Accelerating Sustainable Energy Access in Lesotho through Financial Support Scheme

This initiative in Lesotho aims to catalyze investments in renewable energy-based mini-grids and Village Energy Centres to reduce GHG emissions and support national sustainable energy goals. The Financial Support Scheme provides funding for 10 mini-grids and 10 Village Energy Centres in targeted districts, with a focus on jump-starting the market and attracting private finance through grants and incentives. Geographical locations and selection criteria ensure optimum impact and viability for the projects.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

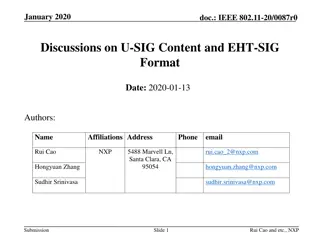

Development of Cornerstone Public Policies and Institutional Capacities to acceleration Sustainable Energy for All (SE4All) Progress FINANCIAL SUPPORT SCHEME (FSS) Funding 10 renewable energy-based mini-grids and 10 Village Energy Centres in 5 districts of Lesotho

FINANCIAL SUPPORT SCHEME (FSS) FSS Overview FSS Overview Objective The objective of the scheme is to catalyse investments in renewable energy-based mini-grids and Energy Centres to reduce GHG emissions and contribute to the achievement of Lesotho s Vision 2020 and SE4All goals. Purpose of facility 1. It is designed to jump-start the market for isolated PV/renewable energy mini-grids and Energy Centres by providing start-up capital and reducing the developers financial requirement. It is to minimise any potential risk on the part of lenders in making loans for renewable energy-based mini-grids/Energy Centres to encourage more private finance for this type of projects by demonstrating acceptable levels of risk. 2. Targeted projects a) b) 10 Village Energy Centres 10 Renewable Energy Mini-grids Instruments Grants (ordinary, performance-based incentive (PBI), subsidy) Implementing Partners UNDP, MEM, UNCDF Period 4 years Budget Total budget: US$ 1.2 million 2

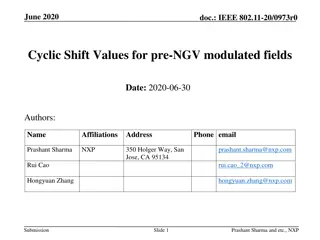

FINANCIAL SUPPORT SCHEME (FSS) Geographical locations Geographical locations - - Renewable Energy Mini Renewable Energy Mini- -grids grids District Mohale s Hoek Location Ketane (Ha Nohana) Ribaneng Matsoaing Tlhanyaku Sehlabathebe (Mpharane) Lebakeng Mokhotlong Qacha s Nek Tosing (Dalewe) Sebapala (Ha Sempe/Lefikeng) Quthing Sehonghong Mashai (Moreneng, St. Theresa) Thaba-Tseka 3

FINANCIAL SUPPORT SCHEME (FSS) Geographical locations Geographical locations - - Village Energy Centres Village Energy Centres District Mohale s Hoek Location Phamong (Central) Koebunyane Mateanong Malingoaneng Mokhotlong Matebeng (Ha Lelignoana) Melikane (Thuoeleng) Qacha s Nek Majara Qhoali Quthing Linakaneng Ha Mokoto (Litsoetseng) Thaba-Tseka 4

FINANCIAL SUPPORT SCHEME (FSS) Criteria for Village Selection Criteria for Village Selection Parameters Category Location of installation (a) Distance to existing grid power source (15 km) (b) Transmission distance based on population distribution (dense or sparse). (c) Accessibility and topography (accessible throughout the year) The site should present potential for productive uses by small entrepreneurs, SMEs, etc. For the project to be economically viable, the potential power consumers should demonstrate: Ability to pay: Prevailing economic activities. Disposable income. Percentage of the population engaged in economically productive activities. Willingness to pay: Current expenditures on power/energy. Quality of current power/energy sources. Desire or need to consume quality power. The generated power must be consumed in order to provide positive social, environmental and economic impact. Cattle rustling, clashes, vandalism, theft, etc. Productivity Payment for services Magnitude of potential power consumers Secure generation site 5

