American Rescue Plan Stimulus Update & Affordable Care Act Changes

The American Rescue Plan provides updates on COVID stimulus packages, including Affordable Care Act changes such as extending subsidies to higher-income individuals and providing additional subsidies for those receiving unemployment benefits, with an aim to extend coverage to uninsured consumers. The plan also includes provisions on premium tax credits, marketplace premium reductions, and COBRA subsidy extensions. Learn more about these critical updates and how they impact healthcare and financial assistance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

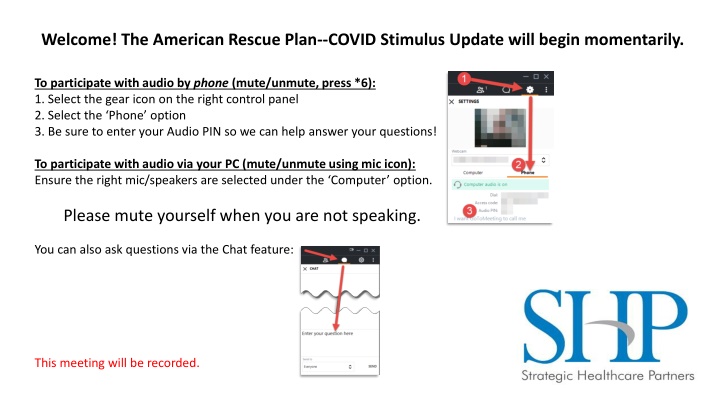

Welcome! The American Rescue Plan--COVID Stimulus Update will begin momentarily. To participate with audio by phone (mute/unmute, press *6): 1. Select the gear icon on the right control panel 2. Select the Phone option 3. Be sure to enter your Audio PIN so we can help answer your questions! To participate with audio via your PC (mute/unmute using mic icon): Ensure the right mic/speakers are selected under the Computer option. Please mute yourself when you are not speaking. You can also ask questions via the Chat feature: This meeting will be recorded.

American Rescue Plan Stimulus Package shpllc.com | 912-691-5711

Affordable Care Act (Health Exchange) Stabilization & Expansion Health Exchange enrollment opened back up for 2/15/21 to 5/15/21. Premium Subsidy Changes for Exchange Plans: Extending ACA subsidies to higher-income people (Above 400% of the FPL) who do not currently qualify for 2021 and 2022. Increasing ACA subsidies for lower-income people who already qualify for 2021 and 2022. Providing additional ACA subsidies for individuals that receive unemployment benefits in 2021 Premium tax credits will limit premium liability to no more than 8.5% of income. CBO estimates that these changes will extend coverage to 2.5 million uninsured consumers. shpllc.com | 912-691-5711

Affordable Care Act Stabilization & Expansion shpllc.com | 912-691-5711

Affordable Care Act Stabilization & Expansion American Rescue Plan Act Lowers Marketplace Premiums for Those Above 400 Percent of Poverty in All States Monthly marketplace premiums 60-year-old couple; $75,000 (435% FPL*) 45-year-old individual; $60,000 (470% FPL*) Under American Rescue Plan Act *** Family of four;** $120,000 (458% FPL*) Under American Rescue Plan Act Under American Rescue Plan Act State Prior law Difference Prior law Difference Prior law Difference U.S. average $511 $425 ($86) $1,920 $531 ($1,389) $1,445 $850 ($595) Georgia $515.00 $425.00 ($90) $1,937.00 $531.00 ($1,406) $1,458.00 $850.00 ($608) shpllc.com | 912-691-5711

Exchange Premium Clawbacks & COBRA Subsidies Eliminating tax credit clawbacks based on Exchange premium subsidies for fluctuating income levels. For 2020, American Rescue Plan will prevent individuals who underestimated their income from having to repay excess subsidies if their income levels are higher than expected 100% of costs of COBRA premiums for laid off-workers will be covered Premium coverage will allow individual to retain their employer-provided coverage through September 30, 2021 Will cover more than 2 million individuals shpllc.com | 912-691-5711

Push for Medicaid Expansion American Rescue Plan offers two additional years of federal funding to encourage Medicaid expansion in the 12 states that have not extended coverage, including Georgia. Non-expansion states to opt to expand Medicaid will receive a temporary increase of 5% points in the FMAP for their non-expansion populations in addition to . 90% FMAP for the expansion population. Given that the adjustment of the FMAP applies to all Medicaid funding, it is projected that expanding states will have more than 100% of their expansion cost covered during the period of increase/90% FMAP. CBO estimate of additional funding to Georgia would be $1.88B. shpllc.com | 912-691-5711

