BRD Group Results 2nd Quarter and 1st Half 2020

Discover BRD Group's results for the 2nd quarter and 1st half of 2020, including insights into financial performance, operational resilience, and responses to the global crisis. The presentation covers key aspects such as corporate lending, deposit collection, revenue impact, cost stability, net cost of risk, return on equity, capital adequacy ratio, and overall fundamentals. Dive into how BRD navigated challenges and maintained a strong financial position amidst a changing landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

BRD GROUP RESULTS 2ndquarter and 1sthalf 2020 | 04.08.2020

DISCLAIMER The consolidated and separate financial position and income statement for the period ended June 30, 2020 were examined by the Board of Directors on July 30, 2020. The financial information presented for the period ended June 30, 2020 and comparative periods has been prepared according to IFRS as adopted by the European Union and applicable at this date. This financial information is at group level, does not constitute a full set of financial statements and is not audited. This presentation may contain forward-looking statements relating to the targets and strategies of BRD, based on a series of assumptions. These forward-looking statements would have been developed from scenarios based on a number of economic assumptions in the context of a given competitive and regulatory environment. BRD may be unable to anticipate all the risks, uncertainties or other factors likely to affect its business and to appraise their potential consequences, and to evaluate the extent to which the occurrence of a risk or a combination of risks could cause actual results to differ materially from those provided in this document. Investors and analysts are advised to take into account factors of uncertainty and risk likely to impact the operations of BRD when considering the information contained in any such forward-looking statements. Other than as required by applicable law, BRD does not undertake any obligation to update or revise any forward-looking information or statements. 2NDQUARTER AND 1STHALF 2020 RESULTS 04/08/2020 2

1 INTRODUCTION

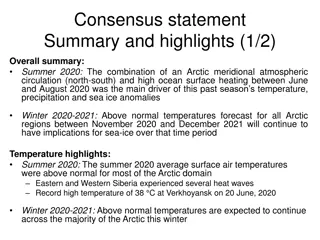

OUR REACTION TO THE CRISIS We entered a worldwide unprecedented sanitary crisis Pandemic confirmed to have reached Romania on February 26, with more than 47,000 COVID-19 cases State of emergency lasting for 2 months, with severe lockdown restrictions, easing progressively started mid May Fourth phase of relaxation measures, scheduled for 1st of July, postponed due to the surge of new cases Our priorities Protect our employees and customers Ensure business continuity through quick and efficient organization adaptation Permanently stand by our clients, providing financial support and easing access to banking services Mitigate the financial impact 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 4

RESILIENT OPERATIONAL PERFORMANCE Sustained corporate lending activity Lending to large corporate clients, up by +4.6% y/y at June 2020 end Retail production impacted by lockdown, but back to pre-crisis level in late June Corporate loan portfolio +5.4% vs June 2019 end Total loan portfolio +1.2% vs June 2019 end Strong deposit collection Retail savings, up by +8% y/y at June 2020 end Deposits, +4.8% vs. June 2019 end Revenues impacted by crisis consequences and regulatory changes NBI RON 1 512m vs. RON 1 609m in H1 2019 Stable costs in Q2 2020 y/y, excl. sanitary expenses, reflecting rapid saving measures engaged, offsetting transformation costs NCR RON -225m vs. RON 144m in H1 2019 Net cost of risk integrating deteriorated economic perspective ROE: 10% Double digit ROE, despite impact of the crisis on NBI and NCR CAR: 27% vs 20% at Jun 2019 end Very strong fundamentals 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 5

2 MACROECONOMIC ENVIRONMENT

COVID-19 CRISIS PUTS AN END TO A 9 YEAR EXPANSIONARY CYCLE Q1 2020 confirmed the end of the expansionary phase of the cycle EU GDP registered the sharpest decline observed since 1995, when reporting started, as COVID-19 containment measures began to be widely introduced GDP GROWTH 7.0% Romania s GDP growth of 2.7%, though showing initial effects of crisis, marked the highest rate in EU 4.8% 4.4% 4.1% 3.9% 3.5% 3.4% Domestic demand remains the main driver of economic expansion, followed by gross fixed capital formation 2.7% 2.5% 2.3% 2.0% 2.0% 1.8% 1.7% 1.2% Net exports kept their negative contribution to growth In Q2, the lockdown led to a strong contraction of activity and consumption 2013 2014 2015 2016 2017 2018 2019 Q1 2020 -2.6% RO EU 2020 GDP expected to drop by 6%-7%* Inflation rate down CPI dropped at a fast pace in the first months of the year printing at +2.6% y/y at June 2020 end (vs 4.0% at Dec-19 end), on disinflationary base effects, the plunge in oil price, the removal of the special excise duty on motor fuels, outpacing strong food inflation generated by Covid-19 outbreak * In a scenario of continued progressive lifting of restrictions 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 7