FINANCIAL SUPPORT SCHEME (FSS) Key features of mini Key features of mini- -grids and Energy grids and Energy Centres Centres Characteristic Services Mini-grid All electricity uses possible, practically feasible are lighting, telecommunication, electric media, cooling of goods, printing, operation of computers, and diverse forms of commercial activities like grinding, welding, hair crabbing Energy centre Battery charging (mobile phones, lanterns, radios, other battery driven devices), dissemination of efficient RE-based energy sources (PV-operated portable LED lights, solar mobile phone chargers, etc.); installation and maintenance; capacity building like training of local technicians; demonstration, Solar PV modules, batteries, regulators, inventers, internet services, efficient cook-stoves, Mobile money transfers, LPGs, Convenient store service Up to several settlements in a walking distance to each other Mainly households and small-medium commercials Service territory One settlement with well-defined borders Customers Households, public, commercial Capacity Main elements Typically 2 kW-2 MW Electric energy generation sub-system with one or more generation units (PV, hydro, wind, etc.); distribution network; power conditioning unit; user s electrical installations, incl. interface equipment between installations and mini-grid and metering (IRENA 2015) Provision of secure power supply to local enterprises, income generation for businesses, improved local service, education and healthcare Up to 10 kW Shop or trading post with the selection of efficient renewable energy products and services Socioeconomic outcomes Enhancing the access to modern energy services for rural households, saving transportation cost and time, distribution of efficient and affordable energy products and services 6

FINANCIAL SUPPORT SCHEME (FSS) FSS direct support to Investors is to: FSS direct support to Investors is to: design and install a mini-grid that will perform efficiently. make it easier for investors to mobilise debt financing through provision of de-risking capital in the form of an investment grant. provide tariff relief to isolated rural consumers, just like those connected to conventional energy-based mini-grids. 7

FINANCIAL SUPPORT SCHEME (FSS) Services offered by the FSS Services offered by the FSS Financial services: Grants for feasibility studies for renewable energy mini- grids Performance-based payments Annual subsidy to Energy Centres Business development services: Business case refinement Financial structuring Matchmaking, preparation of equity/loan agreements Negotiations with external funders Due diligence: Input/output and financial data verification Verification of regulatory compliance Verification of social and environmental impact 8

FINANCIAL SUPPORT SCHEME (FSS) Financial Services provided by the FSS to each of the Financial Services provided by the FSS to each of the renewable energy renewable energy- -based mini based mini- -grids a) support the preparation of feasibility studies/business plans (FS/BP) and partial investment for isolated renewable energy-based mini- grids. grids through provision of a grant, to eligible project developers selected on the basis of competitive bidding, up to 50% for each of the costs involved for the feasibility study / business plans. investment grant, with a maximum per project allocation not exceeding $ 60,000. b) to establish a performance-based incentive (PBI) fund (a subsidy that is also referred to as OBA output-based aid) that will be paid directly to the project developer, based on actual energy production of the PV or renewable energy system. maximum per project annual allocation not exceeding $7,500 for a period of up to 4 years. 9

FINANCIAL SUPPORT SCHEME (FSS) Financial Services provided by the FSS to each of the Financial Services provided by the FSS to each of the Village Energy Centres Village Energy Centres 1) Each Energy Centre will be eligible for a subsidy in the amount of $7,500 for a period not exceeding 4 years subject to demonstrating proof that they facilitate access to modernised energy services to the communities they serve. the total subsidy to each Energy Centre by the end of the project should not have exceeded 50% of the initial cost of its establishment. 10