Georgia Medicaid Waiver Georgia s waiver for Medicaid expansion has moved from approved to under review under new administration. Original go-live was to be 7/1/21; obviously will not occur. Waiver is to cover the donut hole between low income Medicaid and 100% of Federal Poverty Level. Estimated to be 600k Georgians. Originally approved waiver includes documented work search/work requirements. Likely that any waiver approval will need to remove some eligibility limitations; i.e. work requirements/work search requirements. State projection was that 8% of donut hole would obtain coverage. Federal goal is half or more. State goal was 3.4% of insured; half would be 21.4%. shpllc.com | 912-691-5711

Additional Medicaid Provisions Home & Community Based care will receive increased Medicaid reimbursement for one year. Allows states to expand Medicaid coverage to new moms for up to 12 months postpartum to try and reduce maternal mortality rates. shpllc.com | 912-691-5711

HHS Provider Relief Fund Legislation replenishes PRF with an additional $8.5B specifically earmarked for rural providers. While Congress has provided $178B into the PRF through previous legislation, reporting indicates that approximately $11B of that funding has gone to rural providers. While healthcare providers were lobbying for more funding, as of last month, HHS still had $24B in undispersed funds from previously allocated provider relief funds. Unlike PRF s previous targeted distributions, rural providers and suppliers seeking these funds will be required to submit an application to HHS. No news yet from HHS on the application process or distribution methodology that will be used for these funds. shpllc.com | 912-691-5711

HHS Provider Relief Fund Bill defines rural providers as those that: are located in a rural area, as defined in section 1886(d)(2)(D) of the Social Security Act (SSA)). are treated as being located in a rural area under SSA section 1886(d)(8)(E). are located in another area (as defined by the HHS Secretary) that serves rural patients. are a Rural Health Clinic (as defined by SSA section 1861(aa)(2)). furnish home health, hospice, or long-term services or supports in an individual s home located in a rural area (as defined in SSA section 1886(d)(2)(D)). HHS Secretary also has authority to include other rural providers or suppliers as eligible. This definition of rural captures traditionally rural providers and suppliers, but also is broad enough to potentially render eligible a number of urban providers and suppliers that have undergone re-designation to be considered rural, or that may be in urban areas, but treat rural patient populations. shpllc.com | 912-691-5711

Rural Healthcare Grants Provides $500 million through the US Department of Agriculture to award grants to eligible entities, including public municipalities and counties, nonprofit organizations and tribes in rural areas. These grants can be used to cover COVID-19-related expenses and to increase capacity and telehealth capabilities. shpllc.com | 912-691-5711

Bolstering Vaccine Supply & Distributions $47.8 billion to continue implementation of an evidence-based national COVID-19 testing strategy. $7.5 billion directed to the Centers for Disease Control and Prevention to plan, prepare for, promote, distribute, administer, monitor and track COVID-19 vaccines. $7.66 billion to state, local and territorial public health departments to hire staff and procure equipment, technology and other supplies to support public health efforts. $100 million for the Medical Reserve Corps. $800 million for the National Health Service Corps. $200 million for the Nurse Corps. $330 million for teaching health centers that operate graduate medical education. $1.75 billion to support genomic sequencing and surveillance initiatives. shpllc.com | 912-691-5711

PPP Provisions Payroll Protection Program Additional $7.25 billion in funding has been allocated to the PPP. Additional Eligibility: More non-profits will soon be eligible for PPP funds, including: Larger non-profits with up to 500 employees per physical location, compared to a max of 300 employees for second-draw PPP loans. Application deadline for first or second round PPP loans remains the same .March 31, 2021. shpllc.com | 912-691-5711

New PPP Rules Eligibility Criteria for Second-Draw PPP Loans One of the biggest changes with the new PPP is that Congress made funding available to businesses that had previously received a PPP loan. Borrowers are eligible for a second- draw PPP loan of up to $2 million (down from $10M), provided they have: 300 or fewer employees or 500 or fewer employees for non-profit entities. Used or will use the full amount of their first PPP loan on or before the expected date for the second PPP loan to be disbursed to the borrower. Experienced a revenue reduction of 25% or more in all or part of 2020 compared with all or part of 2019. Quarterly- This is calculated by comparing gross receipts in any 2020 quarter with an applicable quarter in 2019; Annually- A borrower that was in operation for all four quarters of 2019 can submit copies of its annual tax forms that show a reduction in annual receipts of 25% or greater in 2020 compared with 2019. Gross receipts to include all revenue in whatever form received or accrued (in accordance with the entity s accounting method) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances. Forgiven first-draw PPP loans are not included in the 2020 gross receipts. shpllc.com | 912-691-5711