RATE CUT AND QUANTITATIVE EASING IN PLACE Policy rate cut To support the economy in the context of unfolding COVID-19 epidemic, the central bank reduced the monetary policy rate twice this year to 1.75%, 75 basis points under 2019 level INTEREST RATE ENVIRONMENT 3.2% 3.2% 3.2% Quantitative easing NBR announced an unprecedented measure of purchasing RON denominated government bonds and stated that it shall provide necessary liquidity to financial institutions through repo operations 3.0% 2.6% 2.2% 2.50% 2.50% 2.50% 2.50% 2.1% 2.00% 1.75% 1.75% Before the outbreak, NBR decided to lower the level of the minimum reserve requirements on FCY denominated liabilities to 6% (down from 8%) starting February 2020, keeping the existing level for RON denominated liabilities at 8% ROBOR 3M (eop) NBR reference rate Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Interbank RON interest rates followed the downward key rate Following policy rate cut, interbank rates dropped and ROBOR 3M decreased to 2.2% at Jun-20 end (average ROBOR 3M at 2.72% in H1 2020, -48 bps YoY) 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 8

EXTENSIVE POLICY OFFSET Relief measures to support the economy Loan facility program (IMM INVEST) : envelop of EUR 3 bn of state guarantee and interest subsidies to support SME sector financing Income supporting measures : indemnity for technical unemployment (amounting to 75% of the net salary, capped at 75% of the average salary in the economy) for employees of companies affected by the crisis Debt moratorium for individuals & companies hit by the crisis (OUG 37) Grace period up to 9 months (not beyond 2020 end) Interest accrued (capitalized for consumer loans, repaid in 60 equal installments for housing loans) Available to debtors without day past due (at request date) and affected by the crisis (based on declaration for individuals, loss of 25% of revenues for companies) No triggered reclassification as non-performing, consistent with EU regulators position Flexibility for the payment of social and tax obligations National and EU stimulus package The Romanian Government has presented on July 2nd 2020 Rebuilding Romania , a National Investment and Economic Relaunch Plan, announced for EUR 100 bn/10 years. EU allocated EUR 80 bn to Romania (EUR 63 bn subsidies and EUR 17 bn loans) as part of its EUR 750 bn recovery plan 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 9

ROMANIAN BANKING SECTOR ENTERED THE CRISIS WITH A HEALTHY PROFILE ROMANIAN BANKING SYSTEM NPL AND NPL COVERAGE RATIOS Solid capital and liquidity positions Loan to deposit ratio at 71% at March 2020, same as at 2019 end (vs 122% at 2008 end) 60.6% 61.0% 56.2% 57.7% 58.5% 57.7% 55.6% EU* Average liquidity coverage ratio of 245% at March 2020 end vs. 240% at December 2019 end, well above regulatory requirement (100%) and European average (150% at 2019 end), indicating a comfortable resilience capacity of the banking sector to liquidity shocks. 44.7% 20.7% 13.6% 9.5% EU* 5.0% 4.1% 3.9% 6.4% 2.7% Total capital ratio of 20.3% at March 2020 vs. 20.0% at 2019 end (compared to 13.8% at 2008 end) Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Mar-20 NPL ratio Coverage ratio Sound risk profile ROMANIAN BANKING SYSTEM SHARE OF FX LOANS TO TOTAL LOANS NPL ratio decreased to 4.0% at May 2020 end vs 4.1% at 2019 end NPL coverage ratio increased to 61.0% (60.6% at 2019 end) well above EU average (44.7% at 2019 end) 63% 62%61%60% 60% 56% 55% Share of FX loans at 32% at March 2020 end (compared to 56% at 2008 end) 49% 42% 37% 34%33% 32% * As of Dec 2019 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 10

