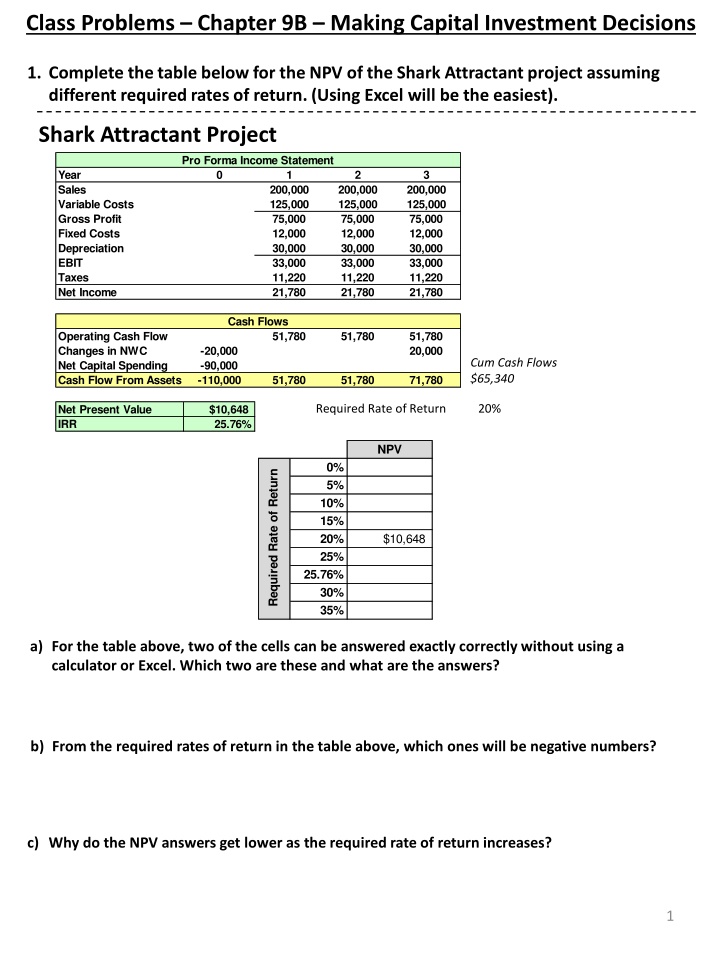

Capital Investment Analysis for Shark Attractant Project

This analysis involves evaluating the NPV of the Shark Attractant project at different required rates of return, determining project cash flows, assessing investor returns, and understanding the impact of varying required rates of return on project feasibility and value.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Class Problems Chapter 9B Making Capital Investment Decisions 1. Complete the table below for the NPV of the Shark Attractant project assuming different required rates of return. (Using Excel will be the easiest). Shark Attractant Project Pro Forma Income Statement Year Sales Variable Costs Gross Profit Fixed Costs Depreciation EBIT Taxes Net Income 0 1 2 3 200,000 125,000 75,000 12,000 30,000 33,000 11,220 21,780 200,000 125,000 75,000 12,000 30,000 33,000 11,220 21,780 200,000 125,000 75,000 12,000 30,000 33,000 11,220 21,780 Cash Flows Operating Cash Flow Changes in NWC Net Capital Spending Cash Flow From Assets 51,780 51,780 51,780 20,000 -20,000 -90,000 -110,000 Cum Cash Flows $65,340 51,780 51,780 71,780 Required Rate of Return Required Rate of Return 20% Net Present Value IRR $10,648 25.76% NPV 0% 5% 10% 15% 20% 25% Required Rate of Return $10,648 25.76% 30% 35% a) For the table above, two of the cells can be answered exactly correctly without using a calculator or Excel. Which two are these and what are the answers? b) From the required rates of return in the table above, which ones will be negative numbers? c) Why do the NPV answers get lower as the required rate of return increases? 1

