CBCR and BEPS Implementation in India: Reporting Requirements and Penalties

Explore the three-tiered standardized approach to transfer pricing documentation for multinational corporations with turnovers exceeding 750 million. Learn about CBCR reporting, Master File, and Local File requirements, as well as the implications for Indian MNCs and subsidiaries under the Finance Bill 2016. Discover the significance of CBCR in evaluating BEPS-related risks and the penalties for non-compliance in India.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

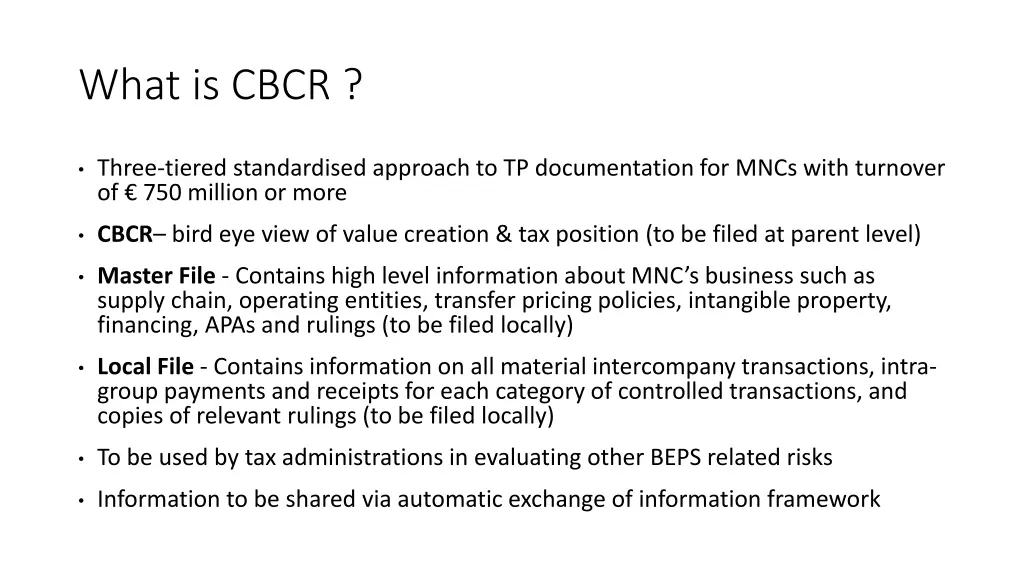

What is CBCR ? Three-tiered standardised approach to TP documentation for MNCs with turnover of 750 million or more CBCR bird eye view of value creation & tax position (to be filed at parent level) Master File - Contains high level information about MNC s business such as supply chain, operating entities, transfer pricing policies, intangible property, financing, APAs and rulings (to be filed locally) Local File - Contains information on all material intercompany transactions, intra- group payments and receipts for each category of controlled transactions, and copies of relevant rulings (to be filed locally) To be used by tax administrations in evaluating other BEPS related risks Information to be shared via automatic exchange of information framework

CBCR Template Revenues Tangible assets other than cash and cash equi- valents Profit (loss) before income tax Cash Tax Paid CIT and WHT Current year tax accrual Tax juris- diction Stated capita l Accumul ated earnings No of employee s Unrelate d party Related party Total 2

CbC reporting template Tax Main business activity(ies) Constitu ent entities resident in the tax jurisdi- ction jurisdiction of organization or incorporatio n if different from tax jurisdiction of residence Provision of services to unrelated Admin., Mgmt or support services Holding shares or other equity Regulated financial services Purchasing or procurement Sales, marketing or distri. Holding or managing IP Internal group finance Mfg or production Tax jurisdi- ction instruments Insurance Dormant parties Other R & D 1. 2. 3.

India and BEPS Finance Bill 2016 proposes Sec 286 which seeks to provide CBCR and Master File reporting Applicable from FY 2016-17 Indian MNCs (satisfying revenue threshold) Indian subsidiaries (being constituent entities) Detailed rules to be notified Penalty Rs 5000 to Rs 50,000 per day for non-furnishing of CBCR or required information Rs 500,000 for finishing inaccurate particulars or non-furnishing of master file data