Branch Accounting: Types, Treatment, Journal Entries

Explore the meaning, types, accounting treatment, and journal entries for branch accounting, including dependent and independent branches. Learn about the features of branch accounting and the different types of branches such as dependent, independent, and foreign branches. Discover the accounting methods and journal entries for each type of branch to effectively manage financial records and assess branch-wise performance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Meaning, Types, Accounting Treatment & Journal Entries BY Kalpana S. Jadhav Assistant Professor

Introduction to Branch Accounts Branch accounts are maintained by businesses to track financial transactions of different branches. They help in analyzing the profitability and performance of each branch. Used by businesses with multiple locations to maintain systematic records.

Features of Branch Accounting Separate accounts for each branch. Helps in profit/loss calculation of each branch. Facilitates better financial control and decision- making. Enables businesses to assess branch-wise performance.

Types of Branches 1. **Dependent Branch** - Does not maintain separate books of accounts; head office records transactions. 2. **Independent Branch** - Maintains its own books of accounts and prepares separate financial statements. 3. **Foreign Branch** - Located in a different country and follows local accounting rules.

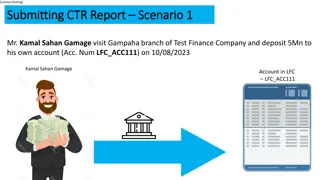

Accounting for Dependent Branches All transactions are recorded in the head office books. Branch does not prepare independent financial statements. Uses the Branch Account method: - Opening balance of branch assets & liabilities. - Goods sent to branch. - Expenses incurred by the branch. - Sales and revenue generated. - Closing balance of assets & liabilities.

Journal Entries for Dependent Branches **For goods sent to branch:** Dr. Branch Account Cr. Goods Sent to Branch Account **For cash sent to branch for expenses:** Dr. Branch Account Cr. Cash/Bank Account **For branch sales (cash & credit):** Dr. Cash/Bank A/c, Dr. Debtors A/c Cr. Branch Account **For expenses incurred by branch:** Dr. Branch Expenses A/c Cr. Cash/Bank A/c **For closing stock at branch:** Dr. Branch Stock A/c Cr. Branch Account

Accounting for Independent Branches Maintains separate books of accounts. Prepares Trading, Profit & Loss Account, and Balance Sheet. Transactions between head office and branch are recorded in respective books. Reconciliation of accounts is required to match inter- branch transactions.

Journal Entries for Independent Branches **For remittance of cash to head office:** Dr. Head Office Account Cr. Cash/Bank Account **For goods received from head office:** Dr. Purchases/Stock Account Cr. Head Office Account **For expenses paid by branch:** Dr. Expenses A/c Cr. Cash/Bank A/c **For profit transfer to head office:** Dr. Profit & Loss A/c Cr. Head Office A/c

Reconciliation of Branch & Head Office Accounts Independent branches and head offices maintain reciprocal accounts. Head Office Account in branch books should match Branch Account in head office books. Any discrepancies are adjusted before preparing final accounts.

Importance of Branch Accounting Helps in evaluating branch performance. Ensures financial control and accountability. Assists in tax compliance and legal requirements. Facilitates decision-making for business expansion.

Conclusion Branch accounting is crucial for businesses with multiple locations. It provides financial insights into each branch's profitability. Understanding journal entries ensures accurate record-keeping. Proper reconciliation ensures consistency in financial reporting.