3 2ND QUARTER AND 1ST HALF 2020 BRD GROUP RESULTS

QUICKLY ADAPTING TO ADDRESS THE CRISIS SITUATION, ENSURE BUSINESS CONTINUITY AND PROVIDE OPERATIONAL SUPPORT TO OUR CLIENTS Protect our customers and employees through implementation of adequate sanitary measures and prevention actions in all business outlets Ensure business continuity with extended WFH, split teams deployed in different work locations Facilitate access to banking services for our customers Permanent communication with the clients, a dedicated web page and integrated communication (website, branches, ATMs, Facebook, etc.) Enhanced contact centre capabilities: number of answered customer calls increased by +46% y/y in H1 2020 Promoting digital channels, with My BRD Mobile and My BRD Net free of charge for 3 months 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 12

FULLY COMMITTED TO SUPPORT OUR CLIENTS WITH FINANCING SOLUTIONS Moratorium Deferral in loan repayment granted for 44k individuals clients as of June 2020 end, postponements granted between 3 and 9 months, for RON 2.9 bn (~14 % of portfolio) Grace period for SBclients: RON 65m (~12% of portfolio) SMEs possibility to benefit from moratorium, though a limited number accessed this option (~2% of portfolio) SB LOANS CONSUMER LOANS HOUSING LOANS CORPORATE LOANS 15% 13% 2% 12% Moratorium Active participation in IMM Invest 1052 requests approved (both Non Retail and Small Business clients), for app RON 600 m, as of 23rd of July 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 13

ACCELERATION OF OUR DIGITAL ROADMAP Contact Center ADAPTED PHYSICAL SET UP FAST ADOPTION OF DIGITAL CHANNELS HIGHLY REACTIVE CUSTOMER INTERACTION CENTER Fast tracked Customer Interaction Centre capabilities to answer increased remote requests Growing digital penetration Fewer branches More specialized 651k MyBRD Mobile & MyBRD Net active clients at June 2020 end, +19% y/y Better service +46% answered customer calls vs H1 2020 -74 branches, to 625 +17% 24/7 banking points +32% volume of transactions vs H1 2019 +83% written interactions vs H1 2020 +35% nb of connections vs H1 2019 96% of corporate clients transactions performed via digital channels Jun 2019 Jun 2020 Apps & website -185 branches since end 2016 CLIENTS DIGITAL EXPERIENCE FURTHER ENHANCED Partnership with Mastercard and Octet Europe, for easy and free of charge access for SMEs to an international trade platform Apple Pay, a safer and faster way to pay, available to BRD digital users Implementation of physical token for BRD@Office with Cronto technology for corporate clients, adding new features Possibility for clients to update their data through the website brd.ro Enhanced digital trade finance offer with automated Letter of Credit flow 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 14

STRONG GROWTH OF CORPORATE FINANCING ACTIVITY NET LOANS (end of period amounts, RON bn) Sustained corporate financing activity Loans to SME up by +7.2% y/y and large companies advance of +4.6% y/y Active participation in IMM Invest Programme Overall leasing portfolio increasing by +16.6% y/y Y/Y +1.2% 31.3 31.0 30.6 8.9 8.9 +5.4% 8.5 +0.5% 20.9 20.7 20.8 -13.2% 1.4 Jun-19 1.3 1.4 Dec-19 Jun-20 INDIVIDUALS LOAN PRODUCTION Retail loan production impacted by lockdown... -45% decrease of retail loans production in Q2 2020 y/y Feb. Jan. Mar. Apr. May Jun. Jul. 120.0 .but strong rebound in consumer loan production in May, back to pre-crisis level starting late June 80.0 40.0 0.0 w2 w4 w6 w8 w10 w12 w14 w16 w18 w20 w22 w24 w26 w28 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 15

DYNAMIC DEPOSIT COLLECTION Consolidation of already broad retail deposit base Increasing retail deposits (+8.1% y/y) with an almost double yearly pace vs previous quarter Individuals savings up +7.5% y/y (o/w current accounts were up by +32% y/y) SAVINGS (end of period amounts, RON bn) Y/Y +4.8% Corporate deposits decrease driven by a double digit compression of large corporate deposits mainly linked to the reduction of EUR non transactional accounts, on an assumed balance sheet management choice, while SMEs resources strongly increased (+18.6% y/y), 47.6 45.9 45.4 15.5 -1.6% 15.5 15.7 Strong liquidity profile 32.1 +8.1% 30.4 29.7 Net loan to deposit ratio at 65.2%, -2.3 ppts y/y High degree of financial autonomy with the share of deposits in total liabilities reaching 92% at June 2020 end, ensuring a stable funding base Strong liquidity buffer at 31% of total assets, +3 ppts y/y Jun-19 Dec-19 Jun-20 Retail Corporate Rebound in asset management activity Activity impacted by the crisis in line with the market evolution, driving down AUM to RON 3.62 bn at March 2020 end Back on an upward trend starting May (AUM RON 3.72 bn at June 2020 end) Market share of 18.1% on open-end mutual funds market, up by +2.3 ppts y/y 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 16

