Aggregate Share Data Modeling: BLP Insights and Analysis

Explore discrete choice modeling using aggregate market data in BLP methodology. Learn about the model of Berry, Levinsohn, and Pakes, resources, and practical guides for estimation within this framework. Dive into market equilibrium, dynamic panel data approaches, and more in the realm of aggregate share data analysis.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

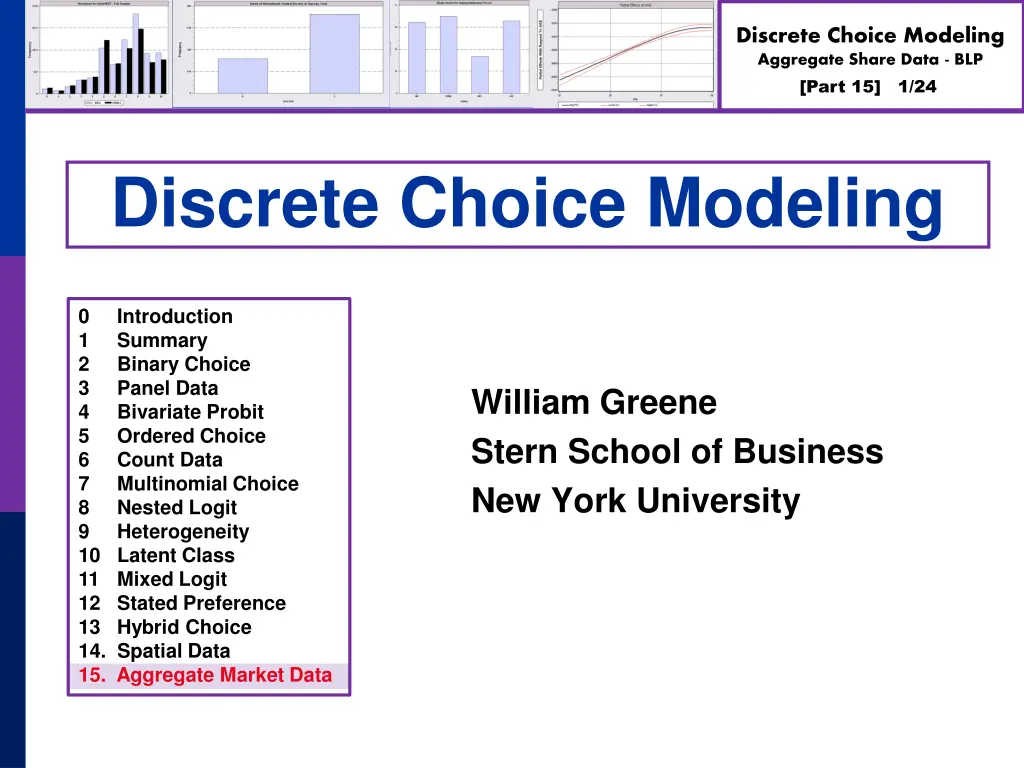

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 1/24 Discrete Choice Modeling 0 1 2 3 4 5 6 7 8 9 10 Latent Class 11 Mixed Logit 12 Stated Preference 13 Hybrid Choice 14. Spatial Data 15. Aggregate Market Data Introduction Summary Binary Choice Panel Data Bivariate Probit Ordered Choice Count Data Multinomial Choice Nested Logit Heterogeneity William Greene Stern School of Business New York University

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 2/24 Aggregate Data and Multinomial Choice: The Model of Berry, Levinsohn and Pakes

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 3/24 Resources Automobile Prices in Market Equilibrium, S. Berry, J. Levinsohn, A. Pakes, Econometrica, 63, 4, 1995, 841-890. (BLP) http://people.stern.nyu.edu/wgreene/Econometrics/BLP.pdf A Practitioner s Guide to Estimation of Random-Coefficients Logit Models of Demand, A. Nevo, Journal of Economics and Management Strategy, 9, 4, 2000, 513-548 http://people.stern.nyu.edu/wgreene/Econometrics/Nevo-BLP.pdf A New Computational Algorithm for Random Coefficients Model with Aggregate- level Data, Jinyoung Lee, UCLA Economics, Dissertation, 2011 http://people.stern.nyu.edu/wgreene/Econometrics/Lee-BLP.pdf Elasticities of Market Shares and Social Health Insurance Choice in Germany: A Dynamic Panel Data Approach, M. Tamm et al., Health Economics, 16, 2007, 243-256. http://people.stern.nyu.edu/wgreene/Econometrics/Tamm.pdf

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 4/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 5/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 6/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 7/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 8/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 9/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 10/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 11/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 12/24

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 13/24 Aggregate Data and Multinomial Choice: The Model of Berry, Levinsohn and Pakes

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 14/24 Theoretical Foundation Consumer market for J differentiated brands of a good j =1, , Jt brands or types i = 1, , N consumers t = i, ,T markets (like panel data) Consumer i s utility for brand j (in market t) depends on p = price x = observable attributes f = unobserved attributes w = unobserved heterogeneity across consumers = idiosyncratic aspects of consumer preferences Observed data consist of aggregate choices, prices and features of the brands.

