AIC Transmission Rate True-Up: Review of Revenue Requirement for Ameren Illinois 2014

"Learn about the 2014 True-Up Stakeholder Meeting for Ameren Illinois, focusing on the Transmission Rate calculations and Revenue Requirement. Explore the timeline, projections, historical data, and future protocol changes discussed in the meeting."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

2014 Attachment O True-Up Stakeholder Meeting Ameren Illinois Company July 29, 2015

AGENDA Main Purpose is to review AIC 2014 Transmission Rate True-Up Calculations Timeline AIC 2014 True Up 2014 AMIL Pricing Zone NITS Charge An additional meeting will be held in October to review the 2016 Projected Transmission Rate calculations. 2

NEW PROTOCOL TIMELINE Schedule Date (Forward-Looking Protocols) June 1 Posting of annual true-up for prior year September 1 September 1 October 15 November 1 March 15 Deadline for annual true-up meeting Posting of net projected revenue requirement for following year Deadline for annual projected rate meeting Deadline for joint meeting on regional cost-shared projects Transmission Owners submit informational filing to the Commission 3

AIC Revenue Requirement Projected 2014 vs Actual 2014 4

AIC 2014 ATTACHMENT O TRUE UP Ameren Illinois Company - AIC Attachment O Revenue Requirement True-Up Year Ended December 31, 2014 Attachment O Net Actual Revenue Requirement (Attachment O, Pg 1, Line 7a) $153,084,880 Net Projected Revenue Requirement (2014 Projected Attachment O, Pg 1, Line 7a) $143,000,924 Under/(Over) Recovery of Net Revenue Requirement $10,083,956 Historic Year Actual Divisor for Pricing Zone (Attachment O, Pg 1, Line 15) Projected Year Divisor for Pricing Zone (2014 Projected Attachment O, Pg 1, Line 15) Difference between Historic & Projected Yr Divisor Prior Year Projected Annual Cost ($ per kw per yr) Prior Year Under/(Over) Divisor True-up 7,205,351 7,045,000 160,351 $20.2982 $(3,254,838) Total Under/(Over) Recovery $6,829,118 Monthly Interest Rate (to be updated through July, 2015) Interest For 24 Months 0.0265% $43,433 Total Under/(Over) Recovery Including Interest (Amount to be included in Projected 2016 Attachment O) $6,872,551 5

AIC 2014 RATE BASE 2014 Projection 1,327,622,018 465,639,921 861,982,097 2014 Actual 1,366,240,974 459,871,993 906,368,981 Change 38,618,956 -5,767,928 44,386,884 Percent Page.Line 2.6 2.12 2.18 Total Gross Plant Total Accum Depreciation TOTAL NET PLANT 3% -1% 5% 100% CWIP RECOVERY 2.18a 0 7,301,137 7,301,137 N/A ADJUSTMENTS TO RATE BASE Account No. 282 Account No. 283 Account No. 190 Account No. 255 Land Held for Future Use CWC Materials & Supplies Prepayments TOTAL ADJUSTMENTS 0 N/A 8% -66% -11% N/A 456% 11% 43% 40% 3% 2.20 2.21 2.22 2.23 2.25 2.26 2.27 2.28 -229,080,460 -17,757,369 40,041,062 -248,516,533 -6,008,729 35,690,801 -19,436,073 11,748,639 -4,350,262 0 0 0 425,040 4,767,079 8,000,238 1,049,481 -192,554,928 2,363,867 5,276,084 11,405,051 1,469,725 -198,319,736 1,938,827 509,004 3,404,813 420,245 -5,764,807 TOTAL RATE BASE 2.30 669,427,168 715,350,382 45,923,214 7% 6

