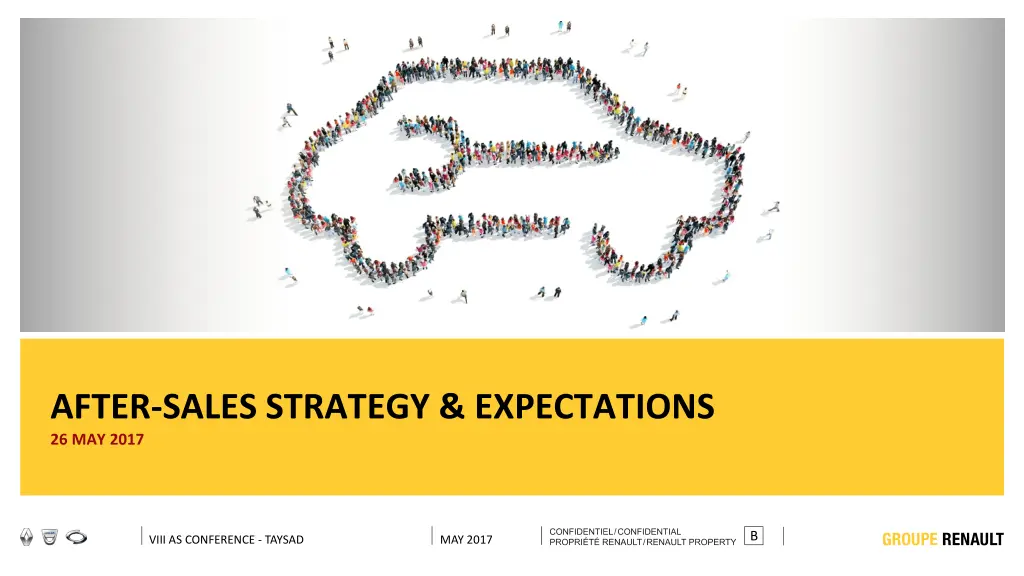

After-Sales Strategy & Expectations at Conference

Explore insights from the B.VIII AS Conference on after-sales strategy and expectations for May 2017. Topics include business overviews, regional turnover analysis, market trends, and new business approaches for Renault and the automotive industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

AFTER-SALES STRATEGY & EXPECTATIONS 26 MAY 2017 B VIII AS CONFERENCE - TAYSAD MAY 2017

CONTENTS 01 RENAULT AS BUSINESS OVERVIEW 02 EURASIA REGION 03 NEW AS PURCHASING ORGANISATION 04 OUR EXPECTATIONS 05 QUESTIONS / ANSWERS B VIII AS CONFERENCE - TAYSAD MAY 2017

01 RENAULT AS BUSINESS OVERVIEW B VIII AS CONFERENCE - TAYSAD MAY 2017

2016 PARTS & ACCESSORIES TURN OVER BY REGION/SEGMENT SEGMENT REGION ASIA PACIFIC ACCESSORIES MAINTENANCE MECANICAL/WEAR & TEAR/ TYRES 8% AMERICAS 11% 6% EURASIA 7% 6% AMI 53% 73% 36% EUROPE BODY/PAINT STILL HIGH DEPENDANCE ON EUROPE B VIII AS CONFERENCE - TAYSAD MAY 2017

AS BUSINESS WORLDWIDE / INTERNATIONAL & EUROPE 84% 83% 81% 83% 80% 72% 76% 73% 73% 74% 74% 28% 27% 27% 26% 26% 24% 20% 19% 17% 16% 17% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 WORLD EUROPE INTERNATIONAL B VIII AS CONFERENCE - TAYSAD MAY 2017

WHERE IS OUR PLAYGROUND? 10 Year Car Park (UIO Unit in Operation) / in Millions 10 Year Car Park (UIO Unit in Operation) / in Millions 24.3 23.4 22.7 22.0 21.8 0.2 0.1 0.1 3.2 0.1 0.1 3.1 3.1 3 3 1.4 1.4 1.4 1.5 1.7 4.3 4.2 4.3 4.4 13.6 13.5 4.8 13.3 13.3 13.2 7.1 7.1 10.6 7.0 6.9 9.9 6.7 9.4 8.9 8.4 8.1 7.4 6.7 5.6 5.0 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 International Europe WW Entry Segment I Segment M1 Segment M2S Segment VU Segment ZEV 1. 2. CAR PARK IS MAINLY INCREASING OUTSIDE EUROPE OVERALL MODEL MIX DETERIORATION B VIII AS CONFERENCE - TAYSAD MAY 2017

