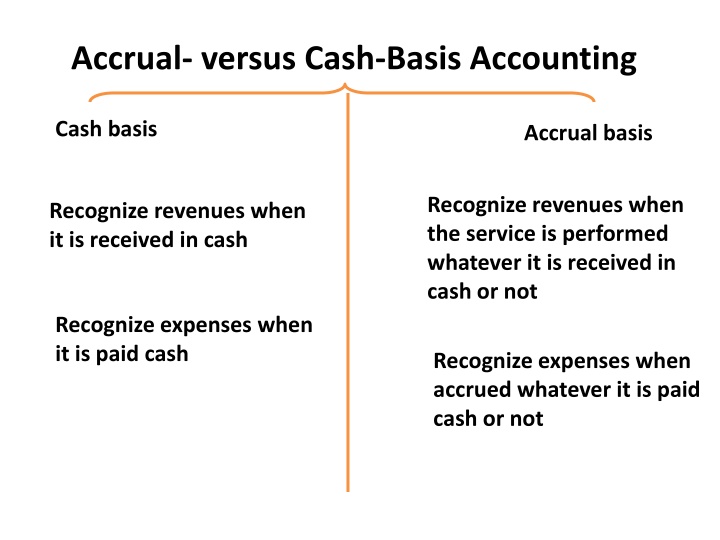

Accrual- versus Cash-Basis Accounting

Learn about ClinCard, a reloadable prepaid card used to pay research participants in studies. Discover its benefits, uses, setup process, and review guidelines for financial awards. Find out whom to contact for different study types and necessary documentation for setup. Gain insights into compensation guidelines and tax implications for research participants.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Accrual- versus Cash-Basis Accounting Cash basis Accrual basis Recognize revenues when the service is performed whatever it is received in cash or not Recognize revenues when it is received in cash Recognize expenses when it is paid cash Recognize expenses when accrued whatever it is paid cash or not

The adjusting entries deferrals Accruals Prepaid expenses Accrued expenses supplies Accrued salaries depreciation Accrued interest Accrued utilities Unearned service revenues Accrued revenues

deferrals Prepaid expense Prepaid insurance Insurance expense(Dr) prepaid insurance (Cr) Prepaid rent Rent expense(Dr) prepaid rent(Cr)

deferrals supplies supplies expense(Dr) supplies (Cr) depreciation Annual depreciation = cost - salvage value/ useful life Depreciation expense (Dr) Accummulated depreciation (Cr)

deferrals Unearned service revenue Unearned service revenue(Dr) service revenue (Cr)

KRAUSE CONSULTING Trial Balance May 31, 2017 explanation debit credit Cash 4500 Accounts recivable 6000 supplies 1900 Prepaid insurance 3600 Equipment 11400 Accounts payable 4500 Unearned service revenue 2000 Owner s capital 18700 Service revenue 9500 Salaries and wagws expense 6400 Rent expense 900 34700 34700

1. $900 of supplies have been used during the month. date Explanation Debit Credit Mar 1 Supplies expense 900 supplies 900

3. The insurance policy is for 2 years. The monthly insurance = 3600/24 = 150 date Explanation Debit Credit Mar 1 Insurance expense 150 prepaid insurance 150

4. $400 of the balance in the unearned service revenue account remains unearned at the end of the month. The earned revenues = 2000-400 = 1600 date Explanation Debit Credit Mar 1 Unearned service revenues 1600 service revenue 1600

6. The office equipment has a 5-year life with no salvage value. It is being depreciated at $190 per month for 60 months. date Explanation Debit Credit Mar 1 Depreciation expense 190 accumulated depreciation 190

2. Utilities expense incurred but not paid on May 31, 2017, $250. date Explanation Debit Credit Mar 1 Utilities expense 250 accounts payable 250

5. May 31 is a Wednesday, and employees are paid on Fridays. Krause Consulting has two employees, who are paid $920 each for a 5-day work week. sun mon tues wed thrus fri may 31 The acrued salary = (920*2/5)*3= 1104 date Explanation Debit Credit Mar 1 Salaries expense 1104 salaries payable 1104

7. Invoices representing $1,700 of services performed during the month have not been recorded as of May 31. date Explanation Debit Credit Mar 1 Accounts receivable 1700 service revenue 1700

ledger Insurance expense Supplies expense date exp debit credit Balance date exp debit credit Balance may31 adj 150 150 may31 adj 900 900 Prepaid insurance Supplies date exp debit credit Balance date exp debit credit Balance Bal 3600 Bal 1900 may31 adj 150 3450 may31 adj 900 1000 Service revenue Unarned Service Revenue date exp debit credit Balance date exp debit credit Balance Bal 9500 Bal 2000 May31 adj 1600 11100 may31 1600 adj 400 May31 adj 1700 12800

Depreciation expense Salaries Expense date exp debit credit Balance date exp debit credit Balance may31 adj 190 190 Bal 6400 may31 1104 Adj 7504 Accumulated depreciation Salaries payable date exp debit credit Balance date exp debit credit Balance may31 adj 190 190 may31 adj 1104 1104 Utilities Expense date exp debit credit Balance Accounts receivable may31 adj 250 250 date exp debit credit Balance Bal 6000 Accounts payable may31 adj 1700 7700 date exp debit credit Balance Bal 4500 May31 adj 250 4750

The adjusted Trial Balance May 31, 2017 Explanation Debit Credit Cash 4500 Accounts receivable 7700 Supplies 1000 Prepaid insurance 3450 equipment 11400 Accumulated depreciation - equipment 190 Accounts Payable 4750 Unearned Service Revenue 400 Salaries payable 1104 Owner s Capital 18700 Service Revenue 12800 Salaries & Wages Expense 7504 Rent Expense 900 Supplies expense 900 Insurance expense 150 Depreciation expense 190 Utilities expense 250 37944 37944