CBN's Hawkish Monetary Policy Decisions to Combat Inflation

The Central Bank of Nigeria implements a series of rate hikes, reserve ratio increases, and monetary policy adjustments to address rising inflation, projecting a need for continued interest rate increases to combat economic challenges.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

GRAND TOWER BI-WEEKLY MARKET WATCH Temilola Adeyemi, ACS, Ph.D Investment Specialist, Grand Towers

Monetary Policy Decisions Nigeria s monetary authority hikes rate by 50bps to 27.25% The Central Bank of Nigeria (CBN) has once again raised its key interest rate by 50 basis points to 27.25%, bringing the total increase for the year to 850 basis points. This decision was made by the Monetary Policy Committee (MPC) in an effort to combat stickycore inflation, which reached 27.60% in August, 2024. In addition to the rate hike, the CBN also: Retained the asymmetric corridor around the MPR at+500bps/-100bps. Raised the Cash Reserve Ratio (CRR) for deposit money banks by 500bpsto 50.0%. Raised the CRR for merchant banks by 200bpsto 16.00%. Retained the liquidity ratio at30.00%. While headline inflation has declined from its peak of 34.19% in July, the CBN's hawkish stance reflects its ongoing concern about rising core inflation, especially in light of the recent 47% increase in petrol prices. The Central Bank of Nigeria (CBN) Governor stressed the necessity for continued interest rate increases due to the current negative real interest rate environment, where inflation outpaces monetary policy rates. Despite the recent hike in the MPR to 27.25% and the decline in headline inflation to 32.15%, a substantial gap persists. We anticipate this gap to widen further, given the recent 47% increase in petrol prices. Grand Towers Market Digest Sept, 2024 2

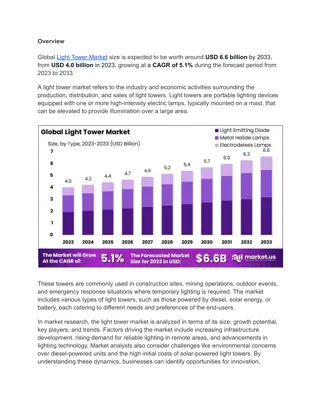

Sticky Inflation fuels CBN Rate Hawkish Action Inflation Numbers and MPR 45 40 37.52% 35 32.15% 30 27.58% 25 27.25% 20 15 10 5 0 Aug Sept Oct Nov Dec Jan Feb Mar Apr May June July August Sept Core Food Headline MPR Source: CBN, Grand Towers Market Insight, Sept 2024 The CBN signaled a need to curb inflation by tightening monetary policy through increased Cash Reserve Ratios (CRRs) for both deposit money banks and commercial banks. In response, the CBN has raised the CRR for deposit money banks by 500 basis points and for merchant banks by 200 basis points. This move will likely reduce the lending capacity of banks, leading to higher borrowing costs for businesses in the real sector. Consequently, this could further burden businesses and hinder economic growth. Grand Towers Market Digest Sept, 2024 3

CBN Aim to Reduce Money Supply Through the CRR The recent increase in the Monetary Policy Rate (MPR) may have a limited impact on the fixed income market due to the Debt Management Office (DMO)'s reduced borrowing appetite, particularly in the treasury bill market. This has resulted in a decline in stop rates from 21.89% in August September. The Monetary Policy Committee (MPC) is closely monitoring the impact of the interest rate hike on inflation and is expected to make further decisions at its upcoming meeting on November 25th and 26th. Based on our inflation projections, the MPC may continue to raise rates to achieve its price stability objective. CBN Aim to Reduce Money Supply 120.00 107 100.00 107.18 80.00 60.00 34.95 40.00 to 18.59% in 20.00 .00 Jan August Aug Feb Sept Dec May June Nov Mar Apr Oct July 2023 2023 2023 2023 2023 2024 2024 2024 2024 2024 2024 2024 2024 Narrow Money Money Supply (M2) Money Supply (M3) Source: CBN, Grand Towers Market Insight, Sept 2024 Grand Towers Market Digest Sept, 2024 4

