AMLCU Webinar - STR Reporting for Tax Advisers

This content covers topics related to Suspicious Transaction Reporting (STR) obligations for tax advisers, including submitting STRs to Revenue, quality of reporting, reasons for looking for STRs in Ireland, and how to submit STRs to Revenue using the online reporting system. It also discusses the importance of providing detailed information in quality STR reports.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

AMLCU Webinar- STR Reporting Tax Advisers 14thSept 2022 1

Presentation Topics STR Reporting Obligations How to Submit STRs to Revenue STR Reporting - Quality How Revenue use STRs Communications/Contact Details

STR Reporting Obligations Criminal Justice (Money Laundering and Terrorist Financing) Act 2010, as amended Report by a Designated Person of suspicion of ML/TF Revenue is not involved in the investigation of Money Laundering-Tax Evasion is a predicate offence Risk Areas: Failure to correct errors/under declaring/overstating/ structures Designated person must make the report as soon as practicable.

Why we look for STRs In Ireland STRs are received by both FIU and Revenue Close co-operation between Revenue and FIU STRs can provide red flags Difference in typologies between Revenue and FIU 4

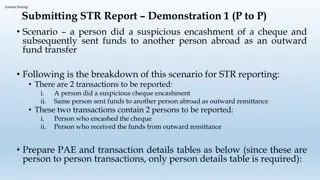

How to Submit STRs to Revenue Reporting Entities Can: 2020 New Online Reporting System for STRs XML upload: Upload single or multiple STR returns in XML format. You can complete the form in the FIUs GoAML system, once accepted, download the generated XML to upload in Revenue. Web Report: Complete and submit an online form detailing suspicious activity. This file can be saved and later uploaded to the FIUs GoAML system. Save attachments. Receive on-line acknowledgements of STRs submitted. 5

What you need to Submit On-line To use the service, you will need: Revenue Online Service (ROS) login details and a valid ROS digital certificate; To register on ROS for STR reporting obligations. The FIU Organisation ID (which is available on FIU GoAML website) is required; A ROS sub-user certificate for all MLROs for STR reporting. 6

Quality STRs Report Indicator associated with tax evasion? Have you provided sufficient details on STR to identify individuals and UBO for entities? Name, full address (also previous) date of birth ? Details of who else is suspected of involvement? Details of any bank accounts or transactions The facts regarding what is suspected or the grounds for suspicion and why. The why should be explained clearly so that it can be easily understood 8

How Revenue use STRs STR are data matched and risk rated on receipt, before dissemination for case working. Rating based on a number of factors, including monetary value. Enhances the intelligence available to Revenue s investigation and intelligence teams. A Revenue source of Intelligence NOT Evidence

How Revenue use STRs ? What they give us: A profile of a business s/individuals activity that is not in keeping with their tax returns High quality STRs can therefore: Support an existing case. Produce a new case. 10

COMMUNICATIONS Information is available on the Revenue Website including detailed Guidelines on how to register for STR reporting www.revenue.ie Hard Copy STRs no longer accepted by Revenue. 11

THANK YOU Suspicious Transactions Unit contact details. If you have any queries in relation to the submission of STRs, please email: Suspicious_Transactions_Unit@revenue.ie 12

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)