NEW BUSINESS APPROACH WITH KEY BREAKTHROUGHS 1. Increase our market share in the overall After-sales Market Topics Before 2016 2017 2020 vision Global part AS market: 460 B OEM Benchmark Benchmark IAM player Original Equipment Manufacturer Silo Organization 35% Organization USFT organization / BU structure 160 B Independent channel 300 B Management Tools TO/UIO K /1000 TO/UIO Market Share 65% Logistics "Cost center" Business development support Only cost saving Purchasing Business growth contributor B VIII AS CONFERENCE - TAYSAD MAY 2017

NEW BUSINESS APPROACH WITH BREAKTHROUGHS 2. Increase our customer retention Topics Before 2016 2017 2020 vision Connectivity / Services AS connectivity offers targeting all Renault / Dacia car park No AS offer Global part AS market: 460 B Customer Retention & $ Spent per visit 16 60% Old tools with "low reactivity" New Tools development (Phenix, ADT3, Alias) 14 IS/IT 50% 12 40% 10 8 30% Limited synergies Common organization with clear roadmap and target Alliance 6 20% 4 10% 2 2nd line (Motrio) Limited range w/o growth Region base plan with realistic multi-brand approach 0 0% Age 1 2 3 4 5 6 7 8 9 10 Spend per visit Retention rate Source; NNA-AS More power to regions and business oriented / clear roles & responsibilities Roles and resp. were not clear Organization B VIII AS CONFERENCE - TAYSAD MAY 2017

02 EURASIA REGION B VIII AS CONFERENCE - TAYSAD MAY 2017

5 REGIONS, CORE OF OPERATIONS Key Dates 2006: the growth in the automotive sector was shifting from Europe to emerging markets 5 RMC creation: system of management for worldwide activities based on a number of geographical regions to be as closely tuned as possible to the needs of its customers to run economical activities as near as possible to its operations 2011: The Group has been taking things even further, making regions even more central to industry competition 2014: Asia-Pacific, Americas, Eurasia, Europe, Africa-Middle East-India Mission: reinforce international Group s development To ensure the means to increase efficiency & impact in all markets and to best seek growth where it is most easily found To maximize the profitability of each region and conquering new markets B VIII AS CONFERENCE - TAYSAD MAY 2017

5 REGIONS, CORE OF OPERATIONS More autonomy & decision-making power REGIONS Implement the strategy in their CORPORATE FUNCTIONS define strategy countries with the network and the develop standards customer set targets STRENGHT: expertise in the field to provide regions the support take operational initiative & send back they need information to the central offices on the specific needs of their markets B VIII AS CONFERENCE - TAYSAD MAY 2017

EURASIA Russia Belorus Moldavia Ukraine Mongolia Romania Kazakhstan Bulgaria Kyrghyzstan Tajikistan Turkey Uzbekistan Turkmenistan Georgia Azerbaijan Armenia B VIII AS CONFERENCE - TAYSAD MAY 2017

03 NEW AS PURCHASING ORGANISATION B VIII AS CONFERENCE - TAYSAD MAY 2017

AS ORGANISATION IN EURASIA PO H/C 7 5 5 RESPONSABILITIES Parts, Motrio, Accessories Local Purchasing Organisation Parts, Motrio, Accessories Local Purchasing Organisation Parts, Motrio, Accessories Local Purchasing Organisation COMMENT Russia Romania Turkey BEFORE the 1st of April 2017 With the creation of new BU all the local purchasing organizations will manage from the same person with the same objectives of BU Countries Commercial Team Regional Commercial Team Logistics Engineering Purchasing AFTER the 1st APRIL 2017 REGIONAL AS BU Countries Commercial Team Regional Commercial Team Logistics Engineering Purchasing B VIII AS CONFERENCE - TAYSAD MAY 2017

04 OUR EXPECTATIONS B VIII AS CONFERENCE - TAYSAD MAY 2017

What are our expectations? Industrially Turkey is the most capable country in the region. We want to use this capacity to have a complete : AS product range for our client Motrio range for all the brands And also Accessories Our objective is to make purchasing for all region countries in first step. Then we want to supply for AMI region where the client profile and product range are same. To realize this growth our priorities are : Best P0 purchasing price Volume rebate B VIII AS CONFERENCE - TAYSAD MAY 2017

05 QUESTIONS & ANSWERS B VIII AS CONFERENCE - TAYSAD MAY 2017