Benefits of a Flexible Spending Account and How it Works

A Flexible Spending Account (FSA) offers pre-tax savings of 20-30% on expenses like prescription medication, child care, and medical costs. Learn about the three types of FSAs, eligible expenses, and how to maximize savings. Understand the details of Child/Dependent Care FSA and Health Care FSA to manage out-of-pocket expenses efficiently. Explore the benefits and guidelines of FSAs to optimize tax savings for you and your family.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

THE BENEFITS OF A FLEXIBLE SPENDING ACCOUNT

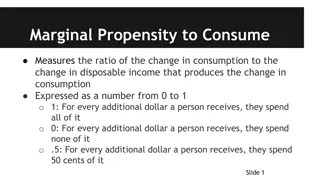

FLEXIBLE SPENDING ACCOUNTS We all have expenses we pay each year: oPrescription Medication oGlasses/Contact Lenses oChild Care oTeeth Cleanings oAnnual Check-ups An FSA allows you to pay for this Pre-Tax and SAVE between 20-30%

THERE ARE THREE TYPES OF FLEXIBLE SPENDING ACCOUNTS Child/Dependent Care FSA Expenses you incur for the care of your child or dependent that allow you to work. Health Care FSA Out of pocket expenses for you and your family s Medical, Dental, and Vision Care. Limited Purpose FSA For those contributing to an HSA, this plan covers out of pocket expenses for you and your family s Dental and Vision Care only.

CHILD/DEPENDENT CARE FSA Covers child care expenses for dependents under 13 years old. Also covers care of a dependent that is physically/mentally incapable of caring for him/herself during work hours. The expense must be work related; both parents must work or go to school on a full time basis. Can include costs for before/after school care, and even summer day camps. Maximum exclusion is $5000 per plan year, calendar year and household. If married filing separate tax returns, the maximum is $2500. Please see guidelines for details. Remember, you cannot claim the Child Care Credit on your taxes if you pre tax the expense with your FSA.

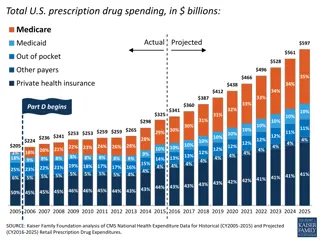

HEALTH CARE FSA Covers the out of pocket Medical, Dental, and Vision Costs for yourself and everyone within your tax family regardless of the health plan they may be enrolled in. Over the counter drugs & medicines are not eligible unless your doctor has provided you with a written prescription. The maximum amount you can contribute to your Health FSA is $2750, which is the expected IRS limit in 2020. Does not cover expenses that would be for cosmetic purposes (face lifts, teeth bleaching, etc.)

On our website, we have an extensive listing of eligible expenses, but here is a quick list that may be helpful: Contact lenses Chiropractor expenses Sunscreen - SPF 15+ Co pays/Deductibles Dental cleanings Prescription Glasses Orthodontia Lasik Surgery Certain First Aid Items https://www.pagroup.us/

HOW THE PLAN WORKS Before the start of the Plan Year determine the amount of out of pocket expenses you and your family will have during your plan year. *Make sure to calculate Child/Dependent Care separately from Health related costs for you and your family. The amount you elect will be divided by the number of pay cycles you have in your plan year. For example, if you re paid bi-weekly and elect $2600 for the year, your per check deduction would be $100. But remember, this is deducted pre-tax, so your take home pay will be reduced by around $70 rather than $100. As you incur expenses, you can either submit a reimbursement claim to be reimbursed tax free OR use your PayPro BenefitCard to pay the expense right out of your Health FSA.

The PayPro BenefitCard! If you sign up for the Health Care FSA, you ll receive a PayPro Benefit Card in the mail. It may look like junk mail - so keep an eye out for it! It is similar to a pre-paid Credit Card, but it only works at medical facilities, pharmacies, doctor offices, retailers with a pharmacy, etc. This card can be used right at the register! Just swipe it - and the amount will be deducted from your Health Care FSA Account and automatically be paid to your provider, or pharmacy. When you use the PayPro Benefit Card - always save your receipt. If we request of a copy of an expense, you ll need to submit an itemized receipt that indicates the nature of service, the date the expense was incurred, your cost, who provided the service, and the individual the expense refers to. If you do not submit those receipts upon request, your card will be suspended. This is an IRS rule.

The PayPro BenefitCard! Many expenses are automatically approved when you use the card, however, there are occasions you will receive an email or letter requesting copies of itemized receipts. The card is used to pay an expense that doesn t match an exact co-pay amount in place with your employer- sponsored insurance plan. The card is used for vision, dental, or PPO insurance expenses. (These costs aren t typically exact co pays.) If your family has a separate insurance plan with different co pays - they won t match. To make the card as beneficial as possible to you - we will process the claim to be put on the card. However, you will receive an invoice or email requesting an itemized invoice showing the services and costs associated with that card swipe. When this is requested, you re required to submit this to PayPro Administrators with 30 days of the original request. Failure to submit the documentation will result in your card being suspended. It can be frustrating - but just know that it s not because we don t trust or like you - it s the IRS that has the rule in place. In about 75% of all expenses, the claim is automatically adjudicated, or approved without your requirement to submit additional documentation! 9

PayPro Benefits Card Your card will be valid for a number of years, so don t throw the card away once you ve spent all of your HealthCare FSA dollars! If you d like an additional card for your spouse, or eligible family member, please call or email us and we ll send you one. The Health Care FSA will reimburse you up to the amount you ve elected for the plan year, regardless of account balance. It is all available day one of the plan year! The PayPro Benefit Card works for the Health Care FSA only.

MANUAL REIMBURSEMENTS If you incur a claim and pay for it out of pocket, or if you re submitting expenses for the Dependent Care FSA, we have a simple process to request reimbursement. Simply complete the Claim Form available on our website, OR use our PayPro What s My Balance Mobile App, to submit the claim directly to us. The form has complete directions - and the mobile app will walk you through the process. Itemized receipts must accompany the claim. Claims should show the nature of service, the date the expense was incurred, your cost, who provided the service, and the individual the expense refers to. Upon receipt of your claim, please allow us up to 3 business days to have it reviewed and entered for reimbursement. Make sure to sign up for direct deposit of your FSA reimbursements it s faster and there s no additional fee! Remember: Dependent Care FSA will only reimburse you up to the balance in your account.

IMPORTANT DETAILS WE HAVE AN APP FOR THAT! Download the PayPro What s My Balance App! You can submit claims, review balances, and more! Check out our helpful website: www.pagroup.us Click on the upper right corner box EMPLOYER/EMPLOYEE FLEX LOGIN . We have videos, worksheets, and you can shop for eligible expenses as well You may only enroll during open enrollment, or upon initial benefits eligibility. All expenses must be incurred between within your plan year. Once you ve enrolled, your election amounts can not be stopped or changed unless you experience a qualifying status change. There is typically a 90 Day Grace Period to submit claims for the previous plan year. Make sure to only elect what you expect to use. Unused funds can be lost at the end of the plan year s submission period.

NEXT STEPS Review the packets provided they provide full details. Worksheets and detailed information can be found at www.pagroup.us Complete and submit your enrollment form. If you are already on the plan and are re-enrolling, a custom form will be provided to you to make enrollment even easier!

Contact Information The plan record-keeper is PayPro Administrators. They can be reached by: Telephone Fax 951-656-9273 951-656-9276 customerservice@pagroup.us claims@pagroup.us 800-427-4549 Email Please call if you have any questions or need assistance!