Affordable Care Act versus Single Payer System and Health Care Challenges

Explore the comparison between the Affordable Care Act and a single-payer alternative, highlighting issues with cost control, universal access, and uninsured populations. Discover the impact on health care in the United States, including rising expenditures and administrative wastage. Consider the potential for a more efficient health care system in line with international standards.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Affordable Care Act (Obamacare) and the Single Payer Alternative Leonard Rodberg Professor and Chair, Urban Studies Department, Queens College and Research Director, NY Metro Chapter, Physicians for a National Health Program November 2015

The Affordable Care Act 2010 A f***** big deal Joe Biden

and Millions Are Still Uninsured Millions 80 Pre-ACA ACA(Projected) 60 54 53 53 52 51 51 51 51 50 50 40 35 28 23 23 23 23 20 0 2012 2013 2014 2015 2016 2017 2018 2019 Note: The uninsured include about 5 million undocumented immigrants. Source: Congressional Budget Office.

Why Health Care Was On the Agenda: Escalating Cost * Estimate is statistically different from estimate for the previous year shown (p<.05). SOURCE: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2014.

and costs are still out of control While Millions still have no coverage. High deductibles and co-pays keep those with coverage from actually using it. Billing-related administrative waste still consumes 20-30% of our health care dollar.

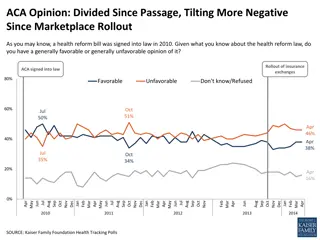

What the Affordable Care Act (Obamacare) Did: It established the principle that the federal government has the responsibility to see that everyone has access to health care. What It Didn t Do: It failed to achieve either cost control or universal access.

It doesnt have to be this way. Every other country covers all their citizens, and spends half of what we do. Total health expenditures as percent of GDP 16 14 12 10 8 US FR SWIZ GER CAN NETH NZ DEN SWE UK NOR AUS 6 4 2 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 Source: OECD Health Data 2010 (Oct. 2010).

What Makes the Difference? Unlike in the US -- in these countries government has a central role in Funding the system Overseeing and regulating it. Our own Medicare program for seniors shows the benefits of a government-funded, regulated system Reliable financing Slower cost growth Transparent coverage decisions.

Most Americans Get Their Coverage from the Private Sector Medicare (49.0 million) Employer- based Private Insurance Medicaid (54.1 million) Military (14.1 million) (169.0 million) Uninsured (42.0 million) Individual Private Insurance (34.5 million) Source:Health Insurance Coverage in the United States: 2013, Census Bureau, 2014

But Most of the Money Comes from the Public Sector Private Insurance 25% Federal Government (existing Medicare, Medicaid, other) 34% (existing Medicare, Medicaid, other) 34% Federal Government Private Insurance 34% Federal tax subsidy 9% (Federal tax subsidy) Out of pocket 12% State and Local Govt (existing Medicaid, other) 13% State and Local Government (existing Medicaid, other) 13% Out-of-pocket 12% Other private funds (charity, etc.) 7% Other private funds (charity, etc.) 7% Source: Health Affairs, Feb. 2010; data for 2009

In Deciding on a Plan, the President Made a Fateful Choice He could have chosen to (1) build on the public sector, which now provides more than half the money, or (2) expand the private sector. He chose to build his program by (1) enlarging Medicaid for the poor, and (2) expanding private insurance for the rest of us

The New Reform Plan: Affordable Care Act (ACA) Continued reliance on private insurance Employment-based insurance unchanged Market competition determines premiums, co-pays, and deductibles Experimental pilot programs try to reduce costs Result: About 10% of the population will get covered, the rest will see little change.