AIC 2014 EXPENSES 2014 Projection 2014 Actual Change Percent Page.Line O&M Transmission Less LSE Expenses Less Account 565 A&G Less FERC Annual Fees Less EPRI, ect. Plus Trans. Reg. Comm. Exp TOTAL O&M 3.1 3.1a 3.2 3.3 3.4 3.5 3.5a 3.8 42,031,093 2,577,054 13,190,160 12,184,795 44,551,839 1,495,616 14,086,181 13,067,946 2,520,746 -1,081,438 896,021 883,152 6% -42% 7% 7% N/A -17% 427% 11% 0 0 0 408,626 96,587 38,136,635 338,476 509,156 42,208,668 -70,150 412,569 4,072,033 TOTAL DEPRECIATION 3.12 22,612,545 24,585,112 1,972,567 9% TAXES Payroll Property Other Income Taxes TOTAL TAXES 0 N/A -16% -18% -22% 10% 8% 3.13 3.16 3.18 3.27 894,566 1,048,910 388,574 31,970,516 34,302,566 747,864 861,889 304,307 35,087,815 37,001,876 -146,701 -187,021 -84,266 3,117,299 2,699,310 TOTAL EXPENSES 95,051,746 103,795,656 8,743,910 9% 7

AIC 2014 CAPITAL STRCUTURE Capital Structure - 2014 Projection $ % Cost Weighted Page.Line 4.27 4.28 4.29 4.3 Long Term Debt Preferred Stock Common Stock Total 1,972,228,239 61,721,350 2,508,477,417 4,542,427,006 43% 1% 55% 100% 0.0615 0.0490 0.1238 0.0267 0.0007 0.0684 0.0957 Capital Structure - 2014 Actual $ % Cost Weighted Page.Line 4.27 4.28 4.29 4.3 Long Term Debt Preferred Stock Common Stock Total 1,850,078,816 61,632,375 2,484,591,823 4,396,303,014 42% 1% 57% 100% 0.0567 0.0491 0.1238 0.0238 0.0007 0.0700 0.0945 Change in Return -0.1217% 8

AIC 2014 TOTAL REVENUE REQUIREMENT 2014 Projection 669,427,168 2014 Actual 715,350,382 Change 45,923,214 -0.12% 3,524,658 Percent Page.Line 2.30 4.30 3.28 TOTAL RATE BASE Rate of Return Return 7% -1% 6% 9.57% 9.45% 64,074,874 67,599,532 Total Expenses TOTAL GROSS REV. REQ. 95,051,746 159,126,620 103,795,656 171,395,188 8,743,910 12,268,568 9% 8% 3.29 3.30 3.30a 3.31 Less ATT. GG Adjustment Less ATT. MM Adjustment GROSS REV. REQ. UNDER ATT. O 5,567,662 5,966,673 1,209,584 164,218,931 399,011 1,209,584 10,659,973 7% N/A 7% 0 153,558,958 9

AIC 2014 TRUE UP & NET REVENUE REQUIREMENT 2014 Projection 153,558,958 10,558,034 2014 Actual 164,218,931 11,134,050 Change 10,659,973 576,016 Percent Page.Line 1.1 1.6 Gross Revenue Requirement Total Revenue Credits 7% 5% 1.6a 1.6b 1.6c 1.6d 1.6e Historic Year Actual ATRR * Projected ATRR from Prior Year Prior Year ATRR True-Up Prior Year Divisor True-Up Interest on Prior Year True-Up 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 N/A N/A N/A N/A N/A 1.7a 1.7b 1.7 NET REVENUE REQUIREMENT Prairie Power AIC Adjusted Revenue Requirement 143,000,924 153,084,880 10,083,956 7% N/A 7% 0 0 0 143,000,924 153,084,880 10,083,956 * AIC did not use a projected calculation in 2012, so there is no prior year True-up included in 2014. 10

