Analysis of City of Rawlins General Fund Revenues and Taxes June 30, 2025

Explore the details of City of Rawlins General Fund Revenues and Taxes as of June 30, 2025. Gain insights into the different revenue sources and budget allocations. Understand the significance of the general fund for government entities and the key components contributing to its financial status.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

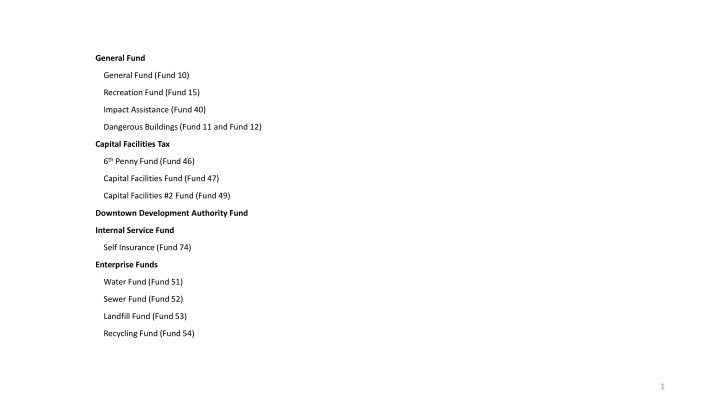

General Fund General Fund (Fund 10) Recreation Fund (Fund 15) Impact Assistance (Fund 40) Dangerous Buildings (Fund 11 and Fund 12) Capital Facilities Tax 6thPenny Fund (Fund 46) Capital Facilities Fund (Fund 47) Capital Facilities #2 Fund (Fund 49) Downtown Development Authority Fund Internal Service Fund Self Insurance (Fund 74) Enterprise Funds Water Fund (Fund 51) Sewer Fund (Fund 52) Landfill Fund (Fund 53) Recycling Fund (Fund 54) 1

General Fund A general fund is the primary fund used by a government entity. This fund is used to record all resource inflows and outflows that are not associated with special-purpose funds. The money flowing into a general fund is usually derived from a variety of taxes, such as income taxes, sales taxes, use taxes, and lodging taxes. The activities being paid for through the general fund constitute the core administrative and operational tasks of the government entity. Since the bulk of all resources flow through the general fund, it is most critical to maintain control over the expenditures from it. 2

City of Rawlins General Fund Revenues June 30, 2025 Balance 6/30/2020 Balance 6/30/2021 Balance 6/30/2022 Balance 6/30/2023 Balance 6/30/2024 Budget 6/30/2025 Percent Taxes and Assessments Intergovernmental Charges for Services Investment Miscellaneous Transfers 11,857,694 462,675 377,495 75,428 145,422 650,150 14,963,913 2,955,397 457,731 45,872 174,260 643,000 9,585,192 326,231 263,748 74,502 187,463 742,037 11,240,714 1,122,773 324,722 177,112 212,170 844,556 11,649,532 470,205 272,610 282,656 328,594 84,988 10,808,367 344,250 304,262 340,000 172,800 84,988 89.66% 2.86% 2.52% 2.82% 1.43% 0.71% 13,568,865 19,240,173 11,179,173 13,922,048 13,088,586 12,054,667 100.00% 5

City of Rawlins Taxes and Assessments June 30, 2025 Balance 6/30/2020 Balance 6/30/2021 Balance 6/30/2022 Balance 6/30/2023 Balance 6/30/2024 Budget 6/30/2025 Property Tax Sales and Use Tax Fifth Penny Tax Motor Vehicle Tax Lodgers Tax Franchise Tax Cigarette Tax Gas Taxes Severance Tax 543,249 5,363,357 3,807,187 315,759 31,885 661,270 47,645 432,795 654,547 404,968 7,153,031 5,323,909 268,001 24,839 690,711 45,905 403,685 648,865 546,985 4,052,793 2,942,620 287,212 36,339 669,636 43,670 412,786 593,151 572,682 4,873,733 3,693,497 284,835 34,747 752,552 39,910 389,226 599,534 660,965 5,261,260 3,600,641 293,325 80,225 718,244 36,510 404,507 593,857 575,000 4,816,410 3,351,557 287,500 36,000 718,000 38,000 389,900 596,000 11,857,694 14,963,913 9,585,192 11,240,714 11,649,533 10,808,367 6

