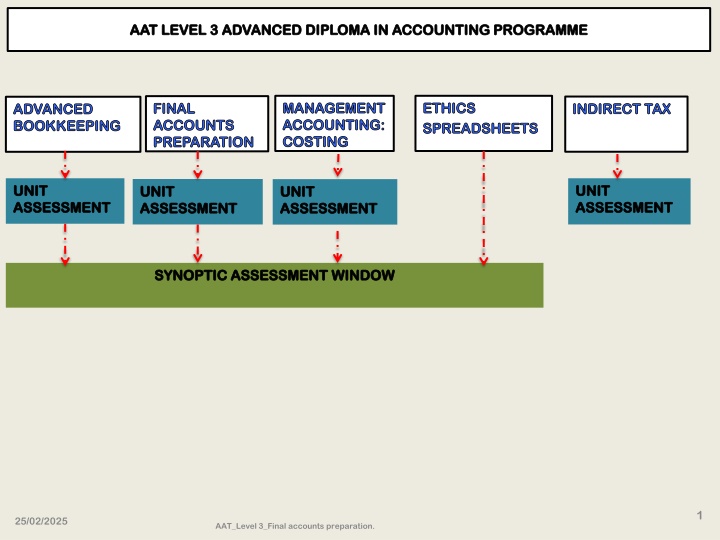

AAT Level 3 Advanced Diploma in Accounting Programme Management

This program covers a range of topics including costing, ethics, spreadsheets, final accounts preparation, indirect tax, and advanced bookkeeping. Students will learn to distinguish between financial recording and reporting needs of different organizations, prepare accounting records, and produce accounts for sole traders, partnerships, and limited companies. The course emphasizes the importance of ethical principles in accounting and provides hands-on experience in financial management.

Uploaded on Feb 25, 2025 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

AAT LEVEL 3 ADVANCED DIPLOMA IN ACCOUNTING PROGRAMME MANAGEMENT ACCOUNTING: COSTING ETHICS SPREADSHEETS FINAL ACCOUNTS PREPARATION INDIRECT TAX ADVANCED BOOKKEEPING UNIT ASSESSMENT UNIT ASSESSMENT UNIT ASSESSMENT UNIT ASSESSMENT SYNOPTIC ASSESSMENT WINDOW 1 25/02/2025 AAT_Level 3_Final accounts preparation.

All Inclusive AAT Advanced Diploma in Accounting Level 3 Programme: 8 thOctober 2019 31st December, 2020. Delivery day and Time: Tuesdays ; 2 p.m. -5 p.m. Actual exam Date Mock Exam Date Total GLHS Delivery Dates Unit Autumn Half Term : 21stOctober 27thOctober Management Accounting : Costing 29thNovember, 2019 7th January, 2020 17thJanuary 14thJanuary 21 Xmas Break: 16thDecember, 2019 5th January, 2020 14th January, 2020 - 10th March, 2020 24 10thMarch 17thMarch Advanced Bookkeeping February Half Term : 17th 23rdFebruary, 2020 17th March -12thMay, 2020 Final Accounts Preparation 24 12thMay 19thMay Easter Break: 10thApril 26th April, 2020 May bank holiday : 8thMay Spring Half Term : 25th 31stMay Final accounts_Limited companies

All Inclusive AAT Advanced Diploma in Accounting Level 3 Programme: 8 thOctober 2019 31st December, 2020. Delivery day and Time: Tuesdays ; 2 p.m. -5 p.m. Delivery Dates Unit Actual Exam Date Mock Exam date Total GLHS Indirect Tax 24 19th May -14thJuly, 2020 14thJuly 21stJuly Summer break : 29th July 6th September Synoptic Assessment Ethics Spreadsheets 9 21stJuly- 8thSept 15thSeptember- 13thOctober 15 6th Oct 13th Oct Autumn Half Term : 19thOctober 25thOctober TOTAL GUIDED LEARNING HOURS 117 Apprenticeship assessment Programme: Monthly 1 hour work-based reviews End point assessment gateway 30thNovember-31stDecember, 2020. Final accounts_Limited companies

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Final Accounts Preparation Unit It involves preparation of final accounts for sole traders and partnerships and initial awareness of limited company accounts. Learning outcomes Learning outcomes Distinguish between financial recording and reporting needs of different types of organisations. Explain the need for final accounts, accounting and ethical principles underpinning their preparation. Prepare accounting records from incomplete information. Produce sole traders accounts. Produce partnerships accounts. Identify the main differences between sole traders and limited companies accounts. Weighting Weighting 10% 7% 27% 31% 20% 5% 25/02/2025 AAT_Level 3_Final accounts preparation. 4