FINANCIAL SUPPORT SCHEME (FSS) Eligibility Criteria for Renewable Energy Mini-Grids and Village Energy Centers (1) Dimension Criteria Geographical Coverage Qualifying project proposals should be implemented within the identified locations in Lesotho as specified above. Solar or hydro mini-grids or Village Energy Centres (interchangeable) Project type It is permissible to substitute one type of a project (e.g., a mini-grid) with another type of a project (e.g., an Energy Centre) provided both types are comparable in terms of the overall coverage of facilities/households. A legal person and a specific type of organisation such as: private company, non-governmental organisation or research institute with registration in Lesotho. Applicant Can provide, either from its own resources or in combination with other shareholders, contribution (in kind or in cash) equal to at least 20% of the total cost of the project. Track record and requisite skills in delivering energy services in rural communities through isolated renewable energy-based mini-grids or Village Energy Centres and other energy access schemes. Prior Experience 11

FINANCIAL SUPPORT SCHEME (FSS) Eligibility Criteria for Renewable Energy Mini Eligibility Criteria for Renewable Energy Mini- -Grids and Village Energy Centers (2) Grids and Village Energy Centers (2) Dimension Criteria Source MUST be either solar or micro-hydro. Renewable energy- based source Financing For mini-grids, the project developer must indicate sources of complementary funding required to cover total project costs including feasibility studies and business plans beyond the maximum grant of $60,000. For village energy centers, the project developer must demonstrate availability and sources of funding for the total project cost. Qualified management The proposal should show evidence that the proposed management team has the necessary technical and managerial skills to oversee the successful setup, sustainable operation and maintenance of the mini-grid or village energy centres. 12

FINANCIAL SUPPORT SCHEME (FSS) Eligibility Criteria for Renewable Energy Mini Eligibility Criteria for Renewable Energy Mini- -Grids and Village Energy Centers (3) Grids and Village Energy Centers (3) Dimension Criteria The project developer should indicate a sound business model demonstrating that there is a long-term business opportunity with solid after-sales services as opposed to a more short-term project opportunity. Business models Priority will be given to those applications that demonstrate reduction in climatic and ecological impacts. Socio-economic conditions Proposal must show how the business will generate positive benefits to the community and local economy at large, e.g. reduction of GHG emissions, job creation, income generation, access to energy equipment etc. Development Impact Applicants are encouraged to integrate tried and tested innovations in their proposal. Such innovative actions would include, but not be limited to, financial mechanisms such as crowd funding and mobile banking, innovative solutions to after-sales services, innovative household energy solutions and innovative actions for the mobilisation, communication and in-house training of the community before, during and after installation of an energy solution. Innovation 13

FINANCIAL SUPPORT SCHEME (FSS) Eligibility Criteria for Renewable Energy Mini Eligibility Criteria for Renewable Energy Mini- -Grids and Village Energy Centers (4) Grids and Village Energy Centers (4) Dimension Criteria The potential for scaling-up of rural energy activities and contributing towards poverty reduction, will Demonstration of the successful deployment, along with proof of capacity to replicate/upscale, will therefore be critical. Scalability be important considerations. Actions aiming at increasing access to energy services for local productive activities so as to promote economic growth, generating jobs and consequently increasing the affordability of an energy service will also be considered an advantage. Productive Use of Energy Compliance with Lesotho laws and regulations and UNCDF/UNDP Environmental & Social Performance Standards including human rights is a must. Compliance 14

FINANCIAL SUPPORT SCHEME (FSS) Key evaluation considerations Sustainability: the proposed (distributed) energy service strategies and the accompanying business frameworks must be commercial and sustainable. The plan should include longer- term projections, revenues, costs/overheads, breakeven, etc. Replicability: the distributed energy service solution should be replicable, representing a business solution that is relevant to and implementable in other districts in Lesotho. Product/technology selection: project developers must work with proven technologies that are preferably, where possible, certified. The intension of this CfP is not to test or pilot technologies/products but rather to test and mature the business strategies that support their dissemination. Developer s own contribution: the developer is expected to provide contribution (in kind or in cash) equal to at least 20% of the total cost of the project. Project developers are welcome to propose business strategies focused on single or multiple technologies/products and services. Impact and cross-cutting issues: project developers are encouraged to develop solutions that have broader socio-economic, environmental, commercial and gender impacts. 15

