BZX629 Week 13 with Andi Roberts - Key Concepts & Learning Goals

BZX629 Week 13 session focuses on fundamental cost concepts, such as cost objects, fixed costs, variable costs, direct costs, and indirect costs. Participants will explore critical concepts to understand the relevance of costs in planning, control, and decision-making. The session also covers learning goals related to contribution in planning, identifying break-even levels, and analyzing what-if scenarios using break-even analysis.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

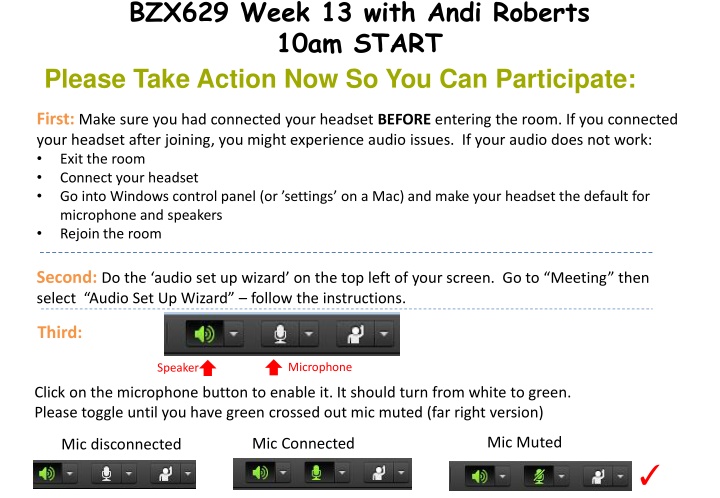

BZX629 Week 13 with Andi Roberts 10am START Please Take Action Now So You Can Participate: First: Make sure you had connected your headset BEFORE entering the room. If you connected your headset after joining, you might experience audio issues. If your audio does not work: Exit the room Connect your headset Go into Windows control panel (or settings on a Mac) and make your headset the default for microphone and speakers Rejoin the room Second: Do the audio set up wizard on the top left of your screen. Go to Meeting then select Audio Set Up Wizard follow the instructions. Third: Microphone Speaker Click on the microphone button to enable it. It should turn from white to green. Please toggle until you have green crossed out mic muted (far right version) Mic Muted Mic Connected Mic disconnected

BZX629 Week 13 10am kick off (UK Time) Andi Roberts

Speaker settings Microphone settings Quick feedback Ask questions to presenters / chat with participants

RECORDING NOTICE! This session will be recorded If you have a private question that you wish to ask, please make a note, and we will discuss at the end when NOT recording

Learning outcomes Goals Review Week 13 activities Answer any questions at this point

Week 13 Learning goals Understand the fundamental cost concepts and their relevance for planning, control and decision-making Recognise the importance of contribution in planning and decision- making Identify the break-even level of output and explore various what if scenarios applying break-even analysis.

Week 13 Critical concepts 1 Critical concepts: Cost object - Ideally, this is the most granular level of cost that is useful and relevant to you in what you are trying to cost (Think Tin of beans) Fixed costs - Those which do not change with different levels of activity (Think baked bean factory) Variable costs - Those that vary proportionately with the level of activity (think tomato sauce for baked beans) Direct costs - Those associated with a specific activity or output (think staffing costs of baked bean production line) Indirect Costs - hose that cannot be identified with or allocated to a specific cost object and which therefore need to be shared between different cost objects (Think accounting department of Baked Bean factory)

Week 13 Activity 1 Cost Types Your organisation or department presumably exists to provide some sort of product or service. What is the principal product or service provided? This product or service can be thought of as a cost object an entity to which costs relate. Identify the main elements of cost in your organisation (or department) and then classify each element as: Direct or indirect (ask yourself whether each cost identified is incurred directly as a result of producing the product/providing the service, or whether it is part of the infrastructure resources necessary to enable the organisation to exist or function efficiently) Fixed or variable (ask yourself whether producing one more unit of the product or service would cause each element of cost to change) with respect to the cost object concerned.

Week 13 Activity 1 Cost Types Your organisation or department presumably exists to provide some sort of product or service. What is the principal product or service provided? This product or service can be thought of as a cost object an entity to which costs relate. Identify the main elements of cost in your organisation (or department) and then classify each element as: Direct or indirect (ask yourself whether each cost identified is incurred directly as a result of producing the product/providing the service, or whether it is part of the infrastructure resources necessary to enable the organisation to exist or function efficiently) Fixed or variable (ask yourself whether producing one more unit of the product or service would cause each element of cost to change) with respect to the cost object concerned. HOW did you get on & what did you notice?