City of Rawlins General Fund Revenue Intergovernmental June 30, 2025 Balance 6/30/2020 Balance 6/30/2021 Balance 6/30/2022 Balance 6/30/2023 Balance 6/30/2024 Budget 6/30/2025 911 Surcharge Restitution Municipal Judge Tow Fee Reimbursements Advocate Grant - State DUI/Eudl Grants Court Bonds Crime Victims CATS Bus Ballistic Vest Advocate Grant - Federal Law Enforcement- Seizure Resource Office Reimbursement Full Court Enterprise IT Donations - Police Wildfire Arson Dog FA ADE BRC Cultural Trust 150 ARPA COVID-19 Related Revenue 77,351.91 3,818.88 130,350.89 78,007.74 3,820.75 134,366.50 550.00 137,669.58 13,717.90 11,271.86 5,798.81 510.43 81,183.53 11,486.32 175,400.88 250.00 17,714.00 1,929.29 (11,225.47) 4,520.00 1,500.39 79,501.14 3,590.63 113,086.82 798.00 16,616.13 2,107.74 2,869.47 4,544.61 2,585.98 111,868.02 705.00 160,733.89 525.00 20,051.78 6,681.10 (8,800.58) 3,833.49 3,442.85 80,000.00 3,500.00 120,000.00 750.00 17,000.00 5,000.00 20,893.15 20,383.93 10,286.24 3,634.20 1,406.46 2,778.30 52,704.36 444.15 75,000.00 4,000.00 3,000.00 0.00 42,504.34 38,476.04 1,870.50 33,720.78 43,281.11 35,000.00 0.00 75,000.00 75,000.00 43,013.40 2,300.00 75,000.00 31,022.30 75,000.00 22,861.33 1,850.17 28,911.00 10,000.00 3,517.45 0.00 0.00 0.00 0.00 0.00 739,792.74 739,792.74 2,447,858.23 0.00 Total Intergovernmental 462,674.97 2,954,593.59 323,105.48 1,119,527.44 1,188,136.70 343,250.00 7

City of Rawlins General Fund Revenue Charges for Services June 30, 2025 Balance 6/30/2020 Balance 6/30/2021 Balance 6/30/2022 Balance 6/30/2023 Balance 6/30/2024 Budget 6/30/2025 Account Name Special Use Permits Corral Permits Restaurant Lease Land Lease/Sales Rent Perpetual Care Miscellaneous Liquor Licenses City Licenses and Permits Engineering/Building Permits Planning and Zoning Prints and Inspections Street Cuts Asphalt Materials Animal Licenses Contractor Licenses Plan Review Animal Shelter Fees Depot Receipts RFD Ambulance Service Cemetery Lot Sales Cemetery Fees 1,040.00 520.00 1,930.00 420.00 4,200.00 124,503.74 2,500.00 122,877.94 29,000.05 7,733.00 42,923.02 350.00 118.00 550.00 3,360.00 1,524.00 27,288.10 51,996.25 9,899.00 7,000.00 4,458.00 4,300.00 10,800.00 1,440.00 500.00 2,800.00 88,715.95 1,350.00 390.00 1,730.00 370.00 8,270.00 60,200.00 3,600.00 13,152.07 25,800.01 6,784.78 48,596.49 1,000.00 500.00 64,678.78 2,870.00 56,413.85 25,883.33 10,540.60 61,561.26 (2,772.00) 120.00 1,177.74 4,912.60 2,086.50 23,596.08 101,992.20 7,398.96 4,940.30 71,987.17 1,250.00 34,186.12 25,500.01 5,490.67 72,442.55 1,300.00 80.00 700.00 11,651.05 959.50 29,107.99 34,990.21 7,203.00 4,800.00 3,534.00 5,870.00 11,930.00 63,000.00 3,000.00 26,514.00 37,333.00 8,600.00 62,500.00 750.00 200.00 2,000.00 5,000.00 2,000.00 27,000.00 25,000.00 9,365.00 10,000.00 7,500.00 4,000.00 9,000.00 8,057.31 28,516.75 5,530.50 51,780.47 746.22 40.00 350.00 2,514.12 1,327.50 26,895.56 11,986.99 7,991.00 6,850.00 5,131.00 3,405.00 9,210.00 1,725.00 4,270.00 1,794.50 33,832.25 14,156.55 8,853.54 6,760.00 11,130.00 9,330.00 12,215.00 3,100.00 7,435.00 8 377,495.20 457,731.10 263,748.37 324,722.27 272,610.19 304,262.00