IMPACT OF CRISIS ON REVENUES IN LINE WITH EXPECTATIONS NET BANKING INCOME (RON m) Resilient NII over the 1st semester Quasi stable NII in H1 2020 (-0.3% y/y) benefitting from positive volume effect induced by growing deposits NII lower (-6.9% y/y) in Q2 2020 interest rate effect turning negative ROBOR 3M average of 2.39% in Q2 2020, -90 bps y/y ROBOR 3M average of 2.72% in H1 2020, -48 bps y/y Y/Y -6.0% 1,609 1,512 Other income Net fees and commissions -22.3% 177 138 387 -14.0% 333 Net interest income -0.3% 1,045 1,042 important drop of individual loan production during the containment period H1-2019 H1-2020 Contraction of NFC triggered by pandemic and regulatory changes Decline in net fees and commissions income, -14.0% y/y in H1 2020 and -23.2% y/y in Q2 2020, following: SEPA regulation enforcement (price alignment of EUR denominated payments to domestic ones, starting from 15th of December 2019) lower volumes of transactions cease of the Western Union activity in August 2019 free usage of remote banking applications (from 15th of March to 15th of June) NET BANKING INCOME (RON m) Y/Y -9.6% +5.1% -23.2% 824 745 Other income Net fees and commissions 91 95 202 155 531 -6.9% Other income evolution explained by exceptional 2019 base effect of reevaluation gains 495 Net interest income Q2-2019 Q2-2020 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 17

OPEX DYNAMICS REFLECTING STRICT CONTROL OF SUNDRY COSTS AND LOWER REGULATORY CHARGES OPERATING EXPENSES (RON m) OPEX evolution for H1 2020, w/o regulatory costs, impacted by: measures taken to address the sanitary crisis (acquisition of protection materials for employees and clients) 2019 salary increase, in a context of accelerating economy - wide wage growth Y/Y -0.5% -40.0% 800 804 72 43 Contributions to FGDB & FR +4.8% 412 403 Other expenses +3.4% +2.2% 344 328 Embarking on a significant saving plan immediate tactical actions (communication & marketing expenses, ban on travels, office supplies) structural actions gradually delivering over time (freeze of hiring, resizing of network, optimization actions which mostly envisage systematization of e-training, reduction in communication budget, external services and travels, and continued automation of processes) while preserving strategic investments in digital transformation Staff expenses H1-2019 H1-2020 OPERATING EXPENSES (RON m) Y/Y Already visible results in Q2 stable staff costs other costs reduced by -2.4% (excluding sanitary costs and negative base effect related to previous year adjustments recognized in June 2019) +3.5% 374 362 +8.0% Other expenses 173 160 +0% 201 201 Staff expenses Q2-2019 Q2-2020 C/I ratio at 52.9% in H1 2020 (vs. 50.0% in H1 2019) 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 18

STRONG ASSET QUALITY GROSS LOANS June 30, 2020 breakdown by segment and currency (RON bn) Loan portfolio market mix 70% on individuals market segment 30% on legal entities market segment 20.9 21.5 Consolidation of RON lending Share of RON denominated loans at 67.8% (vs 67.1% as of June 2019 end) Trend in line with market evolution 9.3 9.9 RON FX Individuals Companies NPL RATIO EBA methodology 20.5% 20.7% NPL ratio close to banking sector level Rather stable evolution versus previous quarter, the effects of Covid- 19 pandemic are not yet visible (3.96% for June vs 4.01% for March computed with the same methodology). 13.6% 13.6% 10.8% 9.6% 6.8% 6.4% 4.01% 5.0% 4.6% 3.96% 4.1% 3.9% Outlook Upward trend expected, especially after the end of moratorium on loan repayments. 3.3% 3.1% Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Mar-20 Jun-20* BRD Banking system * NPL for BRD computed in line with EBA new methodology (excl. RMO & demand deposits) * NPL Ratio for Banking System as of May 2020 All figures at individual level 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 19

