Brexit's Impact on Financial Services: Key Issues and Future Challenges

Explore how Brexit is affecting the financial services sector, from the challenges of leaving the single market to risks such as job losses and market fragmentation. Learn about the importance of transition periods and the need to ensure continuity in regulated contracts and data transfers post-Brexit.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

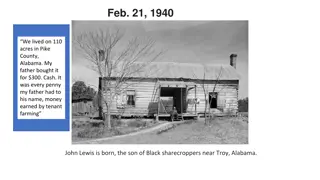

Association for Financial Markets in Europe The Future of the Finance Sector: Brexit and Beyond Simon Lewis, CEO, AFME 19 April 2018 1

AFME: Overview Who we are Association for Financial Markets in Europe The Pan-European trade group representing European capital markets participants A bridge between the European wholesale banking community, politicians, regulators and the public Over 160 members including retail & investment banks, regional banks, investors and market participants such as law firms and consultants Based in London with offices in Brussels and Frankfurt 2

Brexit: timeline UK formally leaves EU; transition period begins EU European Council Summit to conclude withdrawal agreement (Withdrawal) Bill Royal Assent End of transition period European Council approves guidelines for future relationship Informal deadline for negotiations to allow time for ratification Ratification process UK and European parliament and institutions Negotiations on future relationship and ratification New EU Commission and Parliament Apr 19 Dec 20 Nov Oct Jun 23 Mar 29 Mar 18-19 Oct Jun(TBC) 31 Dec 2019 2020 2018 3

Brexit Key issues for financial services 1. Impact of leaving the single market Large volume of financial services provided from UK to the EU27 Banks face significant uncertainty and have undertaken extensive planning to adapt to the loss of passporting Banks are now implementing plans to enable them to continue to serve their clients across Europe e.g. getting licenses in Frankfurt 2. Importance of transition A transition period is essential to provide time for banks to adapt and to avoid a cliff edge Key question is to what extent the political agreement on transition is legally certain. 4

Brexit: Key issues for financial services 3. Avoiding cliff edge risks Need to ensure that existing regulated contracts can continue to be performed after the UK leaves the EU Need to enable personal data to be transferred between the UK and EU Uninterrupted access to financial markets infrastructure e.g. clearing houses 4. Likely impact on jobs and growth Possibility of increased fragmentation of capital markets; potential impact on ability of markets to support jobs and growth e.g. availability of finance to SMEs. 5

Impact on the red economy AFME commissioned a report on the impact of Brexit on SMEs, in particular their use of wholesale banking and Capital Markets services. We held 70+ interviews with treasurers and CEOs of SMEs, large corporates and investors. Overwhelming majority of interviewees wanted Brexit negotiators to maintain existing levels of access for businesses to both UK and EU27 financial services firms 6

SME perspective SMEs most concerned about direct Brexit impacts, such as trade barriers, customs compliance, diverging regulatory regimes 44% do not expect effects of a hard Brexit on the banking sector to flow through to them; 33% fear they will be first segment hit by adverse impacts; 22% were unsure Product Financing operations Financing capital expenditure SMEs are most worried about adverse impacts to their access to wholesale banking services. Key concerns ~60% of SME interviewees use only 1 bank and find switching difficult Brexit related price increases for risk management products Managing risk Managing cash "SMEs are first in the firing line [when there is a credit squeeze]" UK SME "Switching banks would not be easy; This would be something new for us and we would find the process difficult" EU27 SME 7

Importance of other key pan-European initiatives Banking Union Banking union was designed post-crisis to create a safer financial sector for the Eurozone Pan-European banks are now supervised by the ECB Further measures on common deposit insurance are under discussion Capital Markets Union Capital Markets Union aims to integrate further the capital markets of EU member states, to: provide new sources of funding for businesses, especially for SMEs reduce the cost of raising capital increase options for savers across the EU make the EU financial system more stable, resilient and competitive The case for a CMU is more compelling than ever 8

Summary There are multiple milestones in the Brexit timeline Agreement on transition is a major step forward but there is continued uncertainty The timeline is very tight The future UK-EU trading relationship still needs to be negotiated Important EU initiatives including Banking Union and CMU are needed beyond Brexit to support continued European growth 9