Bond Pricing Examples and Calculations

Explore various bond pricing scenarios including current bond prices, coupon rates, and future values based on different parameters such as yield to maturity, time to maturity, and periodic compounding. Learn how to calculate bond prices for different types of bonds, from zero coupon to semi-annual payment bonds.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

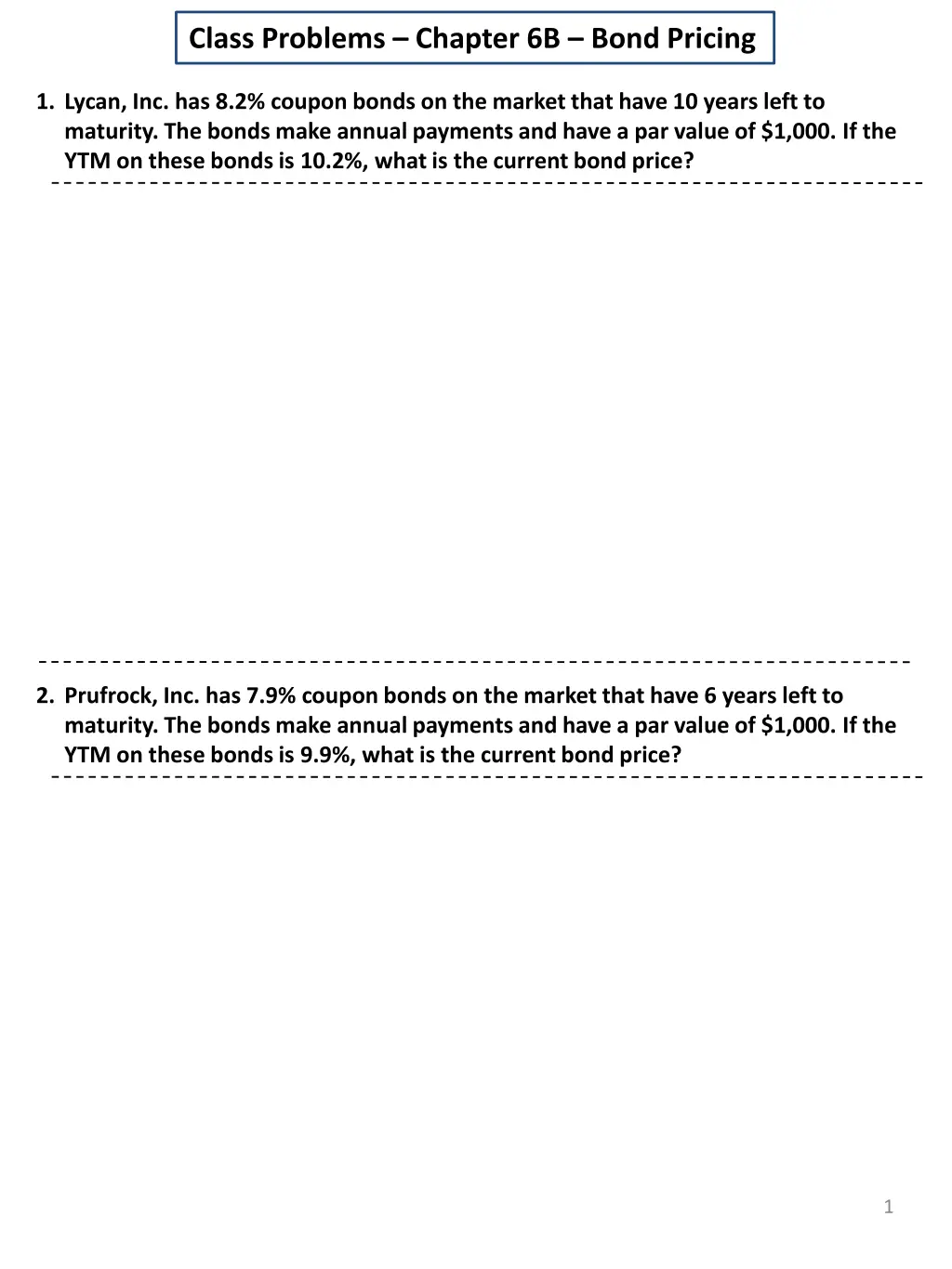

Class Problems Chapter 6B Bond Pricing 1. Lycan, Inc. has 8.2% coupon bonds on the market that have 10 years left to maturity. The bonds make annual payments and have a par value of $1,000. If the YTM on these bonds is 10.2%, what is the current bond price? 2. Prufrock, Inc. has 7.9% coupon bonds on the market that have 6 years left to maturity. The bonds make annual payments and have a par value of $1,000. If the YTM on these bonds is 9.9%, what is the current bond price? 1

3. Volbeat Corporation has bonds on the market making annual payments, with 17 years to maturity, a par value of $1,000, and a price of $956, the bonds yield 9.1%. What must the coupon rate be on the bonds? 4. Barnes Co. has bonds on the market making annual payments, with 15 years to maturity, a par value of $1,000, and a price of $971, the bonds yield 8.3%. What must the coupon rate be on the bonds? Bond Value= 2

Class Problems Chapter 6C Bond Pricing 1. Hardwell Inc. issued 14-year bonds one year ago at a coupon rate of 6.9%. The bonds make semi-annual payments. If the YTM of these bonds is 5.5%, what is the current dollar price assuming a $1,000 par value? 2. Guetta Enterprises issued 17-year bonds one year ago at a coupon rate of 7.3%. The bonds make semi-annual payments. If the YTM of these bonds is 5.3%, what is the current dollar price assuming a $1,000 par value? 3

3. You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. If the YTM on this bond is 4.6%, what is the price of the bond? Assume semi- annual compounding periods. 4. If you invest $3,357.14 today, how much will you have in 24 years if you earn 4.6% interest compounded semi-annually? Bond Pricing with Semi-Annual Coupons 1 1 - + + C F 2t (1 YTM/2) = = + + Bond Value + + 2t 2 YTM/2 (1 YTM/2) 4