Agricultural Biologicals Market Share, Size, and Growth Forecast to 2032

The global agricultural biologicals market was valued at USD 15.29 billion in 2024 and is forecasted to increase to USD 17.42 billion in 2025, ultimately reaching USD 44.70 billion by 2032. This growth represents a robust compound annual growth rate

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

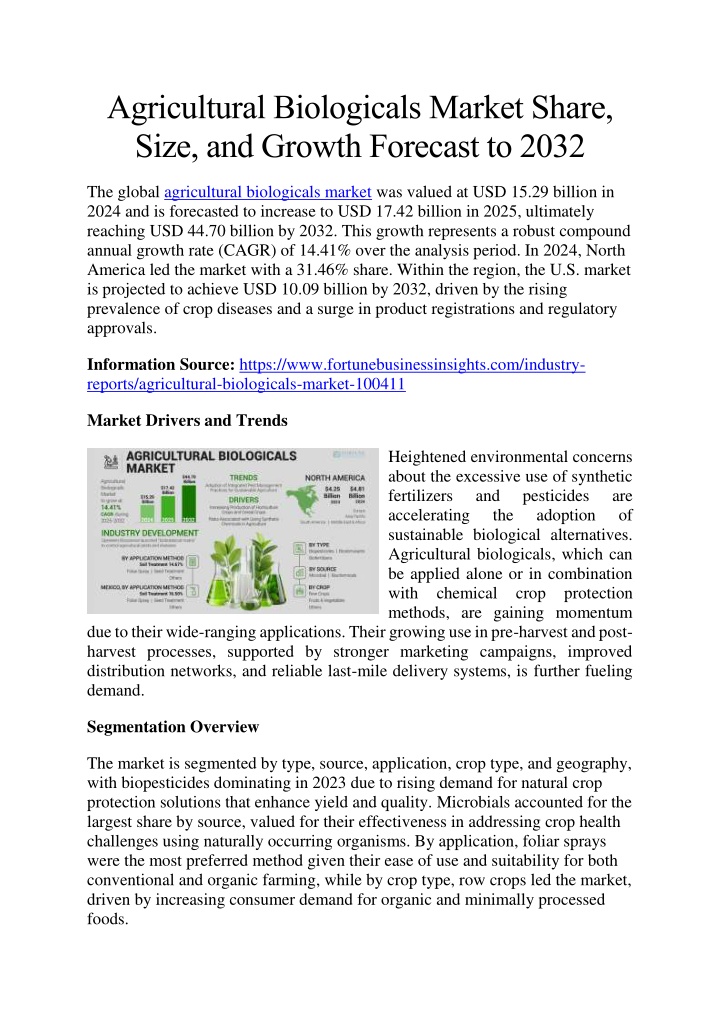

Agricultural Biologicals Market Share, Size, and Growth Forecast to 2032 The global agricultural biologicals market was valued at USD 15.29 billion in 2024 and is forecasted to increase to USD 17.42 billion in 2025, ultimately reaching USD 44.70 billion by 2032. This growth represents a robust compound annual growth rate (CAGR) of 14.41% over the analysis period. In 2024, North America led the market with a 31.46% share. Within the region, the U.S. market is projected to achieve USD 10.09 billion by 2032, driven by the rising prevalence of crop diseases and a surge in product registrations and regulatory approvals. Information Source: https://www.fortunebusinessinsights.com/industry- reports/agricultural-biologicals-market-100411 Market Drivers and Trends Heightened environmental concerns about the excessive use of synthetic fertilizers and accelerating the sustainable biological alternatives. Agricultural biologicals, which can be applied alone or in combination with chemical crop protection methods, are gaining momentum pesticides adoption are of due to their wide-ranging applications. Their growing use in pre-harvest and post- harvest processes, supported by stronger marketing campaigns, improved distribution networks, and reliable last-mile delivery systems, is further fueling demand. Segmentation Overview The market is segmented by type, source, application, crop type, and geography, with biopesticides dominating in 2023 due to rising demand for natural crop protection solutions that enhance yield and quality. Microbials accounted for the largest share by source, valued for their effectiveness in addressing crop health challenges using naturally occurring organisms. By application, foliar sprays were the most preferred method given their ease of use and suitability for both conventional and organic farming, while by crop type, row crops led the market, driven by increasing consumer demand for organic and minimally processed foods.

Regionally, the market is spread across North America, Europe, Asia Pacific, and the Middle East & Africa, each shaped by distinct agricultural practices and regulatory frameworks. Key Report Insights This report examines market growth drivers, restraints, and ongoing trends. It evaluates the impact of the COVID-19 pandemic while outlining strategic developments and innovations introduced by leading players. Growth Catalysts and Challenges: Integrated Pest Management (IPM): Widespread adoption of IPM practices, where biopesticides are integral, is strongly supporting market expansion. Regulatory Constraints: The absence of globally harmonized regulations for biological products could limit wider adoption. Regional Highlights North America maintains its leadership in the market with strong production of soybeans, wheat, and cotton, coupled with a growing reliance on biological solutions for disease management, while Europe is witnessing a faster shift toward biologically sustainable alternatives as rising costs of synthetic nitrogen- and phosphorus-based fertilizers drive demand for more cost-effective options. Competitive Landscape The agricultural biologicals market is moderately consolidated, featuring a mix of established multinationals and emerging innovators. Key players are channeling significant investments into research and development, leveraging strong brand presence, and expanding distribution reach. Continuous innovation is viewed as the primary driver for gaining a competitive edge and scaling market presence. Prominent Market Players Bayer AG (Germany) BASF SE (Germany) Syngenta AG (Switzerland) UPL Limited (India) Marrone Bio Innovations (U.S.) SEIPASA S.A. (Spain) Koppert Biological Systems (Netherlands) PI Industries (India)

Novozymes A/S (Denmark) Gowan Group (U.S.) Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample- pdf/agricultural-biologicals-market-100411 Recent Industry Development August 2022: Chambal Fertilizers and Chemicals Limited (CFCL) launched UTTAM SUPERRHIZA, a Mycorrhiza-based biofertilizer. The product combines advanced plant growth technology with native biological organisms to enhance plant health and maximize Mycorrhiza efficiency.