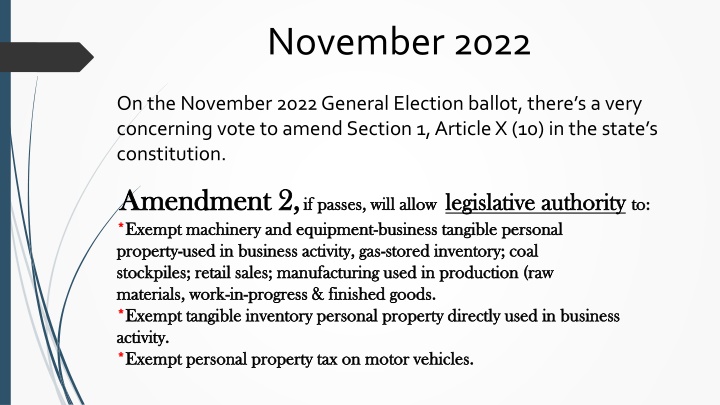

Amendment 2 Impact on Property Taxation in November 2022 Ballot

Learn about the implications of Amendment 2 on property taxation in the upcoming November 2022 election. The proposed amendment could grant legislative authority to exempt certain business properties, affecting property tax revenues that fund K-12 education. Understand the key points and potential consequences of this significant vote.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

November 2022 On the November 2022 General Election ballot, there s a very concerning vote to amend Section 1, Article X (10) in the state s constitution. Amendment 2, Amendment 2,if passes, will allow * *Exempt machinery and equipment Exempt machinery and equipment- -business tangible personal property property- -used in business activity, gas used in business activity, gas- -stored inventory; coal stockpiles; retail sales; manufacturing used in production (raw stockpiles; retail sales; manufacturing used in production (raw materials, work materials, work- -in in- -progress & finished goods. progress & finished goods. * *Exempt tangible inventory personal property directly used in business Exempt tangible inventory personal property directly used in business activity. activity. * *Exempt personal property tax on motor vehicles. Exempt personal property tax on motor vehicles. if passes, will allow legislative authority legislative authority to: business tangible personal stored inventory; coal to:

The legislature wants to control the taxing of business machinery and equipment BUT: And don t forget: Business PP Tax accounts for 24% of the Property Tax Revenue and 2/3 of Property Tax Revenue Funds K-12 Education.

If Amendment 2 passes, it doesnt exempt anything, rather, it permits the Legislature to, through general law, exempt certain properties from property taxation. This Amendment gives current and future Legislatures the ability/power to make changes/exempt business personal property machinery, equipment, and inventory along with personal property vehicle taxes without coming back to you, the taxpayers for your approval.

The numbers on the next slides were requested by Senator Tarr and were generated by an Assessors Task Force. LEGEND Furniture & Fixtures Machinery & Equipment Leasehold Improvements Computer Equipment Inventory Vehicles

2021 Grand Totals Leasehold Improvements Computer Equipment Machinery & Equipment Furniture & Fixtures Inventory Vehicles Non Taxable

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)