403(b) Document Update and Restatement Information

latest updates and deadlines for 403(b) retirement plan documents, including IRS pre-approved documents availability, retroactive reliance options, service provider attachments, restatement deadline, and ERISA provisions for various types of organizations. Ensure compliance and maximum flexibility for your 403(b) plan with detailed information provided in this document.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

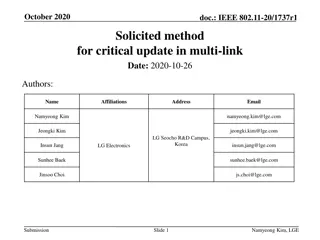

403(b) DOCUMENT 403(b) DOCUMENT UPDATE UPDATE Presented By: Christine LeBlanc

403(b) Documents New IRS pre-approved documents now available Restatement deadline to get retroactive reliance is March 31, 2020 Retroactive effective dates as early as 1/1/2010 can be used Custom effective date and custom language attachments with retroactive effective dates

403(b) Documents New service provider attachment Approved vendors Un-approved vendors Service providers Plan sponsor duties

403(b) Documents Restatement Deadline March 31, 2020 If document was amended timely for final regulations then plan may have retroactive reliance back to 2010. All provisions must be documented in some form Interim amendments Special effective date addendum

403(b) Documents 5 types ERISA for 501(c)(3) Organizations Non-ERISA Deferral Only for 501(c)(3) Organizations Non-ERISA for Governmental Organizations Non-ERISA for Churches without RIA Non-ERISA for Churches with RIA

403(b) Documents ERISA for 501(c)(3) Organizations Robust document intended to provide maximum flexibility Contribution Types Included deferrals pre-tax and Roth voluntary after-tax mandatory - after-tax and pre-tax matching contributions non-elective contributions rollover contributions

403(b) Documents ERISA for 501(c)(3) Organizations Other Provisions ACP Safe Harbor Auto-Enrollment ACA, EACA, QACA Integrated, Age Weighted, and Cross-Tested Non- Elective Contributions

403(b) Documents ERISA for 501(c)(3) Organizations Testing Provisions Designed to be Universal Availability compliant All ERISA language included ACP testing elections included 410(b) failure language included

403(b) Documents Non-ERISA 403(b) Deferral Only for 501(c)(3) Organizations Designed to be used by a 501(c)(3) organization that intends to meet the DOL safe harbor of limited employer involvement under 29 C.F.R. section 2510.3-2(f) Contributions Types include Deferrals pre-tax and Roth Voluntary after-tax rollover contributions

403(b) Documents Non-ERISA 403(b) Deferral Only for 501(c)(3) Organizations Does not include Matching or non-elective contributions Safe harbor provisions Automatic enrollment Vesting provisions

403(b) Documents Non-ERISA for Governmental and Church Employers Robust document intended to provide maximum flexibility Contribution Types Included deferrals pre-tax and Roth voluntary after-tax mandatory - after-tax and pre-tax matching contributions non-elective contributions rollover contributions

403(b) Documents Non-ERISA for Governmental and Church Employers Other Provisions Auto-Enrollment ACA Integrated Non-Elective Contributions Not Included Safe Harbor Auto-Enrollment EACA, QACA Age-Weighted and Cross-Tested Non-Elective Contributions

403(b) Documents Non-ERISA for Church Employers Steeple Church Qualified Church Controlled Employers Retirement Income Account Not subject to Universal Availability