Analyzing Economic Indicators from Multiple Charts

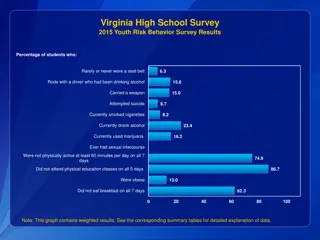

Explore a series of charts depicting various economic indicators such as budget deficits, household income, current account deficits, inflation rates, and tax rates in different countries. Understand the causes behind these trends and consider potential solutions to address these issues.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

You are about to be presented with a series of charts. For each chart, answer the 4 questions: What is it? What caused it?Do they need to do anything about it? and How can they solve it? Be prepared to report your findings back to the rest of the group!

What is it? What caused it? UK public sector current budget deficit, excluding public sector banks ( million) 50000 40000 30000 20000 10000 0 -10000 -20000 -30000 2010 Q1 2011 Q1 2012 Q1 2013 Q1 2014 Q1 2015 Q1 2016 Q1 2017 Q1 Do they need to do anything about it? How can they solve it?

What is it? What caused it? The effects of taxes and benefits on household income by quintile groups, all households, financial year ending 2016(UK) 90000 80000 70000 60000 50000 40000 30000 20000 10000 0 Bottom 2nd 3rd 4th Top All households Original income Disposable income Final income Do they need to do anything about it? How can they solve it?

What is it? What caused it? Current Account Deficit, Top 5 Economies, (Billions of US dollars) - IMF 200.0 100.0 0.0 -100.0 -200.0 -300.0 -400.0 -500.0 2011 2012 2013 2014 2015 2016 United States United Kingdom Brazil Australia Saudi Arabia Do they need to do anything about it? How can they solve it?

What is it? What caused it? Libya: Inflation rate from 2012 to 2018 (%, compared to the previous year) 35.00 32.80 32.14 30.00 27.11 25.00 20.00 15.00 9.84 10.00 6.00 5.00 2.60 2.43 0.00 2012 2013 2014 2015 2016 2017 2018 Do they need to do anything about it? How can they solve it?

What is it? What caused it? Sweden Personal Income Tax Rate (%) 2008-2018 62.0 61.0 60.0 59.0 58.0 57.0 56.0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Do they need to do anything about it? How can they solve it?

What is it? What caused it? UK public sector current budget deficit, excluding public sector banks ( million) 50000 40000 30000 20000 10000 0 -10000 -20000 -30000 2010 Q1 2011 Q1 2012 Q1 2013 Q1 2014 Q1 2015 Q1 2016 Q1 2017 Q1 Do they need to do anything about it? How can they solve it?

What is it? What caused it? The effects of taxes and benefits on household income by quintile groups, all households, financial year ending 2016(UK) 90000 80000 70000 60000 50000 40000 30000 20000 10000 0 Bottom 2nd 3rd 4th Top All households Original income Disposable income Final income Do they need to do anything about it? How can they solve it?

What is it? What caused it? Current Account Deficit, Top 5 Economies, (Billions of US dollars) - IMF 200.0 100.0 0.0 -100.0 -200.0 -300.0 -400.0 -500.0 2011 2012 2013 2014 2015 2016 United States United Kingdom Brazil Australia Saudi Arabia Do they need to do anything about it? How can they solve it?

What is it? What caused it? Libya: Inflation rate from 2012 to 2018 (%, compared to the previous year) 32.80 35.00 32.14 30.00 27.11 25.00 20.00 15.00 9.84 10.00 6.00 2.60 5.00 2.43 0.00 2012 2013 2014 2015 2016 2017 2018 Do they need to do anything about it? How can they solve it?

What is it? What caused it? Sweden Personal Income Tax Rate (%) 2008-2018 62.0 61.0 60.0 59.0 58.0 57.0 56.0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Do they need to do anything about it? How can they solve it?