Advanced Financial Statement Analysis Techniques

Dive into topics like quasi reorganization, foreign currency translation, unrealized gains and losses, long-term liabilities, financing arrangements, bonds at par, premium or discount, and operational obligations in this comprehensive financial statement analysis course.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

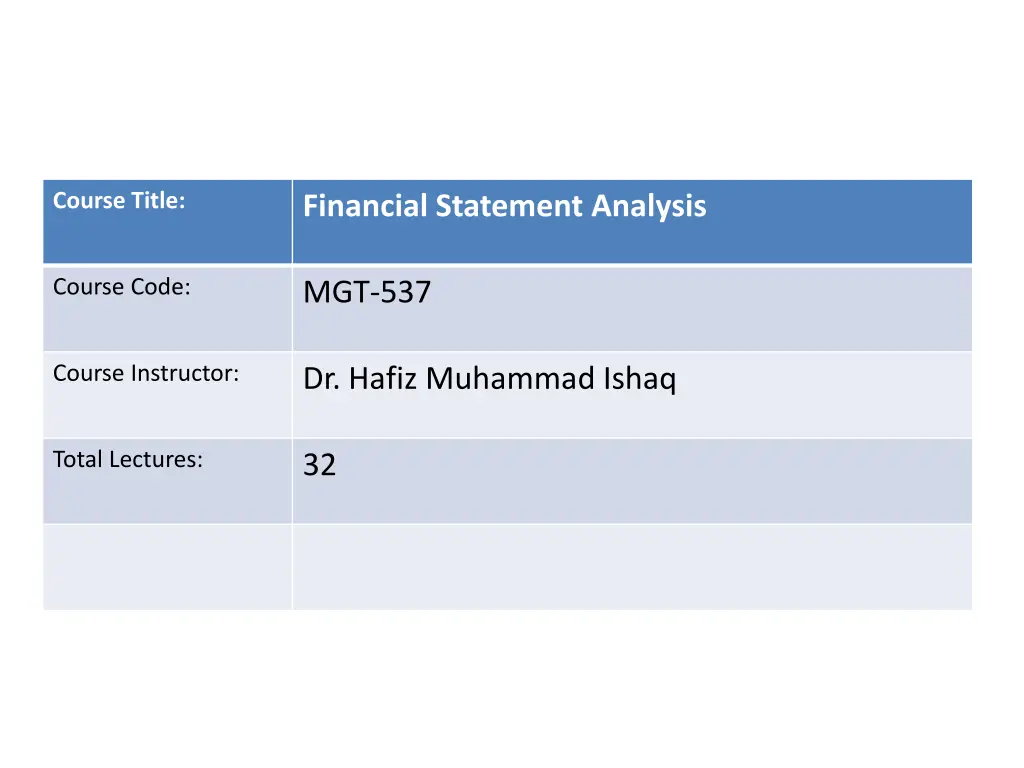

Course Title: Financial Statement Analysis Course Code: MGT-537 Course Instructor: Dr. Hafiz Muhammad Ishaq Total Lectures: 32

Previous Lecture Summary Basic Elements of the Balance Sheet Assets, Current and Fixed Assets Tangible Assets Intangible Assets Different methods depreciation Current liabilities. for calculation of

Today's Lecture Topics Quasi Reorganization Foreign Currency Translation Unrealized holding gains and losses Equity-Oriented Deferred Compensation Employee Stock ownership Plans, Treasury Stock Practical Exercise

Long-Term Liabilities Due in a period beyond one year or operating cycle Related to Financing arrangements Operational obligations

Long-Term Liabilities: Financing Arrangements Notes Payable & Bonds Payable Secured by property: Mortgage notes Credit Agreements Ready lines of credit that may require a compensating balance Not a liability until funds are drawn

Long-Term Liabilities: Financing Arrangements (cont d) Bonds Payable Sold at par, premium, or discount Premium or discount is amortized into interest expense Bond carrying value is amortized to par value Convertible bonds can be converted into common stock Conversion feature enhances bond selling price

Bonds at Par, Premium, or Discount Market Interest Rate Bonds Sold at 6% Premium Bond Par 8% Contractual Interest Rate 8% (Face Value) 10% Discount

Long-Term Liabilities: Operational Obligations Deferred Taxes Difference between accounting and tax methods Difference in the timing of recognizing revenue and expense for accounting and tax purposes Warranty Obligations Estimated; arise from offering product warranties Estimated to achieve matching of sales revenue and associated expense of warranty

