Assumptions and Properties of Explanatory Variables in Econometrics

Exploring the assumptions related to explanatory variables in the classical normal linear model, including the implications of fixed values, boundedness, and consistency. Understand the impact of variations in explanatory variables on estimators' variance and examine the effects on consistency properties.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The preferences: 1- Badi H. Baltagi, Econometrics , Fifth Edition ,2011, Springer Heidelberg Dordrecht London New York. 2-

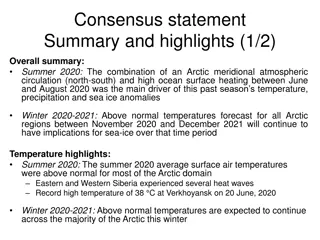

Stochastic Explanatory Variable Stochastic Explanatory Variable The assumption of the classical normal linear model which related with explanatory variables , consist of the following: 1- The explanatory variables are non-stochastic. 2- The values of the explanatory variables are fixed in repeated samples. 3-1 ? ( ?? ? )2is equal to a finite and non- zero number for any sample size.

For assumption 3 , it is required the following restrictions: a) The values of the explanatory variables ( X ) in the sample are not the same. b) The values of the explanatory variables ( X ) in the sample are not grow or decline without limit. For restriction (a), if The values of ( X ) in the sample are not the same, but the differences between them are very small, that is mean ( ?? ? )2will be small and this lead that the value of the variance of the estimators are likely very large. This is what researchers mean when they say, Unfortunately there was very little variation in the explanatory variables . The question that may arise is, what are the effects of the estimators' variance being so large?

For restriction (b), The values of the explanatory variables ( X ) in the sample are not grow or decline without limit which mean that the values of ( X ) should be bounded, this restriction is less curricle, it utilized mainly in proving desirable asymptotic properties, but it is not a necessary condition for consistency in all cases. As an example of a case where the values of the explanatory variable are not bounded, consider the equation of linear trend which given as following: ??= ? + ?? + ?? , t= 1,2,3, , n In that model the explanatory variable ( t ) measure's the time in term of specified periods. Assume that all the basic assumption about the disturbances (??)hold, then as ( n ) increases to infinity, so do the values of the explanatory variable ( t ), in fact we have: 2= =?2 1 12 1 ? ( ?? ? )2=1 2 (1 1 ?12+ 22+ + ?2 1 ?2[1 + 2 + +]2 ? ?? ? ??)

using the last result, we can prove that the consistency property of ? is not affected by restriction (b). The proof will leave to you as an exercise.