Capacity Building Workshop in Financial and HR Management for CSOs

This workshop aims to enhance the financial and HR management capacities of Executive Directors, Finance Managers, and HR Managers of selected CSOs. Through modules covering topics such as financial planning, basic accounting, procurement procedures, and HR management, participants will develop a work plan for improvement. The expected outcome is a detailed plan outlining the expected enhancements for each CSO enrolled in the program.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

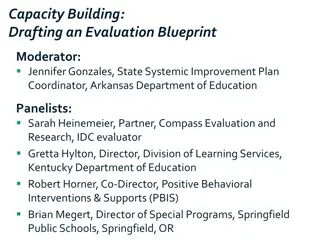

Capacity Building Workshop in Financial and HR Management of CSOs JAGATH KARUNATHILAKA CONSULTANT FINANCIAL AND HR MANAGEMENT OF CSO - SKPA ORGANIZATIONAL CAPACITY DEVELOPMENT CONSULTANCY PROJECT

Objectives To create participants interest and make them accountable in adoption of proper policies, systems, and tools already introduced To discuss consequences on lapses that might be affected, accessing to GF and other donor funds etc. To facilitate developing a work plan outlying the expected improvement over consultancy for capacity development with millstones To discuss consultant s intervention and its limitations in aspect of expected improvement for each CSO

Target Participants: Executive Directors/CEO, Finance Managers and HR Managers of selected CSOs, enrolled for capacity development under SKPA program We have selected 12 CSO who have taken part in virtual workshop.

Scope Review on the expected outcome of the workshops, conducted from 25thAugust 23rd October, 2021 through zoom o Module 1: Financial Manual: Introduction (1 Lesson Day) o Module 2: Finance Planning and Budgeting Process (2 Lesson Days) o Module 3: Basic Accounting System (4 Lesson Days) o Module 4: Financial Reporting Mechanism (5 Lesson Days) o Module 5: Procurement Procedure (4 Lesson Days) o Module 6: Finance Manager s Roles and Responsibilities (1 Lesson Day) o Module 7: HR Management (10 Lesson Days)

Scope Importance in adoption of proper policies, systems and tools, and consequences on lapses that might be affected, accessing to GF and other donor funds A panel discussion by officials of FPA to share their experience and get the feedback if any impediment Devise a work plan outlying the expected improvement over consultancy for capacity development with millstones Support expected from Consultant to Set Up, Revise or Realign present Financial and HR management policies, systems and tools for each CSO

Expected Outcome Devise a work plan outlying the expected improvement over consultancy for each CSOs enrolled for capacity development with millstones

Work Plan First round of information survey based on checklists - CSOs are supposed to assess their position and fill out their status on the consultant assisted checklists (through a two hours Zoom Meeting (August 6 from 9.30 11.00) Consultant physically visits to 13 selected CSOs main office locations and examine their documents in order to revalidate the inputs and strengthen observations etc. Tentative scoping visit dates the preferred location/clusters (from August 9 -17) Consultant carry out assessment and analysis under each CSOs based on their information collected through checklists and from physical visits (August 18 -22) Overall workshop guides with detailed lesson plans - workshop Outlines (From August 10 October 8) CSOs Capacity Building Workshops - Finance and HR Management (from August 25 - October 23)

CSO Finance Checklist - - Y Y Y Y Y - HR Checklist Y - Y Y Y Y - - Abhimana Asia Lanka CORE CSDF ECDIC Heart 2 Heart Lanka Lanka Plus Mithuru Mithuro Movement Pulse Sri Lanka SARD SLIDO YMMA Total Y those who have submitted self-assessment checklists - Y - - 6 - Y - - 6

Overall Management of CSO Level of Sophistication Primitive Budgeting Only Figures compared with previous year Basic Annual Operating Planning Action plan Annual budget synchronize with action plan