AIC 2014 ATTACHMENT GG AIC Attachment GG Calculation - Page 1 (1) (2) (3) (4) Attachment O Page, Line, Col. Line No. Transmission Allocator 1 2 Gross Transmission Plant - Total Net Transmission Plant - Total Attach O, p 2, line 2 col 5 (Note A) Attach O, p 2, line 14 and 23b col 5 (Note B) 1,329,522,359 884,276,054 O&M EXPENSE Total O&M Allocated to Transmission Annual Allocation Factor for O&M 3 4 Attach O, p 3, line 8 col 5 (line 3 divided by line 1 col 3) 42,208,668 3.17% 3.17% GENERAL AND COMMON (G&C) DEPRECIATION EXPENSE Total G&C Depreciation Expense Annual Allocation Factor for G&C Depreciation Expense 5 6 Attach O, p 3, lines 10 & 11, col 5 (Note H) (line 5 divided by line 1 col 3) 1,890,002 0.14% 0.14% TAXES OTHER THAN INCOME TAXES Total Other Taxes Annual Allocation Factor for Other Taxes 7 8 Attach O, p 3, line 20 col 5 (line 7 divided by line 1 col 3) 1,914,061 0.14% 0.14% 9 Annual Allocation Factor for Expense Sum of line 4, 6, and 8 3.46% INCOME TAXES Total Income Taxes Annual Allocation Factor for Income Taxes 10 11 Attach O, p 3, line 27 col 5 (line 10 divided by line 2 col 3) 35,087,815 3.97% 3.97% RETURN Return on Rate Base Annual Allocation Factor for Return on Rate Base 12 13 Attach O, p 3, line 28 col 5 (line 12 divided by line 2 col 3) 67,599,532 7.64% 7.64% 14 Annual Allocation Factor for Return Sum of line 11 and 13 11.61% 11

AIC 2014 ATTACHMENT GG AIC Attachment GG Calculation - Page 2 (1) (2) (3) (4) (5) (6) Annual Allocation Factor for Expense (Page 1 line 9) Line No. MTEP Project Number Project Gross Plant (Note C) Annual Expense Charge (Col. 3 * Col. 4) Project Name Project Net Plant (Note D) 1a 1b 1c 1d 1e 1f Wood River-Roxford 1502 138kV line Sidney-Paxton 138kV Reconductor 18 miles Coffeen Plant-Coffeen, North - 2nd. Bus tie Latham - Oreana 8.5 mile 345kV line Brokaw-S. Bloom 345/138kV Trans & 345kV line Fargo-Mapleridge-20 mile 345kV line & New Sub 728 870 2829 2068 2069 2472 $ 3,424,487 $ 5,994,479 $ 5,592,558 $ 21,649,051 $ 106,683 $ - 3.46% 3.46% 3.46% 3.46% 3.46% 3.46% $118,516.25 $ 3,046,429 $207,459.73 $ 5,294,859 $193,549.86 $ 5,243,540 $749,240.47 $ 21,431,303 $3,692.13 $ 106,522 $0.00 $ - (1) (2) (7) (8) (9) (10) (11) (12) Project Depreciation Expense Line No. MTEP Project Number Annual Allocation Factor for Return Annual Return Charge Annual Revenue Requirement True-Up Adjustment Network Upgrade Charge Project Name Sum Col. 10 & 11 (Note G) (Page 1 line 14) (Col. 6 * Col. 7) (Note E) (Sum Col. 5, 8 & 9) (Note F) 1a 1b 1c 1d 1e 1f Wood River-Roxford 1502 138kV line Sidney-Paxton 138kV Reconductor 18 miles Coffeen Plant-Coffeen, North - 2nd. Bus tie Latham - Oreana 8.5 mile 345kV line Brokaw-S. Bloom 345/138kV Trans & 345kV line Fargo-Mapleridge-20 mile 345kV line & New Sub 728 870 2829 2068 2069 2472 11.61% 11.61% 11.61% 11.61% 11.61% 11.61% $353,769 $614,870 $608,911 $2,488,729 $12,370 $52,502 $99,719 $98,012 $363,763 $1,570 $524,788 $ - $922,049 $ - $900,473 $ - $3,601,732 $ - $17,632 $ - $0 $ - 524,788 922,049 900,473 3,601,732 17,632 $0 $0 0 2 Annual Totals $5,966,673 $0 $5,966,673 3 Rev. Req. Adj For Attachment O $5,966,673 12