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Assessment structure Assessment duration : 2 hours. Computer based exam and marking. Competency : 70% 6 Assessment Tasks. 25/02/2025 AAT_Level 3_Final accounts preparation. 5

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Assessment tasks and content Task Task Content of assessment tasks Content of assessment tasks Reconstruct general ledger accounts. Incomplete records and application of ethical principles underpinning accounts preparation. Final accounts for sole traders. Application of knowledge forming the basis of final accounts preparation. Accounting for partnerships Partnership final accounts and initial reporting regulations relating to limited companies. Total Marks Marks 15 15 1 2 3 4 18 16 5 6 15 21 100 25/02/2025 AAT_Level 3_Final accounts preparation. 6

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Assessment methods Pick lists Select options from a drop-down box Drag and drop- enter narrative. Gap Fill type numbers Enter ticks Enter dates from a calendar. 25/02/2025 AAT_Level 3_Final accounts preparation. 7

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Learning outcomes- Organisations and their final accounts Explain which organisations need to prepare final accounts. Explain applicable regulations relating to different types of organisations. Explain ethical principles which are applied when preparing accounts. Session Approach PRESENTATION, QUIZZES AND DISCUSSION ILLUSTRATIONS AND OTHER EXAMPLES WORK THROUGH EXERCISES IN CLASS AND FOR HOMEWORK Tasks covered Tasks 2 and 3 above. AAT_Level 3_Final accounts preparation. 8 25/02/2025