City of Rawlins General Fund Revenue Miscellaneous Revenue June 30, 2025 Balance 6/30/2020 Balance 6/30/2021 Balance 6/30/2022 Balance 6/30/2023 Balance 6/30/2024 Budget 6/30/2025 Account Name Interest Income 75,428.48 45,872.40 74,501.99 177,111.89 282,656.21 340,000.00 Record Checks E-Citation - City of Rawlins Sale of Fixed Assets Lottery for Cities Wyo Community Gas Murray Street Reimbursement Private Donation Fund Horse Racing Police Night Out 237.00 392.15 10,470.00 213.00 8,340.00 225.00 8,610.00 1,994.99 9,890.00 0.00 82,020.58 21,632.23 300.00 10,000.00 2,500.00 70,000.00 10,000.00 65,275.31 10,140.07 69,770.00 83,074.89 10,322.95 70,000.00 57,133.68 10,228.14 69,770.00 104,267.42 0.00 9,084.20 203,972.45 38,908.82 2,869.00 98,867.96 200.00 80,000.00 0.00 145,422.38 174,259.99 187,462.64 212,170.38 328,594.45 172,800.00 9

City of Rawlins General Fund Expenditures By Department June 30, 2025 Balance 6/30/2020 Balance 6/30/2021 Balance 6/30/2022 Balance 6/30/2023 Balance 6/30/2024 Budget 6/30/2025 Account Name Percent City Council City Manager City Attorney Municipal Judge Information Technology Human Recourses CATS Bus Finance Nondepartmental Public Work Administration Central Shops Streets Division Building Maintenance Community Development Economic Development Grant Writer Building Code Enforcement Police Administration Animal Control 911 Center Fire Departments Code Enforcement Ancillary Infrastructure Downtown Development 69,976.46 641,291.00 217,264.59 191,650.75 365,126.75 87,094.68 58,636.65 409,625.36 1,626,658.96 116,139.00 301,573.84 1,430,516.17 619,154.42 103,043.09 71,856.22 347,094.17 354,616.64 167,953.09 224,663.87 305,345.43 58,636.65 431,528.50 2,090,434.90 129,401.76 235,201.73 995,340.64 683,386.68 153,040.28 90,297.60 423,976.00 364,395.09 212,921.91 360,782.64 265,686.17 58,636.65 448,843.10 2,530,906.98 141,546.15 254,544.22 2,214,559.39 602,478.21 115,397.58 71,695.73 67,112.16 55,758.06 2,232,663.76 153,453.28 505,205.18 1,676,225.61 65,728.88 226,500.00 164,683.91 94,833.04 404,782.75 261,681.31 179,987.95 605,153.91 318,334.13 58,636.65 459,310.44 2,576,954.14 186,184.98 267,091.53 627,171.78 754,382.67 96,875.28 16,728.60 54,859.59 95,644.47 2,375,436.46 237,476.52 627,469.33 1,245,550.85 69,687.58 226,100.00 161,462.02 99,754.79 426,147.00 383,283.06 203,067.31 256,487.65 127,094.02 58,636.65 332,869.53 2,029,078.39 159,369.55 264,298.47 612,365.65 590,462.41 111,116.28 97,790.00 168,271.17 307,289.00 208,977.00 382,732.00 148,702.00 58,636.65 485,156.00 622,579.00 180,348.00 399,329.00 737,110.00 633,287.00 121,456.00 0.80% 1.38% 2.52% 1.71% 3.14% 1.22% 0.48% 3.98% 5.10% 1.48% 3.27% 6.04% 5.19% 1.00% 0.00% 0.00% 0.91% 21.88% 1.41% 5.80% 10.93% 0.86% 1.24% 1.42% 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 111,067.19 2,074,491.05 152,053.49 465,043.16 1,174,626.62 84,252.99 183,250.00 157,986.07 116,222.50 2,143,181.85 154,828.20 569,903.00 1,147,182.21 81,509.96 206,973.74 171,293.39 82,885.08 2,186,062.75 123,902.13 497,363.59 853,823.95 50,503.62 163,125.00 87,784.80 111,504.00 2,669,519.00 171,925.00 707,487.00 1,334,017.00 105,523.00 150,750.00 173,021.00 Total 10,640,522.29 10,839,595.41 13,303,998.26 12,001,795.98 9,699,481.68 9,975,408.82 81.75% Golf Course Club House Recreation Center Shooting Range Green Spaces 457,517.07 224,599.91 600,448.26 100,667.28 451,029.38 408,039.52 206,440.87 618,432.15 95,091.11 554,660.87 501,708.17 213,788.31 753,663.67 91,532.55 673,875.73 516,958.85 260,084.45 864,377.86 115,424.15 668,391.12 419,029.92 288,012.42 655,134.69 123,332.56 532,955.74 507,361.00 238,712.00 618,422.00 70,301.00 791,585.00 4.16% 1.96% 5.07% 0.58% 6.49% Total 1,834,261.90 1,882,664.52 2,234,568.43 2,425,236.43 2,018,465.33 2,226,381.00 18.25% 10 12,201,789.82 100.00%