Overall Management of CSO Level of Sophistication Mature - Strategic Planning Loan term direction (say10 years) Vision; Mission; Values guiding principles Loan term plan (say 5 years) Strategies; Goals; Plans Program Management, Finance Management, HR Management, Procurement (Master Procurement Plan) Short-term plan (say 1 - 2 years) Objectives; Targets; Annual or Biennium budget synchronize with action plan

Overall Management of CSO Level of Sophistication Sophisticated - Strategic Management Strategic Planning + Policies and Procedures (reviewed periodically for its relevance that support in meeting current needs and resulting in tangible outcomes) Guidelines & Templates Governance; Program Management; Communication; Fund raising / resource mobilization; Financial and HR management

A mature system has the following characteristics Clarity of objectives How well it is implemented o Objectives are stated clearly o Line managers take interest o They are shared with all o HR monitors the same well Extent to which it is well structured Extent to which it meets organizational needs o Comprehensive and has all components o The system meets current needs and reviewed periodically for its relevance o Scientifically designed with professional expertise behind Extent to which it is understood o Resulting in tangible outcomes o They are communicated to all o Periodic education/ training programs are conducted for the users o Manuals and guidelines are available

Manual Report Structure CSO Chapter Structure I: Overview Overall Policy Policy Framework Procedure Illustration Key Steps Process Flowcharts Business Case Analysis where some chapters are strategic important Template References Operating Formats Chapter Structure II: Chapter Introduction Policy Guidelines Template References Operating Formats

The Syllabus Module1:Financial Manual: Introduction- August 25, 2021 Nature of Finance and Functions of Finance Management of Non Profit Overview and the Policy Framework Implementation and Compliance Introduction o Sri Lanka Statement of Recommended Practice for Not-for-Profit Organizations (NPOs) (including Non-Governmental Organizations - NGOs) Framework for the Preparation and Presentation of Financial Statements - o Legal Framework and Definition of an NPO o Donations/Contributions, Grants and Donor Agreements Restricted Funds, Unrestricted Funds and Accumulated Fund

The Syllabus Module1:Financial Manual Nature of Finance and Functions of Finance Management of Non Profit Overview and the Policy Framework Implementation and Compliance Introduction o Sri Lanka Statement of Recommended Practice for Not-for-Profit Organizations (NPOs) (including Non-Governmental Organizations - NGOs) Framework for the Preparation and Presentation of Financial Statements - o Legal Framework and Definition of an NPO o Donations/Contributions, Grants and Donor Agreements Restricted Funds, Unrestricted Funds and Accumulated Fund

The Syllabus Module 2:Finance Planning and Budgeting Process(August 30 & 31, 2021) Introduction: overview, policy framework and the planning process Budgeting Framework Budget Planning and Preparation Process Biennium Budget Preparation Flowchart Processes of Sampled CSO Spreadsheet Budgeting Template Cash Flow Projection Template Sample Multi-Program Line Item Budget

The Syllabus Module 2:Finance Planning and Budgeting Process Budget Implementation and Monitoring Key Steps Checklist in Budgeting Income and Expenditure Variance Analysis Budget Revisions: Supplementary Budget The roles and responsibilities for the planning and preparation of Budgets Important Aspects for Creating Budgets at Nonprofit Organizations

The Syllabus Module 3: Basic Accounting System Accounting essentials to set up and operate a Double Entry Accounting System September 6 Accounting Essentials to Set Up and Operate a Double Entry Accounting System Accounting Theory; The Chart of Accounts; The Ledger Concept; Closing the Books; The Financial Statements; and Accounting Controls Basic accounting system comprises a standard Chart of Accounts that comprise a CSO s general ledger. The accounts may be labeled and would classify according to the standard chart of accounts, the list of categories may include Assets; Liabilities; Owners Equity or Accumulated fund; revenues; Operating Expense and other relevant accounts

The Syllabus Module 3: Basic Accounting System Processing a Formal Accounting System for Efficient Accounting and Finance Operations September 7 o Financial and Accounting Operations of a CSO o Fixed Assets and Depreciation o Intangible Assets o Revenue and Receivables o Cash Processing

