Best Practice DC Plans

Challenges and statistics surrounding retirement income readiness in the US as discussed at the Partner Conference 2014. Gain insights on the effectiveness of DC plans, automatic enrollment, employer resistance, and more from industry experts. Learn about the struggles faced by working households and the implications for retirement savings. Discover data on access to retirement plans, earnings levels, and trends among private-sector employees.

Uploaded on Feb 23, 2025 | 1 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Partner Conference 2014 Best Practice DC Plans - A Global Perspective Barry S. Kublin President, BPAS Partner Conference 2014 1

Partner Conference 2014 AGENDA Retirement Income Readiness: an Assessment of the US DC Plan Effectiveness The Politics of Retirement Income Readiness Solutions A Global View of DC Plans Automatic Enrollment Plans in the U.S. Overcoming Employer Resistance to Auto Plans Differentiating Service Models for Auto Plans 2

Partner Conference 2014 Retirement Income Readiness in the US "There are three kinds of lies: lies, damned lies, and statistics. There are three degrees of falsehood: the first is a fib, the second is a lie, and then comes statistics Data Sources: National Institute on Retirement Security Center for Retirement Research at Boston College American Society of Pension Professionals and Actuaries (ASPPA) Vanguard 3

Partner Conference 2014 Retirement Income Readiness in the US 38.3 mm working households (45%) do not own retirement account assets 53% of all households age 25-34 48% of all households age 35-44 40% of all households age 45-54 40% of all households age 55-64 9.9 mm 10.2 mm 9.9 mm 8.3 mm 4

Partner Conference 2014 Retirement Income Readiness in the US Including households without retirement savings, the median retirement account accumulation is $3k and $12k for near-retirement households. Median working-age household earnings: With retirement accounts Without retirement accounts $71,156 $25,413 5

Partner Conference 2014 Retirement Income Readiness in the US In 2011, 52% of private sector EEs age 25-64 had access to a retirement plan on the job Among full-time employees, 44% (35.2 mm) had no access Small businesses account for 2/3 of workers that lack access to a retirement plan Earnings levels are correlated to availability 6

Partner Conference 2014 Retirement Income Readiness in the US Amongst Private- Sector EEs 1979 1999 2011 EEs with access to workplace retirement plan 57.8% 61.9% 52.0% EEs w/o access 42.2% 38.1% 48.0% 7

Partner Conference 2014 Retirement Income Readiness in the US Retirement Savings Targets (multiple of current income to produce 85% replacement ratio) Age Fidelity Aon Hewitt 25 0x 30 ,5x 35 1x 40 2x 45 3x 50 4x 55 5x 60 6x 65 7x 11x 67 8x 8

Partner Conference 2014 Retirement Income Readiness in the US Account balances Age 55-64 account-owning households : $100,000 Age 55-64 all households: $12,000 Account balances as % of working household income (10x goal) Age 0% >0 < 1 x 1 < 4 x 4 x + 45-54 34.9% 39.4% 22.6% 3.2% 55-64 31.8% 31.8% 28.1% 8.3% All 40.1% 40.3% 16.7% 2.9% 9

Partner Conference 2014 Retirement Income Readiness in the US Age-specific benchmarks: Share of working households below target Measured by retirement account balanced (RAB) Measured by net worth (retirement savings, DB benefit, other savings, real estate less debt) % below target for their age Total PV shortfall $ Total retirement assets 89.8% $11.6 T Total net worth 65.1% $6.8 T 10

Partner Conference 2014 Retirement Income Readiness in the US The bottom 40 % of the income distribution ends up almost entirely dependent on Social Security The substantial pension gap between higher-and lower-income individuals is driven primarily by the lower-income group s lower employment rate and the smaller probability of working for an employer that offers pensions 11

Partner Conference 2014 Retirement Income Readiness in the US When lower-income workers do have a pension plan at work, their eligibility and opt-out rates are nearly equivalent to higher-income workers Solutions for this group involve working for organizations that offer retirement benefits, satisfying the eligibility requirements (1,000 hours), and automatic enrollment (prevalence amongst smaller ERs) 12

