Analyzing Consolidated Data for Business Growth

Consolidated data from the ChildFund Alliance website reveals crucial insights into how businesses support the Alliance's Strategic Plan. Examining the annual changes in net revenue, identifying deficits, and exploring future aspirations can help drive sustainable growth and membership engagement. Board members emphasize the need for a renewed focus on organizational growth and disaster relief capacity. However, overcoming the ambition gap in large INGOs requires a strategic shift to adapt to changing contexts and ensure long-term relevance. The evolution of INGOs in international relations necessitates innovative approaches to governance and sustainability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Either hes dead or my watch has stopped Groucho Marx Taking the Pulse of our Consolidated Data November 2017

Opening Thoughts Consolidated data is in the ChildFund Alliance website Members Only section There is a huge amount of information to review What s beyond the data? How does this data illustrate how our businesses support the ChildFund Alliance Strategic Plan? How sustainable are our businesses?

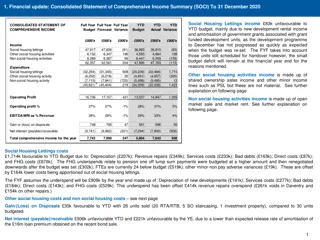

Annual Change in Net Revenue Annual Change in Net Revenue 15.0% 10.0% 5.0% 0.0% FY14 FY15 FY16 FY17 -5.0% -10.0% -15.0% -20.0% -25.0% -30.0% -35.0% AU DE ES FR IE JP KR NZ SE US

Annual Change in Net Revenue Annual Change in Net Revenue 15.0% 10.0% 5.0% 0.0% FY14 FY15 FY16 FY17 -5.0% -10.0% -15.0% -20.0% In FY17, five members had deficits -25.0% -30.0% -35.0% AU CA DE ES FR IE KR NZ SE US

What do we aspire? We are midway through the Alliance s Strategic Plan: Priority Three: Strengthen membership engagement and growth .over the next five years, the Alliance will recruit at least three new members .

We have the ambition build greater capacity in relation to disaster relief .develop specialized products, focused on specific issues .use technology to offer new fundraising products differentiate through vision, focus and branding improve the relationship with supporters .. .Board members think it is necessary for all members to adopt a new and urgent focus on the growth of their organizations . Michael Rose, Priorities for Members

How can we close the ambition gap? .in the past achieving such change in INGOs, with their disperse governance, and horizontal power structures, has been difficult and slow. Despite the revolution that has been taking place around them, large INGOs sometimes appear to underestimate the extent to which their strategic context has changed, with profound implications for their future relevance in international relations, their mission, and their organizational sustainability. Paul Ronalds, The Change Imperative

How does our future look? What do the next five years look like for you? What will be the most significant difference for your organization? In groups of three, describe your organization s strategy and areas of focus (5 minutes each), considering: How are we programmed to think and behave linearly? How much effort do we deploy each year for what incremental return?

What themes emerged? How vulnerable are we? What will we let go of? What s the sweet spot we seek? (How do we innovate?) Issues / Products / Audiences How do our own strategies link to the Alliance Strategic Plan?

Is it time for a broader funding focus? The trouble with a bleeding heart is you die

Are we prepared for a new world order Massive growth in wealth (and power) in last 200 years has also come at a cost Corporates are being challenged as to what is their licence to operate Business is increasingly seeking purpose: How come business (think a can of Coke, a sachet of Pantene) can reach the poorest of the poor anywhere in the world ..but essential social services cannot? Business is a force for good, and good is a force for business Jan Zijderveld, President Unilever Europe

...and tapping new forms of funding Within low return environment there are huge pots of liquidity looking for returns The ability to invest at scale has led to most impact investments being centred on US/Western Europe (especially in housing and energy sectors) This is changing as impact investors mature and look to developing economies

Leveraging inclusive capitalism Inclusive capitalism is delivering a basic social contract comprised of relative equality of outcomes, equality of opportunity, and fairness across generations. Different societies will place different weights on these elements but few would omit any of them Raising investment should be difficult and so long as philanthropy remains easy, there remains a lack of commercial tension What s our entry point to dialogue with business?

There is global impetus to Measure Impact Concept is not new (Theory of Change approach began in 1950s), but is growing rapidly: The shape of value has changed: globally, the majority of market value is now defined as intangible value, (investors seek resilient and purposeful organizations) Shifts in short-term to long-term: it is no longer plausible to leave a gap between short-term commercial decision-making and the wider impacts on society Increasing consumer discernment: consumers and regulators are punishing those who deplete social and environmental value more than ever

Collaborating with a wider eco-system The biggest shift in the users of outcomes measurement has been in the business community Capital market driven for-profit enterprises, both large and small, have begun to use the outcomes evaluation techniques and leverage a richer, deeper analysis of value drivers to support better decision-making Could this be our offer to work alongside business?

Leveraging our knowledge Value Outcomes Universe Measurement Techniques Financial Proxies Drawing on our effectiveness models, and incorporating social, environmental and economic inputs and outputs Defined techniques are utilized for measuring outcomes including modelling, surveying, calculation Financial proxies are used to value the measured outcomes and are drawn from existing proxies or designed specific to the assessment

Closing Thoughts As we explore what will make ChildFund a leading INGO of the future: Our consolidated data highlights that we continue to face funding difficulties while we are being compelled to grow There are rapidly growing funds beyond philanthropy along with a corporate sector seeking purpose (outcomes) How can we apply our understanding of outcome measurement to generate revenue and therefore strengthen membership and ensure our relevance