The Syllabus Module 3: Basic Accounting System Processing a Formal Accounting System for Efficient Accounting and Finance Operations o Payable Processing and Accrual o Inventory Accounting o Debt Accounting o Payroll Activities o Bank Transactions o Financial Recording and Closing Procedures

The Syllabus Module 3: Basic Accounting System Financial Recording and Closing Procedures and functional Competencies in Finance Management relevant to NPOs September 8 o Financial Ledger and Records o Project Accounting o Direct Costs and Indirect Support Costs o Trial Balance General Policies o Closing Activities o Period-end Reporting o Additional Requirements for Half-yearly and Annual Closing Activities including Physical verification o Document Retention and Destruction

The Syllabus Module 3: Basic Accounting System Financial Recording and Closing Procedures and functional Competencies in Finance Management relevant to NPOs September 8 o Financial Ledger and Records o Project Accounting o Direct Costs and Indirect Support Costs o Trial Balance General Policies o Closing Activities o Period-end Reporting o Additional Requirements for Half-yearly and Annual Closing Activities including Physical verification Document Retention and Destruction

The Syllabus Module 3: Basic Accounting System Presentation of Financial Statements - special guideline issued to NPOs to prepare and present their financial statements (SLFRS Framework) September 9 o Underlying Assumptions o A complete set of Financial Statements includes: o Statement of Financial Position. o Statement of Financial Performance the income and expenditure of all funds. o Statement of Changes in net assets/equity. o Cash Flow Statement. o Distribution and Publication of Financial Statements o Appointment of External Auditor

The Syllabus Module 4: Financial Reporting Mechanism Overview of Financial Reporting and Financial Reporting Framework for NPO including Audited Financials and Non Profit Annual Report September 13 o Financial Reporting Framework for NPO o Financial Reporting Cycles o Nonprofit Annual Report o How do you Analyze a Non Profit Financial Statement o Key Financial Metrics to Measure Nonprofit Health Liquidity

The Syllabus Module 4: Financial Reporting Mechanism Conceptual Framework for Financial Reporting in terms of Sri Lanka Statement of Recommended Practice for Not-for-Profit Organizations and NGOs September 14 o How to Use this SL SoRP o Donations/Contributions, Grants o Donor Agreements (Requirements for Audited Financial Statements, a Variance Report, and Narrative Progress Report) o Restricted Funds o Unrestricted Funds

The Syllabus Module 4: Financial Reporting Mechanism Conceptual Framework for Financial Reporting in terms of Sri Lanka Statement of Recommended Practice for Not-for-Profit Organizations and NGOs o Accumulated Fund o Users and their Information Needs o Qualitative Characteristics of Financial Statements (Understandability, Relevance, Reliability and Comparability). o True and Fair View o Underlying Assumptions includes Going Concern; Accrual Basis o Illustrative Financial Statements Structure for NPOs [including NGOs] based on SLFRSs o Application of Sri Lanka Accounting Standards for NPOs

The Syllabus Module 4: Financial Reporting Mechanism Financial Reporting Requirements in terms of SLFRS Framework September 15 o Sample Nonprofit Financial Statements o Sample Nonprofit Significant Accounting Policies NPO Specific Provisions and Significant Accounting Policies Recommended for Not-for-Profit Organizations September 16 o NPO Specific Provision

The Syllabus Module 4: Financial Reporting Mechanism Analyze a Non Profit Financial Statement as to Evaluate Financial Conditions for a NPO September 17 o Nonprofit Financial Analysis Worksheet o Nonprofit Financial Ratio Analysis

The Syllabus Module 5: Procurement Procedure Overview and The Framework of Standard Procurement Process For CSOs & Procurement Preparatory Activities and Procurement Planning - September 21 o The Stages in the Procurement Process Including Procurement Process Flow Chart o Flow Chart of Standard Procurement Procedures o Proposed Procurement Procedure for CSO The Scope o Procurement Committees and their Functions o Procurement Preparatory Activities and Procurement Planning including Master Procurement Plan (MPP), Annual Procurement Plan (APP), Procurement Packaging and Slicing, Detailed Procurement Plan (DPP), Monitoring of Procurement Plan