AIC 2014 ATTACHMENT GG TRUE-UP AIC 2014 Attachment GG True Up (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) Actual Projected Annual Revenue Requirement 1 Projected Attachment GG Revenues Allocated to Projects 1 [Col. (d), line 1 Actual Annual Revenue Requirement 1 Actual True-Up Adjustment Principal Under/(Over) Under/(Over) Under/(Over) Applicable Interest Rate on True-Up Adjustment Interest MTEP Project Number Actual Total True-Up Adjustment Line No. Project Name Attachment GG Revenues Col. (h) x Col. (i) Attachment GG x (Col. (e), line 2x / Attachment GG Col. (g) - Col. (f) p 2 of 2, Col. 102 Col. (e), line 3)]2 p 2 of 2, Col. 102 Line 5 x 24 months 2Col. (h) + Col. (j) 1 Actual Attachment GG revenues for True-Up Year 1 $ 5,755,759 2a Wood River-Roxford 1502 138kV line 2b Sidney-Paxton 138kV Reconductor 18 miles 2c Coffeen Plant-Coffeen, North - 2nd. Bus tie 2d Latham - Oreana 8.5 mile 345kV line 2e Brokaw-S. Bloom 345/138kV Trans & 345kV line 2f Fargo-Mapleridge-20 mile 345kV line & New Sub 728 870 2829 2068 2069 2472 527,494 935,340 873,483 3,231,345 545,315 966,939 902,993 3,340,512 524,788 922,049 900,473 3,601,732 17,632 (20,527) (44,890) (2,520) 261,220 17,632 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% (131) (286) (16) 1,661 112 (20,658) (45,176) (2,536) 262,881 17,744 - - - - - - - - 3 Subtotal $ 5,567,662 $ 5,755,759 $ 5,966,674 4 Under/(Over) Recovery $ 210,915 $ 1,340 $ 212,255 5 Applicable Interest rate per month (expressed to four decimal places) Interest Rate to be updated through July 2015 0.0265% Amount excludes True-Up Adjustment, as reported in True-Up Year projected Attachment GG, page 2, column 11. Rounded to whole dollars. 1 2 13

AIC 2014 ATTACHMENT MM AIC Attachment MM Calculation - Page 1 (1) (2) (3) (4) Attachment O Page, Line, Col. Line No. Transmission Allocator 1 1a 2 Gross Transmission Plant - Total Transmission Accumulated Depreciation Net Transmission Plant - Total Attach O, p 2, line 2 col 5 (Note A) Attach O, p 2, line 8 col 5 Line 1 minus Line 1a (Note B) 1,329,522,359 445,246,305 884,276,054 O&M TRANSMISSION EXPENSE Total O&M Allocated to Transmission Transmission O&M Less: LSE Expenses included in above, if any Less: Account 565 included in above, if any Adjusted Transmission O&M 3 3a 3b 3c 3d Attach O, p 3, line 8 col 5 Attach O, p 3, line 1 col 5 Attach O, p 3, line 1a col 5, if any Attach O, p 3, line 2 col 5, if any Line 3a minus Line 3b minus Line 3c 42,208,668 44,551,839 1,495,616 14,086,181 28,970,042 4 (Line 3d divided by line 1a, col 3) Annual Allocation Factor for Transmission O&M 6.51% 6.51% OTHER O&M EXPENSE Other O&M Allocated to Transmission Annual Allocation Factor for Other O&M 4a 4b Line 3 minus Line 3d Line 4a divided by Line 1, col 3 13,238,626 1.00% 1.00% GENERAL AND COMMON (G&C) DEPRECIATION EXPENSE Total G&C Depreciation Expense Annual Allocation Factor for G&C Depreciation Expense 5 6 Attach O, p 3, lines 10 & 11, col 5 (Note H) (line 5 divided by line 1 col 3) 1,890,002 0.14% 0.14% TAXES OTHER THAN INCOME TAXES Total Other Taxes Annual Allocation Factor for Other Taxes 7 8 Attach O, p 3, line 20 col 5 (line 7 divided by line 1 col 3) 1,914,061 0.14% 0.14% 9 Annual Allocation Factor for Other Expense Sum of line 4b, 6, and 8 1.28% 1.28% INCOME TAXES Total Income Taxes Annual Allocation Factor for Income Taxes 10 11 Attach O, p 3, line 27 col 5 (line 10 divided by line 2 col 3) 35,087,815 3.97% 3.97% RETURN Return on Rate Base Annual Allocation Factor for Return on Rate Base 12 13 Attach O, p 3, line 28 col 5 (line 12 divided by line 2 col 3) 67,599,532 7.64% 7.64% 14 Annual Allocation Factor for Return Sum of line 11 and 13 11.61% 14