Partner Conference 2014 Retirement Income Readiness in the US A recent study from the Social Security Administration shows: - 68% of private-sector workers have access to a retirement plan at work - 78% of full-time workers W-2 Data - 80% of eligible private-sector workers with access to a plan participate - 84% participation rate for full-time workers W-2 Data 13

Partner Conference 2014 Retirement Income Readiness in the US A recent study from the Social Security Administration shows: 37% of part-time private-sector workers have a retirement plan available at work and 54% of those participate W-2 Data 70% of workers earning from $30k to $50k participate in ER plans when available (EBRI) W-2 Data 14

Partner Conference 2014 Retirement Income Readiness in the US 49% of private-sector EEs who work for ERs with less than 100 EEs have a plan available at work, with a 69% participation rate 68% of U.S. households have an IRA or ER- sponsored retirement plan The current system is working very well for millions of working Americans. Expanding availability of workplace savings is the key to improving the system. (ASPPA testimony, Senate Finance Committee, February, 2014) 15

Partner Conference 2014 Which Statistics? Political Environment Problem definition Global best practices Opportunities for improvement 16

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US What America Worries About Most (Gallop, Personal Financial Survey (April, 2013) Financial Concerns 18-29 30-49 50-64 65+ Not enough money for retirement 52% 68% 72% 42% Not paying serious illness medical bills 52% 63% 63% 50% Not maintaining standard of living 46% 51% 61% 42% Not paying normal monthly bills 40% 42% 44% 31% Not paying for children s college 42% 59% 29% 7% Not paying rent or mortgage 38% 39% 39% 19% Not paying credit card bills 16% 21% 22% 14% 17

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Down the Road Storms State-based Initiatives to: increase retirement savings coverage and rates reduce fees Obama care II Federal Budget Pressures CBO cost of retirement savings expensive benefit for the rich ? 18

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US State Initiatives to Address Retirement Income Readiness Concerns: www.pensionrights.org/issues/ legislation/state-based- retirement-plans-private-sector 19

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US California Secure Choice Retirement Savings Trust Act, signed Sept. 2012, to address 6.3 mm workers w/o access to workplace retirement plans Mandatory payroll deduction plans for ERs w/5+ EEs who do not sponsor retirement plan Auto-enroll at 3% w/opt-out Investment Board currently conducting market research to develop final regulations/infrastructure Implementation requires subsequent legislation 20

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Connecticut Act Promoting Retirement Savings, submitted to Governor May, 2014 Establishes CT Retirement Security Board to study and create public retirement program ERs w/5+ EEs who do not sponsor retirement plan Auto-enroll (min TBD w/ER option to increase) Form of benefit lifetime annuity w/lump sum option 21

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US AARP Connecticut released the following statement from State Director Nora Duncan regarding passage of the CT SFY 2014 Budget and Implementer Bill: We re thrilled that our elected officials understood that when it came to retirement security, Connecticut had to act. If older adults do not have enough money for a secure retirement, they will rely more heavily on public assistance. By investing up front in the design of a state retirement savings plan, Connecticut will allow more of its citizens the opportunity to save for their future, and the state will ultimately save money. - 22

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Massachusetts In March 2012, Massachusetts passed an Act Providing Retirement Options for Nonprofit Organizations State Treasurer to sponsor a plan for EEs at small non-profit organizations Tax-qualified, participant directed, ER and EE contributions Plan is pending before IRS for final authorization For non-profit ERs with <21 EEs 23

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US A number of insurance industry groups opposed the bill. Adam Sachs, government relations chair for the National Association of Insurance and Financial Advisors of MA, said, This bill puts the Commonwealth in direct competition with MA companies that are already providing retirement plans to employers of all sizes in MA This is not filling a void, or correcting a market failure it is simply an effort to take business away from MA taxpayers. 24

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Other Initiatives MN, OR, WA, WI Obama myRA $5,500/year, $15k cap, Roth, govt. bonds, payroll deduction plan Targeted at ERs who do not sponsor retirement plans Illinois Maryland MD Secure Choice Retirement Program & Trust, Introduced Jan 2014 5+ EEs, would require IRS tax-qualification and ERISA exemption IL Secure Choice Savings Program Senate passage April 2014, awaiting House action 3% auto-enroll, opt-out Participant directed, target date default Assets managed by IL Treasurer/Board 25

