Cash Flow Forecasting

Cash flow forecasting is crucial for businesses to anticipate financial risks, secure external finance, and make informed decisions. It involves calculating closing balances, net cash flow, and addressing common problems like sales discrepancies and underestimated costs to ensure effective cash flow management.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

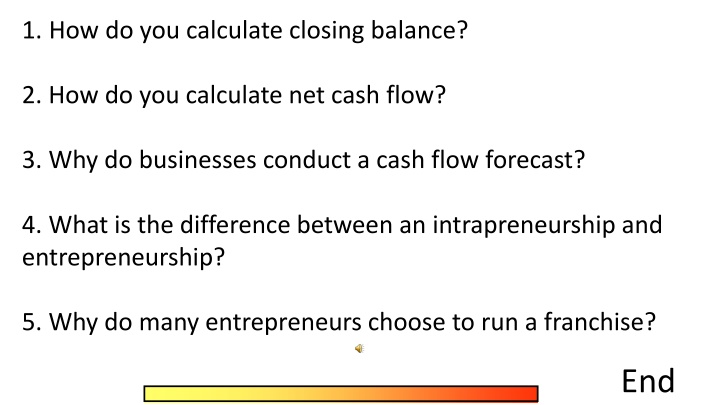

1. How do you calculate closing balance? 2. How do you calculate net cash flow? 3. Why do businesses conduct a cash flow forecast? 4. What is the difference between an intrapreneurship and entrepreneurship? 5. Why do many entrepreneurs choose to run a franchise? End

1. How do you calculate closing balance? Net cashflow + Opening balance 2. How do you calculate net cash flow? Inflows - outflows 3. Why do businesses conduct a cash flow forecast? Obtain external finance as it is a key part of the business plan. It helps identify months of financial risk which in term can help plan which method or methods of finance are needed. 4. What is the difference between an intrapreneurship and entrepreneurship? 5. Why do many entrepreneurs choose to run a franchise?

What problems do you think businesses could face in trying to predict their cash flow?

Common Problems with Cash Flow Forecasts Sales prove lower than expected Easy to be over-optimistic about sales potential Market research may have gaps Customers do not pay up on time A notorious problem for businesses, particularly small ones Costs prove higher than expected Perhaps because purchase prices turn out higher Maybe also because the business is inefficient Underestimated cost assumptions A common problem for a start-up Unexpected costs always arise often significant

The Key to Effective Cash Flow Forecasting The key to cash flow management is having good information A good cash flow forecast: Is updated regularly Makes sensible assumptions Allows for unexpected changes

BIG Text book question Question 2 Question 2 a,b,c a,b,c page 165 Frank Fullerton page 165 Frank Fullerton Case study page 168 Case study page 168 a,b,c Charlton Plastics LTD Charlton Plastics LTD a,b,c (do not attempt d) (do not attempt d)