AIC 2014 ATTACHMENT MM AIC Attachment MM Calculation - Page 2 (1) (2) (3) (4) (5) (6) (7) (8) (9) Other Expense Annual Allocation Factor Page 1 line 9 Transmission O&M Annual Allocation Factor Page 1 line 4 Annual Allocation for Transmission O&M Expense (Col 4 * Col 5) MTEP Project Number Project Accumulated Depreciation Annual Expense Charge (Col 6 + Col 8) Line No. Project Gross Plant (Note C) Annual Allocation for Other Expense (Col 3 * Col 7) Project Name Multi-Value Projects (MVP) 1a Pana-Sugar Creek - CWIP 1b Pana-Sugar Creek - Plant in Service 1c Pana-Sugar Creek - Land 1d Sidney-Rising - CWIP 1e Sidney-Rising - Plant in Service 1f Palmyra-Pawnee - CWIP 1g Palmyra-Pawnee - Plant in Service 1h Fargo-Galesburg-Oak Grove - CWIP 1i Fargo-Galesburg-Oak Grove - Plant 1j Pawnee-Pana - CWIP 1k Pawnee-Pana - Plant in Service 2237 2237 2237 2239 2239 3017 3017 3022 3022 3169 3169 $ 786,204 $ - $ 31,702 $ 27 $ 11,763 $ - $ 94,021 $ - $ - $ - $ 6,396,360 $ - $ 1,820,831 $ 2,823 $ 72 $ - $ - $ - $ 24,481 $ - $ - $ - 6.51% $ - 6.51% $ 2 6.51% $ - 6.51% $ - 6.51% $ - 6.51% $ - 6.51% $ 184 6.51% $ - 6.51% $ - 6.51% $ - 6.51% $ - 1.28% 1.28% 1.28% 1.28% 1.28% 1.28% 1.28% 1.28% 1.28% 1.28% 1.28% $10,078.08 $406.38 $150.79 $1,205.22 $0.00 $81,992.74 $23,340.61 $0.92 $0.00 $313.81 $0.00 $10,078.08 $408.14 $150.79 $1,205.22 $0.00 $81,992.74 $23,524.31 $0.92 $0.00 $313.81 $0.00 15

AIC 2014 ATTACHMENT MM AIC Attachment MM Calculation - Page 2 (continued) (1) (2) (10) (11) (12) (13) (14) (15) (16) MVP Annual Adjusted Revenue Requirement Sum Col. 14 & 15 (Note G) MTEP Project Number Project Depreciation Expense Annual Revenue Requirement Line No. Project Net Plant Annual Allocation Factor for Return Annual Return Charge True-Up Adjustment Project Name (Sum Col. 9, 12 & 13) (Col 3 - Col 4) (Page 1 line 14) (Col 10 * Col 11) (Note E) (Note F) Multi-Value Projects (MVP) 1a Pana-Sugar Creek - CWIP 1b Pana-Sugar Creek - Plant in Service 1c Pana-Sugar Creek - Land 1d Sidney-Rising - CWIP 1e Sidney-Rising - Plant in Service 1f Palmyra-Pawnee - CWIP 1g Palmyra-Pawnee - Plant in Service 1h Fargo-Galesburg-Oak Grove - CWIP 1i Fargo-Galesburg-Oak Grove - Plant 1j Pawnee-Pana - CWIP 1k Pawnee-Pana - Plant in Service 2237 2237 2237 2239 2239 3017 3017 3022 3022 3169 3169 $ 786,204 $ 31,675 $ 11,763 $ 94,021 $ - $ 6,396,360 $ 1,818,008 $ 72 $ - $ 24,481 $ - 11.61% $ 91,299 $ - $ 101,377 $ - $ 101,377 11.61% $ 3,678 $ 352 $ 4,438 $ - $ 4,438 11.61% $ 1,366 $ - $ 1,517 $ - $ 1,517 11.61% $ 10,918 $ - $ 12,123 $ - $ 12,123 11.61% $ - $ - $ - $ - $ - 11.61% $ 742,783 $ - $ 824,776 $ - $ 824,776 11.61% $ 211,118 $ 27,545 $ 262,187 $ - $ 262,187 11.61% $ 8 $ - $ 9 $ - $ 9 11.61% $ - $ - $ - $ - $ - 11.61% $ 2,843 $ - $ 3,157 $ - $ 3,157 11.61% $ - $ - $ - $ - $ - 2 MVP Total Annual Revenue Requirements $1,209,584 $0 $1,209,584 3 Rev. Req. Adj For Attachment O $1,209,584 16