New PPP Rules Eligibility Criteria for First-Draw PPP Loans First-draw PPP loans are available to borrowers that were in operation on Feb. 15, 2020, and come from one of the following groups: Businesses with 500 or fewer employees that are eligible for other SBA 7(a) loans. Sole proprietors, independent contractors, and eligible self-employed individuals. Not-for-profits, including churches. Accommodation and food services operations (those with North American Industry Classification System (NAICS) codes starting with 72) with fewer than 500 employees per physical location. Sec. 501(c)(6) business leagues, such as chambers of commerce, visitors bureaus, etc., and destination marketing organizations that have 300 or fewer employees and do not receive more than 15% of receipts from lobbying. The lobbying activities must comprise no more than 15% of the organization s total activities and have cost no more than $1 million during the most recent tax year that ended prior to Feb. 15. 2020. Sports leagues are not eligible. shpllc.com | 912-691-5711

New PPP Rules PPP borrowers can have their first- and second-draw loans forgiven if the funds are used on eligible costs. As with the first round of the PPP, the costs eligible for loan forgiveness in the revised PPP include payroll, rent, covered mortgage interest, and utilities. In addition, the following costs are now eligible: PPE/Facility Expenditures- Covered worker protection and facility modification expenditures, including personal protective equipment, to comply with COVID-19 federal health and safety guidelines. Property Damage- Covered property damage costs related to property damage and vandalism or looting due to public disturbances in 2020 that were not covered by insurance or other compensation. Essential Expenses- Expenditures to suppliers that are essential at the time of purchase to the recipient s current operations. shpllc.com | 912-691-5711

New PPP Rules Eligible costs (con t): Covered operating expenditures, which refer to payments for any business software or cloud computing service that facilitates business operations; product or service delivery; the processing, payment, or tracking of payroll expenses; human resources; sales and billing functions; or accounting or tracking of supplies, inventory, records, and expenses. To be eligible for full loan forgiveness, PPP borrowers will have to spend no less than 60% of the funds on payroll over a covered period between 8 or 24 weeks. shpllc.com | 912-691-5711

Employee Retention Payroll Tax Credit The ERC was expanded for 2021 and with increased access for more businesses but was set to expire on June 30, 2021. ERC is now extended until December 31, 2021. It further expands eligibility to new startup businesses established after February 15, 2020, with annual gross receipts of up to $1 million. For these businesses, the credit is limited to $50,000 per quarter, per employer. Businesses that experienced more than a 90 percent reduction in gross receipts due to COVID-19 (compared to the same period in 2019) can count all wages paid to employees as eligible wages. The number of full-time employees is irrelevant in this scenario. shpllc.com | 912-691-5711

EIDL Provisions $15 billion is set aside for Economic Injury Disaster Loans (EIDL) $5 billion specifically for businesses that lost at least 50 percent of revenue with fewer than ten employees. EIDL funding will roll out in phases, starting with businesses that did not get the full amount requested in the previous application(s). EIDL funds are limited to $10,000 per entity and applicable to businesses that experienced at least a 30 percent reduction in gross receipts during an eight-week period between March 2, 2020, and December 31, 2021. Businesses with more than 300 employees do not qualify. shpllc.com | 912-691-5711

Extension of FFCRA Provisions Under FFCRA, businesses could receive tax credits against wages paid to employees who had to take time off work due to COVID-19. The American Rescue Plan extends these through September 30, 2021. Additional Changes: Increases eligible wages per employee from $10,000 to $12,000 Expands the type of eligible leave (time off for vaccination is now covered, as an example) Covers up to 60 days of paid leave for the self-employed, compared to the previous 50. These changes are effective for wages paid between April 1, 2021, and September 30, 2021, and are not retroactive. shpllc.com | 912-691-5711

Whats not in the American Rescue Plan? Extension of Forgiveness of Medicare Advanced & Accelerated Payments (MAAP) related to COVID-19. Continuing Moratorium on Medicare Sequestration. Under Appropriations Act passed in December 2020, sequestration is on hold through March 30, 2021 only. Not even until the end of the national public emergency. Permanent expansion of telehealth coverage and accessibility. Smaller provider relief from HHS reporting requirements. Additional provider relief funds for urban providers. shpllc.com | 912-691-5711

Top Takeaways Hospitals- Consider Exchange sign up push. PPP CSBs- Nail down definition of "hospital"; determine whether to apply for PPP. Review quarter over quarter revenues ('19 vs. '20) ASAP for Round 2 qualification. HHS- Keep checking HHS website for updates on PRF reporting requirements and new PRF application process. Lobby for MAAP forgiveness. Monitor Medicaid expansion- Both waiver and full expansion. shpllc.com | 912-691-5711

Wrap Up & Questions Unmute using *6 or the mic icon in the app or use the chat to ask. shpllc.com | 912-691-5711