Week 13 Critical concepts 2 Contribution - Contribution is primarily used for decision-making and applies the concepts of fixed and variable costs. It is calculated by deducting variable costs from sales revenue, with any contribution firstly having to cover fixed costs and then any contribution over and above fixed costs is profit. When calculated on a unit basis it provides an indication of how much an extra unit of output contributes towards profitability. Contribution = sales revenue variable costs Profit = contribution fixed costs Contribution can also be calculated on a unit basis: Contribution per unit = sales revenue per unit variable cost per unit (Think what gives more back to the business cans of baked beans or baked beans with sausages) Operational gearing - The proportion of total costs made up by fixed costs.(Think how much does the plant, machines, delivery trucks etc come to for our baked bean factory compared to materials, staffing etc) Break-even - Identifies the level of activity at which an organisation generates neither profit nor loss, no surplus or deficit. It is designed to show where the value of the inputs equals the value of the outputs. (Think how many cans of beans do we have to sell to make a profit)

Week 13 Activity 2 You have been consulted to advise Ray on how he might improve the business s profitability Reduce price 20% for all meals and drinks would increase the number of meals and drinks sold by 50%. A monthly advertising campaign on local radio stations and in cinemas and newspapers, costing 60,000 per month, is expected to increase the number of meals and drinks sold by 15% while maintaining prices at their current levels. Advise Ray what to do, having regard to both the profitability and the risk of the various options.

Week 13 Activity 2 You have been consulted to advise Ray on how he might improve the business s profitability Reduce price 20% for all meals and drinks would increase the number of meals and drinks sold by 50%. A monthly advertising campaign on local radio stations and in cinemas and newspapers, costing 60,000 per month, is expected to increase the number of meals and drinks sold by 15% while maintaining prices at their current levels. Advise Ray what to do, having regard to both the profitability and the risk of the various options. HOW did you get on & what did you notice?

Ray core calculations Current situation Reduce Prices Increase Advertising a) Total profit 53,000 117,000 90,950 b) Contribution margin (assuming constant sales mix) Break even revenue 0.7463 0.6829 0.7463 803,966 878,606 884,363 Break even (units) meals/drinks 137,826 188,283 151,609 653,000 150,000 4.3533 717,000 225,000 3.1867 750,950 172,500 4.3533 Total contribution earned Total meals sold Average contribution per meal Contribution needed to break-even (i.e. fixed cost) Therefore, number of meals/drinks required 600,000 600,000 660,000 137,826 188,283 151,609

Key insights Profit is highest under reduced selling prices scenario, but so is the risk involved - as evidenced by the increase in breakeven point in terms of number of meals served (i.e. given reduced prices, number of meals sold to break even increases from 137,826 to 188,283). If the estimate of the relationship between price and sales demand is inaccurate, losses could result. A compromise solution might be the increased advertising scenario- since prices are maintained at current levels, a much smaller increase in meals sold is necessary to cover the modest increase in fixed costs (due to advertising expenditure) and hence break even.

WEEK 12 content JUST IN CASE!!!

Week 12 learning goals Identify the different budgeting bases used in practice (incremental, zero base, flexible and rolling bases) Recognise the implications of the severity of budget targets for motivation and performance. Understand the impact of participation in setting budget targets on motivation and performance Recognise how senior management s attitude towards failure to achieve budget targets can influence behaviour (in both desirable and undesirable ways).

Week 12 Activity 1: Garden Furnishings Ltd Prepare a budget and discuss how budgets can be used to improve financial performance. Step 1: From the master budget and additional information provided, you should now prepare a cash budget for the year. Step 2: When you have constructed the cash budget, suggest how the specific information now available (in the master budget and cash budget) might be used by the managers at Garden Furnishings to improve the financial performance and situation of the organisation.

Garden Furnishings LTD How did you get on? WHAT is the secret to success? Did you use thevideo?

10 ways to fix cash flow problems Increase your price Reduce the cost of your payroll Get rid of excess inventory Negotiate with suppliers Merge the business Sell assets you don t need Delay your capital spending Shut down the loss- making parts of your business Raise new debt or refinance Raise equity through the stock market

Dealing with cash flow problems: Audit your business finances Improve profit margins Cut costs Prioritise credit control Cash flow forecasts An organised accounting system Consider alternative funding options Negotiate with creditors Consult a licensed Insolvency Practitioner Company Voluntary Arrangement (CVA)

Week 12 Activity 2 Your budgets Assess whether the budgetary information you (or your line manager) are provided with is completely satisfactory and if not (as is likely to be the case) make recommendations as to how the situation could be improved.

Week 12 Activity 2 Assess whether the budgetary information you (or your line manager) are provided with is completely satisfactory and if not (as is likely to be the case) make recommendations as to how the situation could be improved. HOW did you get on?