AIC 2014 ATTACHMENT MM TRUE-UP AIC 2014 Attachment MM True Up (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) Actual Projected Attachment MM Actual True-Up Applicable True-Up MTEP Actual Annual Revenues Annual Adjustment Interest Adjustment Total Line Project Project Attachment MM Revenue Allocated Revenue Principal Rate on Interest True-Up Requirement 1 to Projects 1 Requirement 1 No. Name Number Revenues Under/(Over) Under/(Over) Under/(Over) Adjustment Projected [Col. (d), line 1 Actual Attachment MM x (Col. (e), line 2x / Attachment MM Col. (h) x Col. (i) p 2 of 2, Col. 142 Col. (e), line 3)]2 p 2 of 2, Col. 142 x 24 months 2 Col. (g) - Col. (f) Line 5 Col. (h) + Col. (j) 1 Actual Attachment MM revenues for True-Up Year 1 $ - - - - - - - - - - - - 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% 0.0265% 2a Pana-Sugar Creek - CWIP 2237 - 101,377 101,377 645 102,022 2b Pana-Sugar Creek - Plant in Service 2237 - 4,438 4,438 28 4,466 2c Pana-Sugar Creek - Land 2237 - 1,517 1,517 10 1,527 2d Sidney-Rising - CWIP 2239 - 12,123 12,123 77 12,200 2e Sidney-Rising - Plant in Service 2239 - - - - - 2f Palmyra-Pawnee - CWIP 3017 - 824,776 824,776 5,246 830,022 2g Palmyra-Pawnee - Plant in Service 3017 - 262,187 262,187 1,668 263,855 2h Fargo-Galesburg-Oak Grove - CWIP 3022 - 9 9 - 9 2i Fargo-Galesburg-Oak Grove - Plant 3022 - - - - - 2j Pawnee-Pana - CWIP 3169 - 3,157 3,157 20 3,177 2k Pawnee-Pana - Plant in Service 3169 - - - - - $ - $ - $ 1,209,584 3 Subtotal $ 1,209,584 $ 7,694 $ 1,217,278 4 Under/(Over) Recovery 5 Applicable Interest rate per month (expressed to four decimal places) Interest Rate to be updated through July 2015 0.0265% 1 Amount excludes True-Up Adjustment, as reported in True-Up Year projected Attachment MM, page 2, column 15. 2 Rounded to whole dollars. 17

AIC 2014 MVP SPEND Ameren MVPs Ameren Name 2014 CAPEX MTEP #s MTEP Description 2237 2239 3017 3169 Pana - Mt. Zion - Kansas - Sugar Creek 345 kV line Sidney to Rising 345 kV line Palmyra-Quincy-Meredosia - Ipava & Meredosia-Pawnee 345 kV Line Pawnee to Pana - 345 kV Line Illinois Rivers $16.07 million 3022 Fargo-Galesburg-Oak Grove 345 kV Line Spoon River $0 million 18

2014 SIGNIFICANT TRANSMISSION PROJECTS ADDED TO PLANT Project Name Total Cost Bondville Route 10 Various ROW projects Various IL Rivers East Quincy-Meredosia 2 Hennepin-Oglesby Cahokia-Turkey Hill Havana-Galesburg-Monmouth East Quincy-Meredosia 1 ADM Decatur Fogarty Substation Salem West-Mt. Vernon West Paxton - Rantoul $36.0 $19.8 $12.3 $11.7 $10.9 $10.8 $9.2 $9.1 $7.4 $7.3 $6.1 $5.8 19

Appendix Supplemental Background Information (Not covered during presentation) 21

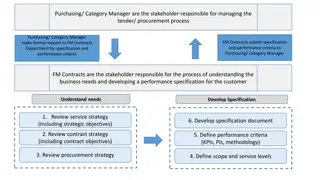

APPENDIX AMIL PRICING ZONE Both AIC and ATXI are transmission owning subsidiaries of Ameren Corporation, as well as a MISO Transmission Owners (TOs) AIC will continue to build and own traditional reliability projects ATXI is in the process of building and will own new regional transmission projects Prairie Power, Inc. became a TO in the AMIL pricing zone effective June 1, 2013. The sum of all there Attachment O net revenue requirements equals the total revenue requirement for AMIL pricing zone to be collected under Schedule 9 (NITS) 22