FINANCIAL SUPPORT SCHEME (FSS) Pre Pre- -feasibility studies feasibility studies UNDP commissioned pre-feasibility studies for mini-grids and energy centres in 20 village communities with the objective to conduct a preliminary assessment, under which conditions mini-grids and energy centres makes economic sense. The pre-feasibility studies consider following aspects: (1) Natural aspects: Topography, potential of all kinds of renewable energy resources with distribution over the year; (2) Demographics for determining the prospective energy demand: scale, age and spatial distribution of population, future development of population; (3) Economic factors: household income, expenses for energy, current efforts for covering energy demands, willingness to pay for energy services, existing local economic activities, consumption patterns; (4) Infrastructure: existence of so called anchor customers i.e. schools, clinics, public authorities, shops, workshops, manufacturing facilities, roads; (5) Costs: capital and operational costs of renewable energy technologies; capital operational costs of electricity lines, capital and operational costs of energy centres. Pre-feasibility studies will be made available to developers on request to facilitate development of the business case. 16

FINANCIAL SUPPORT SCHEME (FSS) Submission Form Presentation of the Call for proposal submission form, and discussion of key points under each section. 17

FINANCIAL SUPPORT SCHEME (FSS) Application process A complete submission consists of the Call for Proposal Submission Form (Word). Any supporting documentation must be submitted in separate documents all attached to the same email. Submit to the email:ls.procurement@undp.org with the subject line FSS Pre- submission workshop . An applicant may submit proposals for more than one site under this call for proposals, 18

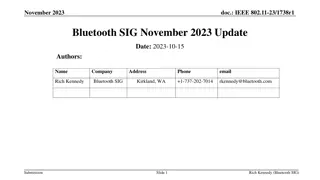

FINANCIAL SUPPORT SCHEME (FSS) FSS Process Overview FSS Process Overview Download submission forms at http://procurement- notices.undp.org/view_notice.cfm?notice_id=55547 or http://uncdf.link/se4all and submit your completed form to UNDP via e-mail: ls.procurement@undp.org. Make sure that your proposal complies with the required standard and is submitted on time. Call for proposals UNCDF will perform project screening against the established evaluation criteria. You may be contacted by UNCDF for additional information. If your project is selected, you will be contacted by the FSS Manager. Applicants who have not been contacted by the established deadline should consider their proposals unsuccessful. Project screening The FSS Manager will carry out due diligence and business case analysis for your project and will provide required support including project development (feasibility studies, business plan, financial model); project financing arrangements (financial structure and sources of finance). Project development If your project is investment ready, it will be presented to the Investment Committee and if approved, an investment grant will be issued and/or performance-based agreement on subsidies will be signed. Project financing If your project is eligible for annual OBA payments or subsidies, you will be subjected to periodic monitoring by the FSS team to verify project performance against the agreed targets. Payments will be made subject to satisfactory performance. Post- investment 19

FINANCIAL SUPPORT SCHEME (FSS) Project selection and evaluation timeline Language of proposal: Proposals must be submitted in English 1) Deadline for submission: The deadline for submission of the investment proposals is 14th June 2019. 2) 3) Please note: Applicants who do not submit the word submission template in its original format within the deadline will not be considered, and successful applicants will be contacted after the deadline. 4) Successful longlisting: FSS management team will endeavour to inform Successful and Unsuccessful applicants for the longlisting by 12th July 2019. Those applicants who will not have been contacted by then should consider their proposals unsuccessful. 5) Successful shortlisting: FSS management team will endeavour to inform Successful and Unsuccessful applicants for the shortlisting by 30th August 2019. Those applicants who will not have been contacted by then should consider their proposals unsuccessful. 6) Inquiries: For additional inquiring about the application process please send your inquiry to: ls.procurement@undp.org with the subject INQUIRY . 7) Acknowledgement of receipt: FSS management team will acknowledge receipt of your email by replying to the email address from which the application was sent. 8) Selection Criteria: FSS management team will use the criteria as defined in the FSS guidelines in evaluating the proposals for long listing and short listing. 20