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Organisations: Final accounts A business is treated separately from owners when its accounts are being prepared. Sole traders Owned and run by one person. Partnerships Owned and run by 2 or more people. Limited Company Separate legal entity from owners. Not for profit Business is run for public good. Limited Partnerships Members have limited liability. 25/02/2025 9 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Background incorporation Businesses can be incorporated or non-incorporated. Unincorporated businesses There is no legal distinction between the business and its owners (e.g. sole traders or partnerships). The owners have unlimited liability they may be personally liable if the business cannot pay its debts. Owners do not have to prepare and file accounts but need records to confirm and complete personal tax returns. Tax liability is not shown in the accounts, as owners are taxed under self-assessment rules. 25/02/2025 10 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Background incorporation Businesses can be incorporated or non-incorporated. Incorporated businesses These businesses are limited partnership or companies which are separate legal entities. They can enter contracts, own assets and incur liabilities in their own right. They must prepare financial statements and present them to shareholders and file them with the Registrar of Companies. Tax liability is shown in the accounts. 25/02/2025 11 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Limited liability Liability of owners is restricted to their original investment, if business fails. Owners ( shareholders or members) must own at least 1 share in the company. They must prepare financial statements and present them to shareholders and file them with the Registrar of Companies. Tax liability is shown in the accounts. Types of companies Public limited companies (plc) can raise finance from the public on a stock exchange. Private limited companies (Ltd) cannot invite the public to purchase shares via a stock exchange. Tax appears in the accounts of these companies as they are legal persons. 25/02/2025 12 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Limited liability partnerships ( LLP) This form of business is set up in law by the LLP Act 2000: LLP is a legal person in law and can enter contracts in its own right. Liability is restricted to amounts stated in the partnership agreement and members are agents of the LLP. LLPs must: o Register with Companies Registrar and formation documents signed by 2 members. o Prepare and file accounts and returns. LLPs may: o Have their accounts audited. LLPs are not: o Subject to corporation tax but members are taxed individually based on their profit share. 25/02/2025 13 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Owners and managers Sole traders and partnerships: o Own and manage their businesses o Take drawings for personal expenses. The partnership agreement sets out how profits or losses are shared between partners. Large companies tend to be managed by directors , separate from the main shareholders. Directors are agents of the shareholders: o Financial statements are required by law to show how directors have managed the business affairs ( their stewardship role) 25/02/2025 14 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Ownership considerations sole trader to partnerships. A sole trader should take account of the following issues prior to forming a partnership: Advantages Advantages More than one person making finance contributions Disadvantages Disadvantages Partners may have different interests, leading to disagreement. Cessation impacts: where a partner retires or resigns funds must be available to pay them off. More regulation a partnership agreement must be in place. Records must be maintained for drawings and profit share. A range of expertise and ideas is available to the business. 25/02/2025 15 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Ownership considerations sole trader and partnerships to companies. Prior to incorporation the following issues should be considered: Advantages Advantages Limited liability- owners not personally liable for debts of the business. Financing easier to raise finance by issuing shares, loan stock or bank loan. Investment appreciation rising profits lead to increased share price and investment gain. Disadvantages Disadvantages Increased regulation annual accounts preparation, presentation to members and filing. Audit of accounts payment for assurance. Control- professional directors may manage business on a day to day basis. Complete activity 1 - Page 7. Complete activity 2 - Page 7. Complete activity 3 - Page 8. 25/02/2025 16 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Companies Act 2006 It outlines the key law relating to formation governance and administration of companies. Breaching the Act could result in a fine and / or imprisonment. A key area is the role and responsibilities of directors: o Directors must maintain proper accounting records. o Directors must prepare annual financial statements for presentation at annual general meeting. o Directors must file these statements with the Registrar of Companies within 9 months of the accounting period. o The financial statements must be audited ( if not exempted) and give a true and fair view of the financial transactions 25/02/2025 17 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Not for profit organisations These may include charities, clubs, societies or NGOs ( non- governmental organisations). They have stakeholders (e.g. funders) as opposed to shareholders and do not pay dividends. They focus on income generation and cash flow. 25/02/2025 18 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Charities The Charity Commission: o Provides the required status before any organisation can operate as a charity. o Issues Statements of Recommended Practice (SORPs), specifically applicable to charities. Charities must: o Pass a public benefit test to operate as a charity. o Comply with relevant accounting standards, charity law and good practice. o Prepare a Statement of Financial Activities ( SOFA) and Statement of Financial Position for inclusion in an annual report that must be submitted to the Charity Commission. Complete activity 4 page 10 25/02/2025 19 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Professional ethics Accountants must work competently and meet deadlines when preparing the financial statements for presentation to management and shareholders. Accounting is a professional occupation that : o Requires extensive training, study and maintenance of specialised knowledge . o Is represented by professional associations which oversee certification and licensing of members. Professional bodies like the AAT issue Codes of Ethics that provide a framework for fundamental values and quality. The Code does not prescribe specific rules but provides guidance on behaviour. This position of trust and responsibility is regulated by the International ethics Standards Board (IESBA), falling within control of the International Federation of Accountants (IFAC). 25/02/2025 20 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Personal and Professional Qualities The AAT requires members to develop both personal and professional qualities: Personal Qualities Quality Quality Reliability Explanation Explanation This ensures that work meets professional standards. Members should take ownership of own work. Work delays could be costly and disruptive to clients. These are important for building business and professional relationships with colleagues and clients. Responsibility Timeliness Courtesy Respect 25/02/2025 21 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Personal and Professional Qualities The AAT requires members to develop both personal and professional qualities: Professional Qualities Quality Quality Independence Explanation Explanation Ability to form own opinions based on facts. Member must be independent in mind and be seen to be independent. Members must be responsible for their judgement and decisions. Member should always have a questioning mind about motives and information received from others. General responsibility to both employer and a wider society. Accountability Scepticism Social responsibility 25/02/2025 22 AAT_Level 3_Final accounts preparation.

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Ethics These are norms, beliefs and standards that guide appropriate professional behaviour to protect the public interest. Businesses are morally responsible for their actions. Accountants are deemed to work in the public interest. Role of the accountant This depends on where the accountant works: o In practice- providing a range of services to clients e.g. auditing. o In business employed by commercial organisation. o In the public sector employed by a public service organisation e.g. local authority. Their role is guided by : o Law and other regulations setting out the basic requirements. o Professional codes of ethics of the accounting profession e.g. AAT code of professional ethics. 25/02/2025 AAT_Level 3_Final accounts preparation. 23

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Fundamental principles AAT code - P.I.P.C.O This stands for ? o Professional competence and due care. o Integrity o Professional behaviour. o Confidentiality. o Objectivity AAT_Level 3_Final accounts preparation. 25/02/2025 24

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Ethical principles Fundamental principles AAT code Principle Principle Professional competence Explanations Explanations You must maintain appropriate professional knowledge and skill to deliver a competent professional service to clients or employers. And due care Act diligently obligation to deliver agreed work ( ability; realistic timescales) Honesty in professional /business relationships. You must avoid any action that may bring the profession into disrepute. You must not disclose or use to your advantage information obtained from professional contacts. Do not allow bias, conflict of interest or undue influence to override professional or business judgements. Integrity Professional Behaviour. Confidentiality Objectivity 25/02/2025 AAT_Level 3_Final accounts preparation. 25

