Causes of the Great Depression in the 1920s and 1930s Revealed

Explore the true reasons behind the Great Depression in America, from stock market crashes to financial collapses, and understand the economic complexities that led to this historic event. Uncover the misconceptions of the past and the updated knowledge we have today, shedding light on international trade failures, banking systems, and the impact of financial multipliers. Gain insights into how speculation, weak regulations, and the collapse of financial markets contributed to this economic downturn.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Cause of the Great Depression America in the 1920s and 1930s The LBJ Presidential Library Humanities Texas June 13, 2018 Michael W. Brandl, PhD The Ohio State University, Department of Economics

Overview The Economics Causes of the Crash of 1929 and the Great Depression. What we used to think. What we know now. Q&A 2 2

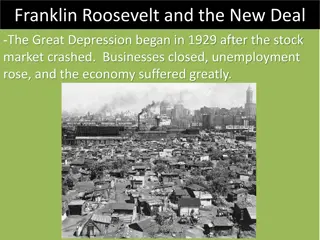

What we used to think Stock market crash caused banks to fail was the cause of the Depression. Commercial banks lent money to stock market speculators. Speculation & attempts to corner the market push prices up. When stock market crashed speculators could not repay loans to banks and thus banks lost depositors money. Depositors attempted to withdraw funds as panic ensues only to find banks don t have funds. Roulette wheels in bank lobby analogy. There is some truth to this, but reality is more complicated. Just like life 3 3

What we know today Speculation was part of an asset bubble The irrational increase in the market price of an asset. Greater fool theory Easy access to credit Weak or no regulation Long history of these, very difficult to predict But when they pop increases in liquidity are needed Confidence needs to be restored. Poor risk analysis of bankers was NOT limited to Wall Street. Many banks in small towns and rural areas also failed. Bad agricultural loans Crony capitalism 4 4

More what we know today Collapse of international trade Both US and Europe follow Mercantilist policies. Idea: exports > imports will lead to prosperity. Fact: they work in short run, but are a disaster in long run. The failure of the Federal Reserve Established in 1913 to be the lender of last resort during financial panics response to Panic of 1907. Death of Benjamin Strong in Oct. 1928 Fed follows the dogma of Real Bills doctrine Main idea: just because we have institutions in place, does not mean they will function properly. 5 5

More of what we know today The financial multiplier. Collapses in financial markets can and do have larger and longer lasting impacts than other causes of economic downturns. Financial collapse worse than natural disasters or even political disruptions. Deflationary death spirals. Negative expectations can be self fulfilling prophesies. In many ways FDR s Fear itself was economically accurate. But controlling fear without institutional changes will not be enough. 6 6

Q&A Ask questions about anything Feel free to contact me: michael.brandl@rice.edu michael.brandl @michaelbrandl 7 7 7