APPENDIX - MISO ATTACHMENTS O, GG & MM Calculate rates for Schedules 9, 26 & 26-A Attachment GG - Schedule 26 Attachment MM - Schedule 26-A Attachment O - net revenue requirement billed under Schedule 9 Schedules 26 and 26-A are billed by MISO Schedule 9 is billed by Ameren 23

APPENDIX - MISO ATTACHMENT GG Cost Recovery for certain Network Upgrades Eligible projects Market Efficiency Generator Interconnections Cost shared based upon project type MISO-wide based on load Subregional based on LODF (Line Outage Distribution Factor) AIC has four Attachment GG projects completed Two additional projects under construction These projects were approved by MISO under prior Tariff provisions which allowed limited cost sharing for certain reliability projects 24

APPENDIX - MISO ATTACHMENT MM Cost recovery for Multi-Value Projects (MVPs) Very similar format as Attachment GG Criteria for being considered Developed through planning process and support energy policy Multiple types of economic value across multiple pricing zones with benefit to costs > 1 Address at least one: Projected NERC violation Economic-based issue Cost shared across MISO based on load AMIL Zone is approximately 9% Ameren MVPs will primarily be built by ATXI AIC will be responsible for modifications needed to its existing facilities 25

APPENDIX - MISO ATTACHMENT O, GG & MM All transmission costs included in Attachment O calculation Schedule 9 based on net revenue requirement reductions for: Costs recovered in Schedules 26 & 26-A Revenue Credits Point-to-Point revenue in Schedules 7 & 8 Rental revenue Revenue from generator interconnections 26

APPENDIX - MISO TRANSMISSION EXPANSION PLAN (MTEP) Developed on an annual basis building upon previous analysis MISO, Transmission Owners & Stakeholders Includes subregional planning meetings MTEP goals Ensure the reliability of the transmission system Ensure compliance with NERC Standards Provide economic benefits, such as increased market efficiency Facilitate public policy objectives, such as meeting Renewable Portfolio Standards Address other issues or goals identified through the stakeholder process Multiple future scenarios analyzed End result comprehensive, cohesive plan for MISO footprint MTEP approved by MISO Board of Directors 27

MISO MVPS Brief history of development Began investigating value added expansion in 2003 2008 Regional Generation Outlet Study (RGOS) - formed basis of Candidate MVP portfolio Portfolio refined due to additional analysis MISO approved portfolio of 17 Projects Seven transmission line segments (MTEP proj numbers) in Ameren territory Ameren identifies these three projects as: Illinois Rivers (four line segments) Spoon River Mark Twain (two line segments) Broadly cost-shared, AMIL pricing zone allocated 9% of each MVP no matter where project is located or who builds it 28

APPENDIX - RATE INCENTIVES FERC approved the following rate incentives for Illinois Rivers in Docket No. EL10-80 CWIP (no AFUDC) Abandonment (requires additional filing prior to recovery) Hypothetical capital structure during construction for ATXI FERC approved similar incentives for Spoon River and Mark Twain Projects in Docket No. ER12-2216 30

APPENDIX - MISO WEB LINKS Transmission Pricing - Attachments O, GG & MM Information https://www.misoenergy.org/MarketsOperations/TransmissionSettlement s/Pages/TransmissionPricing.aspx Ameren OASIS http://www.oasis.oati.com/AMRN/index.html MTEP 14 https://www.misoenergy.org/Planning/TransmissionExpansionPlanning/ Pages/MTEP14.aspx MTEP 15 https://www.misoenergy.org/Planning/TransmissionExpansionPlanning/ Pages/MTEP15.aspx Schedule 26 & 26-A Indicative Charges https://www.misoenergy.org/Planning/TransmissionExpansionPlanning/ Pages/MTEPStudies.aspx 31

APPENDIX AIC Additional questions on these topics can be sent to Ameren at: MISOFormulaRates@ameren.com 32