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Fundamental ethical principles To achieve their objectives accountants must comply with fundamental principles or rules that guide behaviour. These ethical rules are considered collectively. Principles Principles Professional competence and due care. Explanations Explanations Achieve and Achieve and enhance competence by competence by maintaining CPD keep up to date with auditing and accounting developments. Ensure you possess professional and technical skills for new assignments. Examples Examples Turn down, outsource or obtain training for work you cannot do. enhance Duty of care Duty of care - -work performed to the highest standards. New client fully aware of risk/ financial implications of outcome of work. AAT_Level 3_Final accounts preparation. 25/02/2025 26

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Fundamental ethical principles Principles Principles Integrity Explanations Explanations Straight forward and honest approach in professional relationships. Examples Examples Being requested by management to make adjustments that are not true or fair. Inappropriate behaviour or advice to clients which breach the law or regulations. Do not disclose information that is not already in the public domain. Do not let personal opinions affect advice that is given. Professional behaviour. Do nothing to bring the profession into disrepute by being unprofessional or acting illegally. Keep clients information secret unless there is a legal duty to disclose. Confidentiality ( See next slide) Objectivity Act without bias or duress and ensure decisions are based on facts. AAT_Level 3_Final accounts preparation. 25/02/2025 27

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Confidentiality Normally accountants must observe and maintain confidentiality in all business dealings, apart from in the following situations: Situation Situation Explanations Explanations Disclosure is legally permitted and authorised by client or employer. Disclosure is required by law. Crime Agency request ( for money laundering) A professional duty to do so. investigation that is in the public interest. For example, permission to contact an existing auditor. HMRC investigation; court cases; National As part of a Financial Reporting Council Assessment approach to resolving ethical problems: Explain the unethical problem the threat. State principle (s) affected. Suggest solution the safeguards. 25/02/2025 AAT_Level 3_Final accounts preparation. 28

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation The conceptual framework This identifies potential threats to the accountants independence -A.S.I.F.S The accountant will face different challenges to the ethical principles - either in practice or business. Threats to accountants in practice: A.S. I.F.S: Threat Threat Advocacy Explanations Explanations Promoting a position or opinion of a client that could compromise future objectivity. Financial or other interest which could influence judgement or behaviour. Perceived or real duress preventing the accountant from being objective. Arising from close or personal relationship making the accountant too sympathetic to interests of others. Review of judgement or information where accountant was previously involved. Self-interest Intimidation Familiarity Self-review AAT_Level 3_Final accounts preparation. 25/02/2025 29

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Ethical principles problem-solving procedure There is a requirement to identify and evaluate threats to any appointments; Apply safeguards; Otherwise discontinue or resign from the appointment. Threats A.S.I.F.S Threat Threat Self- interest Explanation Explanation Financial or other interests may influence judgement or behaviour. A previous judgement is re- evaluated by accountant responsible for that judgement. Examples Examples Undue fee dependence on one client Self-review Tax and consultancy work carried out by same engagement team. 30 AAT_Level 3_Final accounts preparation. 25/02/2025

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Ethical principles Threats Threat Threat Advocacy Explanation Explanation Promoting a view or position that in time may affect objectivity. Examples Examples Acting on behalf of clients that may be in dispute with other parties. Long term engagements with the same clients. Threatened withdrawal of services. Familiarity Close relationships may affect objectivity. Actual or perceived threats may hamper objectivity. Intimidation AAT_Level 3_Final accounts preparation. 25/02/2025 31

AAT Level 3 Advanced Diploma in accounting: 2019 Unit: Ethics Ethical principles There is a requirement to identify threats to any appointments and apply safeguards, discontinuing or resigning. Safeguards Professional, legislation and regulation: o Education, training and experience minimum professional entry requirements. o Continuing professional development (CPD). o Corporate governance regulations. o Professional standards, monitoring and disciplinary procedures. o External reviews of information produced by members. AAT_Level 3_Final accounts preparation. 25/02/2025 32

AAT Level 3 Advanced Diploma in accounting: 2020 Unit: Final Accounts Preparation Data protection and security There is a risk that a business may lose competitive advantage or face business disruption due to loss or interference with its data: o Risk of error or malfunction of computers. o Malicious or fraudulent behaviour such as computer hacking. Complete activity 5 Page 14 Complete test your learning Pages 17-19. 25/02/2025 33 AAT_Level 3_Final accounts preparation.