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Federal Budget Considerations if this Congress want to help, work with me to fix an upside- down tax code that gives big tax breaks to help the wealthy save, but does little or nothing for middle-class Americans. (President Obama, 2014 State of the Union Address) 26

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Federal Budget Considerations Dave Camp, Chairman, House Ways and Means Committee, REPUBLICAN, MI Tax Reform Act (2014 draft) 401k limit to be comprised of 50% pre-tax, 50% Roth For 2014, $8,750 pre, $8.750 Roth plus 50/50 on catch-up Generates $143 billion over 10 years 27

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Federal Budget Considerations Inflation adjustments to DB benefit limits, DC contribution limits to be frozen for 10 years Generates $63 billion over 10 years (inflation rate?) TRA 2014 (cont.)Camp 25% deductibility limit on ER/EE contributions to DC plans vs. 35% top marginal rate (10% tax on $52,000) 28

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Federal Budget Considerations The American Society of Pension Professionals & Actuaries (ASPPA) and the ERISA Industry Committee (ERIC) expressed concern with Camp s tax reform proposal. Should this proposal become law, ASPPA said, it would subject individuals in the new 35% tax bracket to a 10% surtax on all contributions made to a qualified retirement plan that is, both employer and employee contributions. In effect, this proposal would tax contributions to qualified retirement plans twice, ASPAA noted: individuals would pay the 10% surtax when contributions are made to the plan, and then pay tax again at the full ordinary income tax rate when the money is distributed from the plan during retirement. 29

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Summary Policy makers at the State and Federal level concerned about the rate of retirement plan participation and savings Politicians often react to polls Absent progress from private-sector service providers relative to participation and savings rates and cost effectiveness, there is an emerging willingness amongst elected officials to provide for public-sector-based solutions. 30

Partner Conference 2014 The Politics of Retirement Income Readiness Issues in the US Summary Substantially all proposals being discussed at the state level include a mandate for automatic enrollment for EEs in organizations that do not offer retirement plans A mandate for non-401k/403(b)/457 plans An optional feature for qualified plans? 31

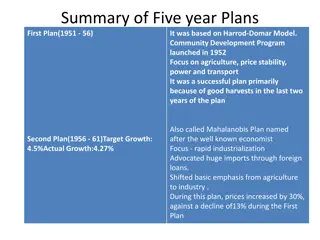

Partner Conference 2014 A Global View of DC Plans Country Overall Index Country Overall Index Denmark 80.2 USA 58.2 Netherlands 78.3 Poland 57.9 Australia 77.8 France 53.5 Switzerland 73.9 Brazil 52.8 Sweden 72.6 Mexico 50.1 Canada 67.9 China 47.1 Singapore 66.5 Japan 44.4 Chile 66.4 S Korea 43.8 UK 65.4 India 43.3 Germany 58.5 Indonesia 42.0 32

Partner Conference 2014 A Global View of DC Plans Total Adequacy Sustainability Integrity USA 2012 59.0 58.3 58.4 61.1 2013 58.2 56.6 57.8 61.2 Average 2012 61.0 62.2 52.1 71.5 2013 61.6 63.5 52.8 70.8 33

Partner Conference 2014 Chile DC System Pioneered Social Security in Latin America, establishing a PAYGO system in 1924 Country of 17 mm In late 1960s, 500k retirees receiving benefits In late 1970s, 1 mm retirees receiving benefits System was greatly underfunded, deemed a fiscal burden, Too many schemes for different sectors, ineffective regulatory environment for investments 34

Partner Conference 2014 Chile DC System Reformed in 1981 Mandatory DC program All workers establish individual accounts with private firm Mandatory contribution rate: 10% of pay; optional voluntary contributions 6 investment options, five target portfolios plus government bond fund Up to 60% of assets may be invested in non-Chilean securities 35

Partner Conference 2014 Chile DC System Largest investment firms in the system iShares: Vanguard: Franklin-Templeton: Upon retirement Age 60 for women Age 65 for men Accumulated fund balance my be paid out as a programmed withdrawal option (RMD recalculated every year) OR value of purchased annuity 11.2% 10.8% 9.1% 36