A capital projects funds are used to * Track financial resources for acquiring or construction major capital assets * Account for resources legally restricted and contractually required for capital asset acquisition. * Support capital projects during their life. * Accounts for financial resources for major capital facilities. * Cover acquisition, construction, or improvement of capital assts other than those acquired through proprietary or fiduciary funds. 11

Balance 6/30/2023 Balance 6/30/2021 Accumulated Depreciation Additions Disposals Transfers Depreciable Assets Building and Improvements Fire Department General Government Golf Course Parks Police Department Public Works Recreation Total Building Improvements 494,372.61 1,459,075.75 911,927.48 489,502.83 596,480.29 461,307.28 2,180,819.45 6,593,485.69 19,099.85 81,809.52 25,011.73 16,292.69 23,742.57 16,608.90 78,842.65 261,407.92 8,480.00 17,660.60 11,944.00 14,574.48 490,417.98 1,523,224.67 924,995.21 505,795.52 620,222.86 477,916.18 2,274,236.58 6,816,809.00 General Fund Accumulated Depreciation (14,574.48) 38,084.60 0.00 Infrastructure General Government Golf Course Parks Public Works Total Infrastructure 1,595,739.34 1,083.33 15,621.79 2,597,474.85 4,209,919.31 193,103.60 200.00 1,008.30 292,512.41 486,824.31 1,788,842.94 1,283.33 16,630.09 2,889,987.26 4,696,743.62 0.00 0.00 Furniture and Equipment Fire Department Auto and Truck Machinery and Equipment General Government Auto and Truck Machinery and Equipment Golf Course Machinery and Equipment Parks Machinery and Equipment Police Department Auto and Truck Machinery and Equipment Public Works Auto and Truck Machinery and Equipment Recreation Auto and Truck Machinery and Equipment 1,459,198.27 911,830.16 135,882.38 70,406.16 8,575.00 478,343.98 67,610.33 61,807.92 1,518,895.32 442,084.42 252,152.89 1,710,500.81 37,445.74 72,038.10 (32,957.98) 322,556.61 1,542,163.27 240,375.64 671,637.73 32,223.88 132,804.35 571,057.26 149,712.80 35,974.02 21,290.95 (42,000.00) 206,395.87 332,142.52 2,218,708.08 62,814.62 134,450.20 394,957.14 2,078,807.03 274,351.25 1,873,934.72 603,943.86 119,956.55 46,125.11 1,993,891.27 548,794.30 105,435.84 (4,161.17) 48,302.95 651,324.43 11,021.70 60,893.96 3,000.00 165,821.09 (27,191.00) 83,515.65 546,397.30 10,883,389.22 819,232.40 1,429,998.10 23,108.10 10,249,515.42 Total Accumulated Depreciation 21,686,794.22 1,567,464.63 1,468,082.70 23,108.10 21,763,068.05 12

