Biofertilizers Market Share, Size, Growth Forecast by 2032

In 2024, the global biofertilizers market was valued at USD 2.53 billion and is projected to rise from USD 2.83 billion in 2025 to USD 6.34 billion by 2032, growing at a CAGR of 12.21% between 2025 and 2032.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

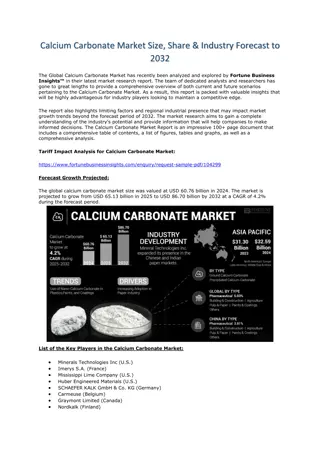

Biofertilizers Market Share, Size, Growth Forecast by 2032 In 2024, the global biofertilizers market was valued at USD 2.53 billion and is projected to rise from USD 2.83 billion in 2025 to USD 6.34 billion by 2032, growing at a CAGR of 12.21% between 2025 and 2032. North America led the market in 2024 with a 30.83% share, while the U.S. market alone is forecasted to reach USD 1.28 billion by 2032. Growth in this sector is primarily supported by the expansion of organic farming, along with government policies and financial incentives that encourage sustainable agricultural practices. Biofertilizers, bioinoculants, consist of living microorganisms that improve plant nutrition by colonizing the rhizosphere when applied to seeds or soil. Commonly microorganisms include nitrogen- fixing bacteria, cyanobacteria, phosphate-solubilizing microbes, also called used and certain fungi. These organisms enhance soil microbial activity, increase nutrient availability for plants, and improve crop productivity. They also help restore soil fertility, protect crops from pests and diseases, and remain effective long-term, as the parent inoculum can enrich soil for several years without repeated applications. Due to their natural composition and lower production costs, biofertilizers are more affordable than synthetic fertilizers, making them an attractive choice for farmers and gardeners. The COVID-19 pandemic, however, disrupted production due to difficulties in sourcing raw materials, which affected the broader agricultural supply chain. Information Source: https://www.fortunebusinessinsights.com/industry- reports/biofertilizers-market-100413 Report Summary This report provides a detailed analysis of the biofertilizers market, highlighting growth drivers, restraints, and opportunities. It also reviews recent innovations, partnerships, and competitive strategies adopted by leading players. Market Drivers & Challenges

Sustainable Alternatives for Soil Health Overuse of chemical fertilizers such as monoammonium phosphate and calcium nitrate has contributed to soil degradation and declining productivity. Biofertilizers are gaining traction as eco-friendly solutions that promote soil regeneration and natural crop development. Despite their advantages, challenges such as high production costs, crop- specific effectiveness, and shorter shelf life compared to chemical fertilizers remain barriers. Nonetheless, supportive government initiatives, farmer awareness programs, and stronger distribution networks are expected to accelerate adoption. Market Segmentation Cereal Crops Dominate the Market In 2024, cereal crops represented about 43.74% of global biofertilizer demand. Their dominance is linked to the rising demand for organic cereals, consumer awareness of their health benefits, and compatibility with organic farming practices. Regional Insights North America & Europe at the Forefront of Organic Farming North America and Europe continue to lead, supported by widespread adoption of organic farming practices in countries like the U.S. and Mexico. For instance, North America generated USD 470.83 million in biofertilizer revenue in 2019. USDA data shows that from 2015 to 2016, certified organic farms and businesses in the region grew by 13%. South America is emerging as a promising growth region, particularly in Brazil and Argentina, where governments are encouraging environmentally sustainable farming. Competitive Landscape Innovation & Collaborations Strengthen Market Presence Companies are focusing on product innovation, diversification, and cross-border partnerships to strengthen their presence. These strategies are shaping competitive dynamics and extending the reach of biofertilizer solutions worldwide.

Key Companies in the Market: Monsanto BioAG (Missouri, U.S.) Rizobacter Argentina S.A. (Argentina) Novozymes A/S (Copenhagen, Denmark) Symborg (California, U.S.) Agrinos AS (Oslo, Norway) Agri Life (Telangana, India) Camson Bio Technologies Ltd. (Karnataka, India) Gujarat State Fertilizers & Chemicals Ltd. (Gujarat, India) BioWorks Inc. (New York, U.S.) Lallemand Inc. (Montreal, Canada) Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample- pdf/biofertilizers-market-100413 Recent Developments June 2019: Bayer (Germany) and Novozymes (Denmark) renewed their strategic partnership to advance and distribute innovative biological solutions. Novozymes also broadened its global distribution through collaborations with Univar Solutions (U.S.) and UPL (India) for agricultural biological products.