Partner Conference 2014 Chile DC System Age 65 male contributing for 80% of working life projected to receive benefit amounting to 60% of pre-retirement income, in the form of a J&S DC benefit supplemented by non-contributory public system that is means-tested and funded by general tax revenue 37

Partner Conference 2014 UK DC System UK Pension Act of 2008/2011 mandates ERs to automatically enroll workers into ER sponsored plans starting in 2012 (phase-in by size of ER) Intent increase private pension coverage from 33% to 75% Prior system of DC plans (Stakeholder Pension Act of 2001) failed; utilized opt-in strategies New system allows EEs to opt-out, but ERs must sweep every 3 years Age 22 earning 15,800 (US) mandatory All workers earning 9,500 can opt-in and receive match 38

Partner Conference 2014 UK DC System UK Pension Act requires 4% EE contribution and 3% ER contribution (matching formula), 1% GOVT contribution; plan may provide for additional ER and EE contributions McDonalds UK 37k EEs in UK, 35k are hourly Enrolled 1,150 salaried and 11,500 hourly employees to date w/ 3.48% and 2.15% opt-out rates respectively 39

Partner Conference 2014 UK DC System National Employment Savings Trust competes against private firms for ER plans 75 bp cap on default funds No distributions upon change of employment, no loans, no hardships, benefits available at age 55 One time 25% lump sum distribution, balance annuitized 40

Partner Conference 2014 A Global View of DC Plans Common Challenges/Solution Requirements Increase retirement age to reflect increasing life expectancy Encourage/require higher levels of private savings to reduce future dependence on the public pension Increase coverage for EEs in the private system Reduce leakage from the system prior to retirement 41

Partner Conference 2014 Automatic Enrollment in the US Automatic enrollment is arguably one of the most powerful tools employers have to bolster employee retirement readiness. The problem isn t education, access, or as some claim, a broken system, it s inertia. (Sapers % Wallack, 2013) Education is very important, but auto features produce real results. (Credit Suisse) 9% auto-enroll, 1% auto-increase up to 15% 42

Partner Conference 2014 Automatic Enrollment in the US Organ donor participation rate in Denmark (opt-in): 4.25% Organ donor participation rate in Sweden (opt-out): 86% 47.2% of 401k plans have auto-enroll feature 61.5% of plans with >5k participants 13.6% of plans with <50 participants 89.8% of Plans with auto-enrollment (AE) sweep new hires only 43

Partner Conference 2014 Automatic Enrollment in the US 69% Manufacturing Industry adoption of AE plans 52% Insurance 54% Health Care 44% Retail 39% Financial 44

Partner Conference 2014 Automatic Enrollment in the US 23% of AE also provide for auto-increases (AI) Contribution Caps on AI plans <6% 6% 7-9% 10% >10% 7.8% 44.4% 8.5% 28.2% 11.1% Annual rate of increase 97% report 1 - 1.99% 3% report 2 - 2.99% 45

Partner Conference 2014 Automatic Enrollment in the US Default contribution rate with AI < 3% 3-3.99% 4-4.99% 5-5.99% 6% + 14% 44% 14% 15% 13% Participants in AE plans without AI contribute 1% LESS than participants in non-AE plans (participant rate is higher, average deferral is lower) Default rate for AE plans is the major contributing factor to this phenomenon 46

Partner Conference 2014 Other Factors Affecting Retirement Income Readiness 12% 3% Annuity/In stallment payout option in plans Loans payments post termination of employment 47

Partner Conference 2014 Bold Auto Plan Design 6%-8% automatic enrollment rate within 45 days of date of hire, depending upon average comp and top heavy considerations Impact of raising default rate from 3% to 6% 25% increase in GAP success rate for lowest income quartile 48

Partner Conference 2014 Bold Auto Plan Design Include part-time employees These persons will become members of the retirement community, they may convert to full-time status with current or subsequent ER, and they also need to start early and save regularly Eligibility for ER contributions may based upon longer length, hours of service and vesting schedule 49

Partner Conference 2014 Bold Auto Plan Design Increase auto-enrollment rate by 2% until total EE/ER contribution rate reaches 15% of pay Subject to AI above 10% is not a safe harbor design Auto sweep non-participating EEs every year Auto increase EEs every year 50