Long-Term Liabilities: Warranty Obligations Product warranties require the seller to correct any deficiencies in quantity, quality or performance for a specific period of time Warranty obligations are estimated in order to recognize the obligation at the balance sheet date Charge the expense to the period of sale

Long-Term Liabilities: Operational Obligations (cont d) Minority Interest Reported on consolidated financial statements Represents the interest in the equity of a partially-held subsidiary by the non majority owners Not a liabilitybut for purposes of analysis treat as a liability Other Noncurrent Liabilities As circumstances warrant Redeemable Preferred Stock Excluded from stockholders equity For analysis, treat as a liability

Stockholders Equity The residual ownership interest in the assets of an entity that remains after deducting its liabilities Paid-in Capital Retained Earnings

Stockholders Equity: Paid-in Capital Par value In some states, referred to as stated value Considered legal capital by many states Established by the articles of incorporation Usually a minimal value No-par stock

Stockholders Equity: Paid-in Capital (cont d) Additional paid-in capital Issue price in excess of par (stated) value Other sources Treasury stock transactions Stock dividend transactions Donated capital

Stockholders Equity: Paid-in Capital (cont d) Common Stock Shareholder ownership Voting rights Election of board of directors Major corporate decisions Liquidation rights secondary to Creditors Preferred stock

Stockholders Equity: Paid-in Capital (cont d) Preferred Stock Does not normally convey voting rights May carry any or all of these features: Preference as to dividends Accumulation of dividends Participation in dividend beyond stated dividend rate Convertibility into common stock at holder s discretion Preference in liquidation secondary to creditors Callable at issuer discretion Redemption at future maturity value Donated Capital Donated by outside entities Shareholder surrender of stock

Stockholders Equity: Retained Earnings Undistributed earnings of the corporation Net income for all prior periods Less dividends declared to shareholders

Stockholders Equity: Other Quasi-Reorganization Eliminates a deficit balance of retained earnings Retained earnings are dated for 5-10 years Equity-Oriented Deferred Compensation A reduction to stockholders equity that is amortized (expensed) to future periods of employee service

Stockholders Equity: Other (cont d) Employee Stock Ownership Plans (ESOPs) A qualified pension plan Tax benefits for the employer and employee Unearned compensation reduces stockholders equity Treasury Stock Stock purchased and held by the issuing corporation Recording and disclosure Record at par value; deduct from paid-in capital Record at cost; deduct from total stockholders equity

Statement of Stockholders Equity Reconciles the beginning and ending balances of all components of stockholders equity Account changes indicate Issuance of stock: paid-in capital increase Acquisition of treasury stock: treasury stock increase Net income: retained earnings increase Dividends: retained earnings decrease

Balance Sheet Presentation Issues Financial analysis is complicated by Many assets recorded at cost rather than fair (replacement) value Varying valuation methods Within a firm from item to item Within an industry from company to company Not all items of value are listed as assets Certain contingent liabilities may be excluded

Chapter End Problem The Aggarwal Company has had 10,000 shares of 10%, $100 par value preferred stock and 80,000 shares of $5 stated- value common stock outstanding for the last three years. During that period, dividends paid totaled $0, $200,000, and $220,000 for each year respectively. Required: Compute the amount of dividends that must have been paid to preferred stockholders in each of the three years given the following four independent assumptions: 1. Preferred stock is nonparticipating and cumulative. 2. Preferred stock participates up to 12% of its par value and is cumulative. 3. Preferred stock is fully participating and cumulative. 4. Preferred stock is nonparticipating and noncumulative. stockholders and common

Chapter End Problem The Roswell Company has had 5,000 shares of 9%, $100 par- value preferred stock and 10,000 shares of $10 par-value common stock outstanding for the last two years. During the most recent year, dividends paid totaled $65,000; in the prior year, dividends paid totaled $40,000. Required: Compute the amount of dividends that must have been paid to preferred stockholders and common stockholders in each year, given the following independent assumptions: a. Preferred stock is fully participating and cumulative. b. Preferred stock is nonparticipating and noncumulative. c. Preferred stock participates up to 10% of its par value and is cumulative. d. Preferred stock is nonparticipating and cumulative.

Lecture Summary Quasi Reorganization Foreign Currency Translation Unrealized holding gains and losses Equity-Oriented Deferred Compensation Employee Stock ownership Plans Treasury Stock Practical Exercise