The Syllabus Module 5: Procurement Procedure Commonly used procurement methods and financial delegation under direct procurement & Preparation of biding documents and bidding procedure - September 22 o Commonly used procurement methods o International Competitive Bidding (ICB) o Limited International Bidding (LIB) o National Competitive Bidding (NCB) o Limited National Bidding (LNB)

The Syllabus Module 5: Procurement Procedure Commonly used procurement methods and financial delegation under direct procurement & Preparation of biding documents and bidding procedure o Shopping o National Shopping (NS) o International Shopping (IS) o Registration of Suppliers/Contractors o Use of Rainbow Pages o Force Account

The Syllabus Module 5: Procurement Procedure Commonly used procurement methods and financial delegation under direct procurement & Preparation of biding documents and bidding procedure o Direct Contracting o Repeat Orders o Direct Contracting to Community Based Organizations o Emergency Procurement o Two stage Bidding Process o Two Envelop System o Pre-qualification

The Syllabus Module 5: Procurement Procedure Commonly used procurement methods and financial delegation under direct procurement & Preparation of biding documents and bidding procedure o Financial Threshold Limits for Different PCC and Financial Authority under Direct Procurement o Invitation, Closing and Opening of Bids o Bid Evaluation o Award of Contract

The Syllabus Module 5: Procurement Procedure Special Procurements o Procurement of Commodities o Procurement of Spare Parts o Repairs and Maintenance o Repairs to Motor Vehicles and Equipment o Purchasing of Fuel o Information Systems o E-Procurement

The Syllabus Module 5: Procurement Procedure Contract Administration o Contract Administration Plan (CAP) o Performance Assessment Plan (PAP) o Surveillance Techniques o Monitoring Methods

The Syllabus Module 5: Procurement Procedure Stores (Inventory) Management o Stores (Inventory) Records o Handing over and Taking Over of Stores o Stock Controls o Stores Verification o Actions to be taken for the Disposable Items o Order of Write-Off and Surcharges on losses

The Syllabus Module 5: Procurement Procedure Selection and Recruitment of Individual Consultants and Firms - September 24 o Type of Consulting Services o Appointment of Consultant Procurement Committees o Selection Methods and the Selection Process

The Syllabus Consultant Selection Process Evaluation of technical proposals o Preparation of TOR o Public opening of financial proposal of the Consultancy o Preparation of Cost estimate and the budget o Publication of EOI Determine the organizations which have achieved the minimum score specified in the RFP o o Preparation of Long List o Evaluation of financial proposals of such organizations o Preparation of the Short List o Final evaluation of quality and cost o Preparation of RFP o Negotiations and award of the contract to the selected Consultancy organization o Issuance of RFP to short listed Consultants o Receipt of technical and f financial proposals o Award of Contract o

The Syllabus Consultant Selection Methods Individual Consultants Consultancy Organizations: Individual Consultants Single Source (ICS) Quality and Cost Based Selection (QCBS); o o Individual Consultants Competitive (ICC) Quality Based Selection (QBS); o o Selection under a Fixed Budget (FBS); o Least Cost Selection (LCS); o Selection Based on Consultant s Qualifications (CQS); o Single Source Selection (SSS); and o Selection of particular types of Consultant o

The Syllabus Module 6: Finance Manager s Roles and Responsibilities September 27, 2021 The Finance Manager is responsible for managing the financial activities, ensuring legal and regulatory compliance of the financial functions Sample JD template with area of key responsibilities, key qualification, knowledge and skills, attitudes with all other information. Get the information for following questions to develop a sampled JD for Finance Manager position of CSO Developing a Position Description for Finance Manager of CSO

The Syllabus Module 7: HR Management Business Code Practice, Compliance and Data Security (October4) o Human Resource Management Overview Business Code Practice & Compliance o Organizational chart clearly delineating basic job roles o Conflict of interest, organizational communication like open door policy, rumors and blackmailers, issuing employee details, service letters and salary particulars, access to personnel files, mass media communication, communication channels, confidential information, o Dress code, attendance and punctuality, use of organizational property