COST OF RISK INCORPORATING DETERIORATED MACROECONOMIC CONTEXT COST OF RISK EVOLUTION 538 2,083 438 Net cost of risk at 205 bps in Q2-20 (vs 59 bps in Q1- 20), driven mainly by: Updated macroeconomic scenarios embedding Covid context, leading to higher expected losses Lower recovery performance given the new context 1,883 338 1,193 1,193 238 205 198 137 800 138 631 461 38 157 -62 -124 -224 -246 CoR (RONm) CoR (bps) -73 -376 -81 -162 -120 -162 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q2-19 Q2-20 Note: Cost of risk in bps for Q2-2019 and Q2-2020 is annualized NPL COVERAGE RATIO - EBA methodology Solid NPL coverage ratio following prudent provisioning policy 76.6% 74.2% 74.2% 74.5% 74.0% 73.3% 69.3% 66.7% 61.0% 61.0% 60.6% 58.5% 57.7% 57.7% 56.2% 55.6% NPL coverage ratio well above banking sector average Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Mar-20 Jun-20* BRD Banking System * NPL coverage ratio for BRD computed in line with EBA new methodology (excl. RMO & demand deposits) * NPL coverage ratio for Banking System as of March 2020 All figures at individual level 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 20

VERY SOLID CAPITAL POSITION SOLVENCY RATIO Strong high quality capital base -27bp CAR of 27% at June 2020 end +145bp +49bp Regulatory own funds composed solely of Tier 1 capital Increase in own funds on a yearly basis mainly driven by the retention of the entire 2019 net profit, considering (i) the high uncertainty about the long term economic consequences of the Covid 19 outbreak, (ii) BRD strong commitment to support the Romanian economy in difficult times, and (iii) regulator recommendation +528bp 20.01% 26.69% Retained profit Evolution of RWA influenced mainly by the implementation of the provisions regarding the temporary relief on the RW of EUR sovereign exposures, introduced through Regulation 873, approved late June in response to COVID-19 pandemic (+140 bps impact in solvency ratio at June 2020 vs June 2019) Other OCI RWA Jun-20 Jun-19 Bank only Capital adequacy ratio Own funds (RONm) Total risk exposure amount (RONm) Capital requirements (RONm) Jun-19 20.0% 5,789 28,924 2,314 Dec-19 24.9% 7,322 29,404 2,352 Jun-20 27.0% 7,385 27,387 2,191 Note: Own funds for 2019 include the FY net profit, according to the GSM decision 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 21

5 CONCLUSIONS

CONCLUSIONS Entered a strong and unprecedented crisis Quickly and successfully adapted our organization to protect employees and customers, and to ensure business continuity Stand by our clients in these difficult times loan moratorium active participation in IMM INVEST sustained corporate financing activity eased the access to banking services As expected, revenues were hit and cost of risk was directly impacted by the deteriorated economic environment Cost adjustment measures were immediately taken While preserving strategic investments in digital transformation Financial performance directly impacted by the crisis, but resilient, and the fundamentals remain very solid strong capital adequacy ratio very comfortable liquidity position elevated asset quality 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 23

6 Q&A SESSION

APPENDIX BRD GROUP KEY FIGURES BRD STANDALONE - KEY FIGURES STOCK PRICE PERFORMANCE FINANCIAL CALENDAR FOR 2020 GLOSSARY CLIENT SEGMENTATION

BRD GROUP | KEY FIGURES (1) Variations at constant exchange rate; (2) Bank only, including impact of prudential filters in Sep-17 and Dec-17; RON m Net banking income Q2-2020 Q2-2019 Change -9.6% H1-2020 1,512 H1-2019 1,609 Change 745 824 -6.0% Operating expenses (374) (362) +3.5% (800) (804) -0.5% Gross operating income 371 463 -19.8% 713 805 -11.5% Financial results Net cost of risk (165) 118 n.a. (225) 144 n.a. Net profit 174 486 -64.2% 415 787 -47.3% Cost/Income 50.2% 43.9% 6.4 pt 52.9% 50.0% +2.9 pt ROE 8.3% 25.2% -16.9 pt 9.8% 20.9% -11.0 pt RON bn Net loans including leasing (RON bn) Jun-20 Dec-19 Jun-19 vs. Jun-19 +1.2% vs. Dec-19 31.0 31.3 30.6 -0.9% Retail 22.1 22.3 22.2 -0.4% -1.0% Corporate 8.9 8.9 8.5 +5.4% +0.2% Loans and deposits Total deposits (RON bn) 47.6 45.9 45.4 +4.8% +3.6% Retail 32.1 30.4 29.7 +8.1% +5.8% Corporate 15.5 15.5 15.7 -1.6% -0.6% Loan to deposit ratio 65.2% 68.2% 67.5% -2.3 pt -3.0 pt CAR* Capital adequacy 27.0% 24.9% 20.0% +6.9 pt +2.1 pt Franchise No of branches 625 648 699 (74) (23) (*) according to Basel 3; CAR at Bank level; 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 26