City of Rawlins Sixth Penny Tax December 31, 2024 6/30/2022 6/30/2023 6/30/2024 12/31/2024 Assets Cash $2,020,612 $3,375,422 $4,771,932 $5,246,609 Fund Balance Fund Balance Net Income Total Fund Balance 2,768,387 (747,774) 2,020,612 2,020,612 1,354,810 3,375,422 3,375,422 1,396,510 4,771,932 4,771,932 474,678 5,246,609 Revenue Specific purpose Tax 2019 Interest Total Revenue 1,116,301 6,468 1,122,768 1,393,810 17,705 1,411,515 1,363,594 51,122 1,414,716 457,514 19,163 476,678 Expenditures Street Infrastructure 1,870,543 56,705 18,206 2,000 Net Income ($747,774) $1,354,810 $1,396,510 $474,678 14

A balanced budget is a situation in financial planning or the budgeting process where total expected revenues are equal to total planned spending. * A balanced budget occurs when revenues are equal to or greater than total expenses. * A budget can be considered balanced after a full year of revenues and expenses have been incurred and recorded. * Proponents of a balanced budget argue that budget deficits burden future generations with debt. Frozen Positions for Fiscal Year 2025 3 1 1 Police Officer I Police Administration Parks Technician Green Spaces Project Coordinator Downtown Development Street projects were frozen for FY 2025 Capital Purchases were capped at $1,000,000 All together essential items cut from the budget about to approximately $2.5M. 15

An enterprise fund is a self-supporting government fund that sells goods or services to the public for a fee. It represents typical government services for which the government collects usage charges from the public. The city employs four enterprise funds: * Water Fund * Sewer Fund * Landfill Fund * Recycling Fund 16

City of Rawlins Water Transmission Line June 30, 2024 Grant Amount Priority One Priority Two Source Sage Creek Basin Springs Water Supply Springs Rehabilitation - Sage Creek Boxes All Remaining Components Source Water Protection Projects 1,870,000 8,557,000 300,000 ARPA III 30,000 ARPA IV 134,000 Sage Creek Transmission Pipeline 5,659,000 2,321,409 WWDC Potable Water Storage Tank Farm 1MG Tank - Extend and Pint 3MG Tank Paint 4,741,000 937,000 1,464,000 Potable Water Transmission Low-Pressure transmission Line High Pressure Transmission Line 7,348,000 SCADA 1,500,000 1,000,000 CDBG Grant Ground Water Supplies Nugget Wells Miller Hill Vault 119,000 71,000 North Platte River Pipeline System River Pump Station Steel Transmission Line and Ancillary Items 276,000 12,684,000 Dams and reservoirs Rawlins 157,000 Distribution System Water Mains Pressure Control Station 2,000,000 1,000,000 29,675,000 18,842,000 3,651,409 Total 48,517,000 17

City Manager Priorities Software Solutions Financial Software Conversion Water Transmission Line Water Master Plan In Town Water and Sewer Projects Brownfield Grant Selected Ayres as Contractor Economic Development Plan From 2012 City of Rawlins Comprehensive Master Plan From 2012 Employee Policy Manual Department Reorganization Salary Study Business Plans Cash Reserves Deferred Maintenance VFW Baseball Field Renovation Funded Depreciation Title 19 Amendments Edinburgh Street Project Rate Analysis 18

Policies to be written: * Procurement Manual Revenue Expenditure Travel Credit Cards * Administration of Federal and State awards * Fund Balance Policy * Operating Budget Policy * Annual Audit * Capital Asset Management * Long-Term Financial Planning * Debt Policy * Investment Policy * Accounting, Auditing, and Financial Reporting * Internal Control and Risk Management * Fleet Replacement * Records Retention 20