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 15/24 BLP Automobile Market Jt t

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 16/24 Random Utility Model Utility: Uijt=U(wi,pjt,xjt,fjt| ), i = 1, ,(large)N, j=1, ,J wi = individual heterogeneity; time (market) invariant. w has a continuous distribution across the population. pjt, xjt, fjt, = price, observed attributes, unobserved features of brand j; all may vary through time (across markets) Revealed Preference: Choice j provides maximum utility Across the population, given market t, set of prices pt and features (Xt,ft), there is a set of values of wi that induces choice j, for each j=1, ,Jt; then, sj(pt,Xt,ft| ) is the market share of brand j in market t. There is an outside good that attracts a nonnegligible market share, j=0. Therefore, tJ j=1s ( p X f , , | ) 1 < j t t t

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 17/24 Functional Form (Assume one market for now so drop t. ) Uij=U(wi,pj,xj,fj| )= xj' pj + fj + ij = j + ij Econsumers i[ ij] = 0, j is E[Utility]. j q j = + j Market Share E Prob( ) q Will assume logit form to make integration unnecessary. The expectation has a closed form.

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 18/24 Heterogeneity Assumptions so far imply IIA. Cross price elasticities depend only on market shares. Individual heterogeneity: Random parameters Uij=U(wi,pj,xj,fj| i)= xj' i pj + fj + ij ik = k + kvik. The mixed model only imposes IIA for a particular consumer, but not for the market as a whole.

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 19/24 Endogenous Prices: Demand side Uij=U(wi,pj,xj,fj| )= xj' i pj + fj + ij fj is unobserved Utility responds to the unobserved fj Price pj is partly determined by features fj. In a choice model based on observables, price is correlated with the unobservables that determine the observed choices.

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 20/24 Endogenous Price: Supply Side There are a small number of competitors in this market Price is determined by firms that maximize profits given the features of its products and its competitors. mcj = g(observed cost characteristics c, unobserved cost characteristics h) At equilibrium, for a profit maximizing firm that produces one product, sj + (pj-mcj) sj/ pj = 0 Market share depends on unobserved cost characteristics as well as unobserved demand characteristics, and price is correlated with both.

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 21/24 Instrumental Variables ( and are our h and f.)

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 22/24 Econometrics: Essential Components jt = = = ~ Type I extreme value, IID across all choices + + U U x f ijt i jt ijt (Outside good) v , i0t i0t + = diagonal( ,...) i i 1 ijt jt + exp( x f ) i jt : = = Market shares: s ( X f , ) ,j 1,..., tJ j t t i J mt + + 1 exp( x mt f ) i = m 1

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 23/24 Econometrics jt + exp( x f ) i jt : = = Market Shares: s ( X f , ) ,j 1,...,J j t t i t J mt + + x 1 exp( x mt f ) i = m 1 jt + exp( f ) i jt = Expected Share: E[s ( X f , : )] dF( ) j t t i J mt + + 1 exp( x mt f ) i i = m 1 on: Expected Shares are estimated using simulati 1 s ( , : ) R jt ( + ( + + exp[ x v ) f ] R ir jt = X f j t t J = r 1 mt + ( + ( + + 1 exp[ x v ) mt f ] ir = m 1

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 24/24 GMM Estimation Strategy - 1 jt ( + ( + + exp[ x v ) f ] 1 R R ir jt s ( = X f , : ) jt t t J = r 1 mt + ( + ( + + 1 exp[ x v ) mt f ] ir = m 1 We have instruments E[f ( ) f is obtained from an inverse mapping by equating the z such that jt = z ] 0 jt jt jt s fitted market shares, , to the observed market shares, so ( , f s X S t t S . t t t s X f t t 1 = = ( , : ) S : ). t t t t t t

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 25/24 GMM Estimation Strategy - 2 We have instruments E[f ( ) z z such that jt = ] 0 jt jt f s X f t t s 1 = = ( , : ) 1 J S so ( X S , : ). t t t t t t t t f g J Define = z t t jt jt = j 1 t g Wg = ) GMM Criterion would be Q ( where = the weighting matrix for mi W For the entire sample, the GMM estimator is built on 1 1 = f and Q( T J t t t nimum distance estimation. g Wg T J g z )= t jt jt = = t 1 j 1 t

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 26/24 BLP Iteration = ( , Find a fixed log[ ( , With in hand, use GMM to (re)estimate f step or exit if - is sufficiently small. step is straightforward - concave function (quadratic form) of a concave function (logit probability). Solving the step is time consuming INNER Recent research has produced several alternative algorithms. (0) t f Begin with starting values for structural parameters and . f and starting values for t (M 1) t (M 1) t (M 1) (M 1) Compute predicted shares INNER (Contraction Mapping) log( f f s X f : , ). t point for (M) t OUTER (GMM Step) (M 1) t (M 1) t (M 1) t f (M 1) (M 1) (M) t f (M 1) t f (M 1) (M 1) = + S ) s X : , )] ( , , ) t t (M) t (M) (M) , . (M) t f (M 1) t f Return to GMM IN NER and very complicated. (M) t f Overall complication: The estimates can diverge.

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 27/24 ABLP Iteration tis our ft. is our ( , ) No superscript is our (M); superscript 0 is our (M-1).

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 28/24 Side Results

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 29/24 ABLP Iterative Estimator

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 30/24 BLP Design Data

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 31/24 Exogenous price and nonrandom parameters

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 32/24 IV Estimation

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 33/24 Full Model

Discrete Choice Modeling Aggregate Share Data - BLP [Part 15] 34/24 Some Elasticities