BRD | KEY FIGURES FOR BANK ONLY (1) Variations at constant exchange rate; (2) Bank only, including impact of prudential filters in Sep-17 and Dec-17; RON m Net banking income Q2-2020 Q2-2019 Change -13.4% H1-2020 1,433 H1-2019 1,566 Change 712 822 -8.5% Operating expenses (353) (339) 4.1% (755) (760) -0.6% Financial results Gross operating income 359 482 -25.6% 677 805 -15.9% Net cost of risk (157) 124 n.a. (203) 154 n.a. Net profit 172 513 -66.6% 405 803 -49.5% Cost/Income 49.6% 41.3% 8.3 pt 52.7% 48.6% 4.2 pt ROE 8.5% 27.8% -19.3 pt 10.0% 22.2% -12.3 pt Loans and deposits RON bn Net loans (RON bn) Jun -20 Dec-19 Jun-19 vs. Jun-19 +0.7% vs. Dec-19 29.2 29.5 29.0 -0.9% Retail 21.1 21.3 21.2 -0.7% -1.2% Corporate 8.1 8.1 7.8 +4.6% +0.1% Total deposits (RON bn) 47.72 46.0 45.4 +5.0% +3.7% Retail 32.1 30.3 29.69 +8.1% +5.8% Corporate 15.6 15.7 15.75 -0.8% -0.5% Loan to deposit ratio 61.2% 64.0% 63.8% -2.6 pt -2.8 pt 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 27

BRD | STOCK PRICE PERFORMANCE Market capitalisation EUR 1.7 bn 4,000 16.0 3,500 3,000 14.0 2,500 12.0 2,000 1,500 10.0 1,000 8.0 500 6.0 0 Volume ('000 shares, rhs) Price (RON, lhs) BRD is part of the main market indices on the Bucharest Stock Exchange BRD is in Top 5 largest domestic companies listed on the local stock exchange BRD s share price reached RON 11.56 as of June 2020 end, -8.5% y/y and -27% ytd. 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 28

FINANCIAL CALENDAR FOR 2020 6th February: Preliminary 2019 financial results and annual press conference 23rd April: General Shareholders Meeting for approving the 2019 annual financial results 7th May: Presentation of the 1st quarter 2020 financial results 3rd August: Presentation of the 2nd quarter and 1st half 2020 financial results 5th November: Presentation of the 3rd quarter and 9 months 2020 financial results 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 29

GLOSSARY CLIENT SEGMENTATION The Retail category is comprised of the following customer segments: Individuals BRD provides individual customers with a range of banking products such as: savings and deposits taking, consumer and housing loans, overdrafts, credit card facilities, funds transfer and payment facilities. Small business business entities with annual turnover lower than EUR 1m and having an aggregated exposure at group level less than EUR 0.3m. Standardized range of banking products is offered to small companies and professionals: savings and deposits taking, loans, transfers and payment services. The Corporate category is comprised of the following customer segments: Small and medium enterprises - companies with annual turnover between EUR 1m and EUR 50m and the aggregated exposure at group level higher than EUR 0.3m. The Bank provides SMEs with a range of banking products such as: savings and deposits taking, loans and other credit facilities, transfers and payment services. Large corporate - within corporate banking BRD provides customers with a range of banking products and services, including lending and deposit taking, provides cash-management, investment advices, securities business, project and structured finance transaction, syndicated loans and asset backed transactions. The large corporate customers include companies with annual turnover higher than EUR 50m, municipalities, public sector and other financial institutions. 2ND QUARTER AND 1ST HALF 2020 RESULTS 04/08/2020 30

BRD GROUPE SOCIETE GENERALE - INVESTOR RELATIONS +4 021 380 47 62 | investor@brd.ro; www.brd.ro