2. Answer the questions below using the following data: Shark Attractant Project Pro Forma Income Statement Year Sales Variable Costs Gross Profit Fixed Costs Depreciation EBIT Taxes Net Income 0 1 2 3 200,000 125,000 75,000 12,000 30,000 33,000 11,220 21,780 200,000 125,000 75,000 12,000 30,000 33,000 11,220 21,780 200,000 125,000 75,000 12,000 30,000 33,000 11,220 21,780 Cash Flows Operating Cash Flow Changes in NWC Net Capital Spending Cash Flow From Assets 51,780 51,780 51,780 20,000 -20,000 -90,000 -110,000 Cum Cash Flows $65,340 51,780 51,780 71,780 Required Rate of Return 20% Net Present Value IRR $10,648 25.76% a) Assume an investor offers to loan Underwater Adventures, Inc. the $110,000 needed to fund this Shark Attractant project and the investor requires a 25.76% return. Does this project generate sufficient cash to pay this return? Is any cash left over after paying the investor? Prove out your answer by showing a roll forward of the cash flows by year (including paying the investor each year). Year 1 Year 2 Year 3 Beginning Cash Balance Required Return to Investor Cash Flow from the Investment Ending Cash Balance b) Assume the investor above requires a 20% return. Does this project generate sufficient cash to pay this return? Is any cash left over after paying the investor? Prove our your answer by showing a roll forward of the cash flows by year (including paying the investor each year). Year 1 Year 2 Year 3 Beginning Cash Balance Required Return to Investor Cash Flow from the Investment Ending Cash Balance c) This says the investor received $18,399 of value in addition to their 20% return. But the NPV calculation says the investor receives $10,648 of value. How do you explain this disparity? 2

Class Problems Chapter 9C Making Capital Investment Decisions 1. Tomorrowland, Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $1,950,000. The fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $2,145,000 in annual sales, with annual costs of $1,205,000. If the tax rate is 35%, what is the OCF for this project? 2. In the previous problem, suppose the required return of the project is 14%. What is the project s NPV? 3

3. In the previous problem, suppose the project requires an initial investment in net working capital of $150,000, and the fixed asset will have a market value of $175,000 at the end of the project. What is the projects Year 0 net cash flow? Year 1? Year 2? Year 3? What is the new NPV? 4

4. Consider an asset that costs $545,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $95,000. If the relevant tax rate is 35%, what is the after-tax cash flow from the sale of this asset? 5. An asset used in a four-year project has an acquisition cost of $7,100,000 and will be sold for $1,460,000 at the end of the project. The asset will be depreciated 82.72% over the four-year project period based on the accelerated depreciation tables. If the tax rate is 34%, what is the after-tax salvage value of the asset? 5

6. Rolston Music Company is considering the sale of a new sound board used in recording studios. The new board will sell for $27,300, and the company expects to sell 1,500 per year. The company currently sells $1,850 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,520 units. The old board retails for $24,900. Variable costs are 55% of sales, depreciation on the equipment to produce the new board will be $2,150,000 per year, and fixed costs are $3,200,000 per year. If the tax rate is 38%, what is the annual OCF for the project? 6

7. Kenny, Inc. is looking at setting up a new manufacturing plant in South Park. The company bought some land six years ago for $5.3 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent facilities elsewhere. The land would net $7.4 million if it were sold today. The company now wants to build its new manufacturing plant on this land; the plant will cost $26.5 million to build and the site requires $1.32 million worth of grading before it is suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project? Why? 8. Winnebagel Corp currently sells 28,000 motor homes per year at $77,000 each and 7,000 luxury motor coaches per year at $120,000 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 29,000 of these campers per year at $23,500 each. An independent consultant has determined that if the company introduces the new campers, it should boost the sales of its existing motor homes by 2,500 units per year and reduce the sales of its motor coaches by 750 units per year. What is the amount to use as the annual sales figure when evaluating this project? Why? 7

Class Problems Chapter 9D Making Capital Investment Decisions 1. Automatic Transmissions, Inc. has the following estimates for its new gear assembly project: price = $960 per unit; variable cost = $350 per unit; fixed costs = $3.6 million; quantity = 55,000 units. Suppose the company believes all of its estimates are accurate only to within +/- 15%. What values should the company use for the four variables given here when it performs its best case and worst case scenario analysis? Scenario Base Case Best Case Worst Case Unit Sales Unit Price Unit Variable Cost Fixed Costs Consider a three-year project with the following information: initial fixed asset investment = $645,000; straight-line depreciation to zero over the five-year life; zero salvage value; price = $38.70; variable costs = $29.65; fixed costs = $315,000; quantity sold = $90,000 units; tax rate = 34%. How sensitive is OCF to changes in quantity sold? 2. 8

