option for most members. FALSE

Medicare Prescription Payment Plan (M3P) Not all members are likely to benefit from the M3P program Likely to benefit = high out-of-pocket costs at the beginning of the year CMS established a threshold of $600 at point-of-sale to identify members Most likely to benefit members may find more benefit from the Low-Income Subsidy (LIS) program, which expanded in 2024.

Low Income Subsidy (Extra Help) Expansion In 2024, the IRA expanded LIS program by: Eliminating the partial benefit Expanding eligibility for full benefits Those who qualify for LIS (Extra Help) Program will pay: No deductibles No premiums for Part D drug plans Modest copayments for generics or brands No Part D late enrollment penalty, if applicable

Creditable Coverage The Part D benefit redesigns made by the IRA will cause some commercial plans to move to a non-creditable status. The IRA increased the Defined Standard benefit. Creditability determined by a benefit s actuarial value equaling or exceeding the Defined Standard based on the average member. HSA plans most impacted due to integrated medical and Rx benefits If coverage stops being creditable, members will incur a late enrollment penalty (LEP) when signing up for a Part D plan that stays with them as long as they have Part D coverage

Next Steps for Plans IRA Part D benefit redesign shifts liability for all stakeholders Majority of liability shifts to Part D plans PDPs disproportionality impacted Increase member liability for prescription drugs (cost-share increase) Add management to ensure appropriate drug use Reevaluate plan benefits

What is not changing in 2025? Need for simple, affordable, and sustainable health care for seniors Quality of health plan matters while Star Ratings may change methodology, high quality plans should still be considered Need for relationships and member-focused health care Multiple changes impacting agents, members and providers Priority Health s focus on customer service remains to help navigate changes in benefits, answer questions, identify opportunities for savings