The Syllabus Module 7: HR Management Data security or Privacy policy o Protection of confidential information and trade secrets o Code of conduct and organizational ethics Employment Practices o Human rights and equal opportunities, prohibition of harassment, prohibition of forced or child labor, o Provision of occupational health and safety environment, o Disclosure of employee personal information o General formalities like pre-employment formalities and commencement of employment and induction

The Syllabus Module 7: HR Management Recruitment, Selection and Induction (October 5) Recruitment and Selection o Overview, policy framework and procedures on recruitment o Manpower planning, recruitment planning, vacancy awareness and advertising, o Candidate screening, interview and assessment process, recruitment finalization, o Post recruitment process, and recruitment of project staff.

The Syllabus Module 7: HR Management Recruitment, Selection and Induction Induction and Integration Program o Pre induction, induction and post induction phases of new recruits o New leader assimilation program guideline o Induction program content and checklists

The Syllabus Module 7: HR Management General Terms and Conditions of Employment (October 6) Working hours and attendance: time attendance and attendance recording systems Leave entitlement: various leave provision include annual/ vacation leave, casual leave, medical leave, maternity leave General provision for: duty leave, short leave, half day leave, unauthorized leave, lieu leave, day- off, leave to attend courts, leave to vote at elections, duty leave for official purpose, duty leave to attend training, leave without pay, and special leave for communicable/ infectious diseases and absence from work due to accidents while on duty

The Syllabus Module 7: HR Management General Terms and Conditions of Employment Procedure for application of leave and employee responsibility of using the privilege of leave Declaration of weekly holidays, procedure to engage for work outside the normal working hours engage in overtime Procedure for assessment and confirmation of employees who are under period of probation.

The Syllabus Module 7: HR Management Rewards and Recognition (October 7) Remuneration structure include base salary and other allowances, pay increase, overtime rates etc. Payment of salaries and overtime, pay administration and pay records including EPF/ETF Other fringe benefits like bonus, attendance incentives, leave encashment, salary advance, festival advance, and medical benefits etc. Employee well-being practices like annual trip, family gathering events HR practices on non remuneration recognition like commendation, appreciation, staff retreat etc.

The Syllabus Module 7: HR Management Performance Review, Training & Learning Practices (October 11) Performance Planning, Monitoring and Review Performance management system includes formal process of planning, monitoring and reviewing o Performance appraisal and review mechanism: setting performance standards and targets under pre- defined performance criteria (KRAs /KPIs), conduct formal bi-annual review and annual appraisal o Appraisal process: conducting appraisal interviews one to one, one to may or 360 degree feedback analysis o Framework of competency: competency mapping, competency analysis competency feedback assessment, potential assessment for feeder job position o Behavioral, trait and result-oriented performance appraisals o

The Syllabus Module 7: HR Management Performance Review, Training & Learning Practices Training, Development and Learning Practices o Training Planning: Training Need Analysis (TNA): capturing individual training needs as well as departmental or functional training needs that requires addressing competency gaps o Preparation of annual training plan, training calendar and the training budget, o Organizing and conducting training programs: Training program planning, preparation of a session plan, selecting appropriate training methodology, build internal and external resource fleet, coordinating and administering a training program and conduct training evaluation o Training for the skills needed for future development professional skills and leadership development etc. o Various sources of learning: departmental meeting, performance review discussion, internet etc.

The Syllabus Module 7: HR Management Superannuation and Severance (October 12) Severances practices o Retirement o Volunteer resignation Superannuation: providing terminal benefits within the legal provision o Vacation of employment o Employees Provident Fund o Medical condemnation o Employees Trust Fund o Dismissal on disciplinary grounds o Payment Of Gratuity Or Pension o Expiration of the contract period o Redundancy of the service contract o Conduct exist interviews o Terminal dues and benefits and clearance on severance