3. You are considering a new product launch. The project will cost $780,000, have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 180 units per year; price per unit will be $16,300, variable cost per unit will be $11,100, and fixed costs will be $535,000 per year. The required return on the project is 11%, and the relevant tax rate is 35%. a) Management believes the unit sales, variable cost, and fixed cost projections given here are probably accurate to within +/- 10%. What are the best and worst cases for these projections? What is the NPV for base case, best case and worse case? Scenario Unit Sales Unit Variable Cost Fixed Costs Base Case Best Case Worst Case Base Case - OCF Base Case - NPV 9

Best Case - OCF OCFBest = (Sales Costs) x (1 Tax rate) + (Deprecation x Tax rate) = [($16,300 - $9,990) x 198 - $481,500] x .65 + ($780,000/4) x .35 = $499,122 + $68,250 = $567,372 Best Case - NPV Year 0 Year 1 Year 2 Year 3 Year 4 ($780,000.00) $567,372.00 $567,372.00 $567,372.00 $567,372.00 Present Value of Annuity Factor (t = 4, r = 11%) = 3.10245 $1,760,243.26 $980,243.26 Worst Case - OCF Worst Case - NPV 10

b) Evaluate the sensitivity of your base-case NPV to changes in fixed costs. OCF at New Fixed Cost Arbitrarily change Fixed Costs to $545,000 from $535,000 OCF= (Sales Costs) x (1 Tax rate) + (Deprecation x Tax rate) = [($16,300 - $11,100) x 180 - $545,000] x .65 + ($780,000/4) x .35 = $254,150 + $68,250 = $322,400 NPV at New Fixed Cost Year 0 Year 1 Year 2 Year 3 Year 4 ($780,000.00) $322,400.00 $322,400.00 $322,400.00 $322,400.00 Present Value of Annuity Factor (t = 4, r = 11%) = 3.10245 $1,000,229.88 $220,229.88 Sensitivity Evaluation NPV ($240,395.81 $220,229.88) ($535,000 - $545,000) = Fixed Costs $20,165.93 -$10,000 = = -$2.02 For every dollar of Fixed Cost increase, NPV decreases by $2.02 11

4. We are evaluating a project that costs $1,720,000, has a six-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 91,000 units per year. Price per unit is $37.95, variable cost per unit is $23.20, and fixed costs are $815,000 per year. The tax rate is 35%, and we require a return of 11% on this project. a) Calculate the base case cash flow and NPV. What is the sensitivity of NPV to changes in the sales figure? Explain what your answer tells you about a 500-unit decrease in projected sales. OCF for Base Case NPV for Base Case OCF for New Sales Arbitrarily pick sales of 92,000 units NPV for New Sales Sensitivity to Sales 12

b) What is the sensitivity to OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs. OCF at New Variable Cost Arbitrarily choose Variable Cost of $20 OCFNew = (Sales Costs) x (1 Tax rate) + (Deprecation x Tax rate) = [($37.95 - $20.00) x 91,000 - $815,000] x .65 + ($1,720,000/6) x .35 = $531,992.50 + $100,333.33 = $632,325.83 Sensitivity Evaluation OCF ($443,045.83 $632,325.83) ($23.20 $20.00) = Variable Costs = -$59,150 If variable costs decrease by $1, then OCF would increase by $59,150. Shortcut: Lowering variable costs by $1 on 91,000 units, saves $91,000 in pre-tax dollars. Deducting the taxes of 35% from this, results in $59,150 ($91,000 x .65) of increased net income and OCF. OCF = (91,000 units x $1 per unit) x .65 (-1) Variable Costs = - $59,150 If variable costs decrease by $1, then OCF would increase by $59,150. 13

c) Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within +/- 10%. Calculate the best case and worst case NPV figures. Scenario Base Case Best Case Worst Case Price $37.95 $41.75 $34.16 Quantity 91,000 100,100 81,900 Variable Cost $23.20 $20.88 $25.52 Fixed Costs $815,000 $733,500 $896,500 Best Case - OCF Best Case - NPV Worst Case - OCF OCFWorst = [($34.16 - $25.52) x 81,900 - $896,500] x .65 + ($1,720,000/6) x .35 = - $122,774.60 + $100,333.33 = -$22,441.27 Worst Case - NPV Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 ($1,720,000.00) ($22,441.27) ($22,441.27) ($22,441.27) ($22,441.27) ($22,441.27) ($22,441.27) Present Value of Annuity Factor (t = 6, r = 11%) = 4.23054 ($94,938.69) ($1,814,938.69) 14