Affordable Care Act or ACA: The Health Reform Law of the Land Starting in 2014, online insurance marketplaces offer private insurance to individuals and employers Citizens and legal immigrants required to purchase private insurance or sign up for Medicaid. Premium subsidies up to 400% poverty level Medicaid for all below 138% poverty level Hardship waiver if premium too expensive can remain uninsured!

and Costs Keep On Rising National Health Expenditures (trillions) $5.0 $4.7 6.6% annual growth ACA (CMS Actuary) Current projection ACA (Commonwealth Fund) $4.67 $4.5 $4.5 $4.0 6.4% annual growth $3.5 6.0% annual growth $3.0 $2.5 $2.0 National Health Expenditures as Percent of GDP 17.8 17.9 18.0 18.2 18.8 19.3 19.8 20.2 20.5 21.0 $1.5 $1.0 $0.5 $0.0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Notes: * Modified current projection estimates national health spending when corrected to reflect underutilization of services by previously uninsured. Source: D. M. Cutler, K. Davis, and K. Stremikis, Why Health Reform Will Bend the Cost Curve, Center for American Progress and The Commonwealth Fund, December 2009. Estimated Financial Effects of PPACA as Amended, Richard Foster, CMS Actuary, April 2010

Principal Consequences Little change for most people Those using the marketplaces face costly premiums, deductibles and copays and limited choice of doctors and hospitals Millions remain uninsured and underinsured Costs continue to rise

How Canadians Get Health Care Provinces pay for all health care, with federal government contributing a single payer system No co-pays or deductibles Doctors bill the province once a month Hospitals receive an annual budget Funded through federal and provincial taxes Result: 100% of the population covered, spend 10% of GDP on health care

The Public Route to Health Care Reform: Conyers Expanded and Improved Medicare for All Single Payer HR 676 Extend Medicare to cover everyone Comprehensive benefits, free choice of provider No cost-sharing (no deductibles, no co-pays) Public agency pays the bills Funded through progressive taxes Costs no more than we are now spending

Single PayerReform in New York State: Gottfried-Perkins New York Health Bill Universal coverage: everybody in, nobody out! Comprehensive benefits No co-pays or deductibles Free choice of doctor and hospital All payments from a single state fund Covering everyone while spending less

New York Health #1 Who Would Be Eligible? Every resident of New York State No barriers due to age, sex, income, employment, or health status No premiums No co-pays No deductibles

New York Health #2 Comprehensive Benefits Primary and preventive care Inpatient and outpatient hospital care Care coordinator assists in navigating the system, receiving necessary care Prescription drugs Dental, vision, & hearing care Free choice of doctor, including primary care physician & specialists, and hospital

New York Health #3 Who Will Run It? Administered by NYS Dept of Health Overseen by broadly-representative Board of Trustees including consumers and providers

New York Health #4 How Will It Be Paid For? Insurance premiums eliminated Graduated payroll assessment, 80%/20% paid by employer/employee Graduated assessment on upper-bracket non- wage income (dividends, rents, capital gains) Federal funds from Medicare, Medicaid, ACA (needs Federal waiver in 2017) All funds placed in NY Health Trust Fund

Big Savings from Unified System: Billing and insurance overhead now Allocation of Spending for Hospital and Physician Care Paid through Private Insurers consume nearly 30 cents of every dollar Spending through private insurers Other Insurer Costs and Profit 11% Insurer Billing 8% 28% Hospital Billing 4% Physician Billing 5% Medical Care 64% Medical Care Administration 9% Source: James G. Kahn et al, The Cost of Health Insurance Administration in California: Estimates for Insurers, Physicians, and Hospitals, Health Affairs, 2005

Covering Everyone while Saving Money! 2019 $B Additional costs Covering the uninsured and poorly-insured +1.4% Elimination of cost-sharing and co-pays Enhanced Medicare & Medicaid fees Savings Reduced insurance administrative costs -9.9% Reduced physician & hospital admin costs -7.2% Bulk purchasing of drugs & devices -5.7% Reduced fraud 4.0 11.2 10.8 26.0 -28.6 -20.7 -16.3 - 5.4 -71.0 +3.9% +3.8% Total Costs +9.1% -1.9% Total Savings -24.7% Net Savings -15.6% - 45 Source: Economic Analysis of the NY Health Act, Gerald Friedman, April 2015

Mexican Universal Health Care https://www.youtube.co m/v/N938k6lIugY