What is Happening in the Banking Sector? Metrics FBN GTB Access Zenith UBA The Central Bank of Nigeria (CBN) launched the Banking Sector Recapitalization Programme 2024 on March 28, 2024, aiming to stimulate significant growth in the industry over the next two years. The CBN increased the minimum capital requirements for commercial, merchant, and non- interest banks in Nigeria. Commercial banks are now required to have a minimum capital of N50 billion (regional), N200 billion (national), or N500 billion (international). Against this backdrop, banks have been raising funds through various methods, including rights issues, public offers, and bonus issues. It is important to review their performance in light of these capital-raising activities. Total Assets(NB) 23,425.53 14,510.97 36,596.70 27,575.81 28,337.53 Total Equity(NB) 2,213.50 2,399.63 2,837.43 3,193.96 2,985.15 Gross Earnings (NB) 514.93 1,392.55 2,195.74 2,101.37 1,003.55 PAT (NB) 360.27 905.57 281.33 577.99 316.30 EPS (N) 10.11 32.12 7.61 18.41 8.90 Interim DPS (N) 0.40 (final) 1.00 0.45 1.00 2.00 Market Price (N) 28.14 47.50 19.00 37 22.95 ROE 16.27% 37.74% 9.91% 18.09% 12.57% ROA 1.53% 6.24% 0.77% 2.096% 1.11% Earnings Yield 35.92% 67.62% 40.05% 49.75% 38.77 P/E Ratio 2.78 1.48 2.50 2.00 2.58 Source: Bank s Financials Q2 Reports, Grand Towers Market Insight, Sept 2024 Grand Towers Market Digest Sept, 2024 5

Comparable Analysis of FUGAZ 1. Total Assets: Access Bank leads with 36,596.70 billion in total assets, indicating its large asset base and potential to generate revenue. Zenith Bank follows closely with 27,575.81 billion, and UBA is third at 28,337.53 billion. FBN ( 23,425.53 billion) and GTB ( 14,510.97 billion) have smaller asset bases but still substantial enough to indicate strong operations. 2. Total Equity: Zenith Bank holds the highest equity at 3,193.96 billion, a good sign of strong shareholder value and financial stability. Access Bank and UBA also show high equity levels, with 2,837.43 billion and 2,985.15 billion, respectively. FBN lags slightly behind at 2,213.50 billion, while GTB has 2,399.63 billion. Recommendation: Zenith Bank is attractive for equity-focused investors, indicating strong capitalization and possibly higher financial resilience. 3. Gross Earnings Access Bank and Zenith Bankleads with 2,195.74 billion and 2,101.37 billion in gross earnings, respectively indicating their ability to generate revenue efficiently, while GTB follows with 1,392.55 also reporting strong earnings. UBA and FBNlag behind at 1,003.55 billion and 514.93 billion. However strong earning does not usually lead to strong profitability. Grand Towers Market Digest Sept, 2024 6

Comparable Analysis of FUGAZ 4. Profit After Tax (PAT) GTB stands out with the highest PAT of 905.57 billion, followed by Zenith Bank at 577.99 billion. UBA ( 316.30 billion) and FBN ( 360.27 billion) have moderate profitability compared to these leaders. Recommendation: GTB is the best performer in terms of profitability, a key factor for income-focused investors. 5. Earnings Per Share (EPS) GTB reports the highest EPS at 32.12, showing high profitability per share, which is very appealing to investors. Zenith Bank also shows strong EPS at 18.41, with FBN at 10.11.Access Bank and UBA have lower EPS values of 7.61 and 8.90. Recommendation: GTB is highly attractive based on EPS, offering better returns for shareholders. 6. Dividend Per Share (DPS) UBA offers the highest dividend per share (DPS) at 2.00, making it appealing for dividend-focused investors. GTB and Zenith Bank also offer decent dividends at 1.00 each. FBN and Access Bank lag behind with 0.40 and 0.45, respectively. Recommendation: UBA is the best choice for dividend income investors, however UBA declared N0.50k in 2023. One need to consider the sustainability of this new position. Grand Towers Market Digest Sept, 2024 7

Comparable Analysis of FUGAZ 7. Return on Equity (ROE) GTB outshines others with a high ROE of 37.74%, showing strong profitability relative to equity. Zenith Bank also has a strong ROE at 18.09%, while FBN reports 16.27%. UBA (12.57%) and Access Bank (9.91%) have comparatively lower ROE. Recommendation: GTB is clearly the best performer based on ROE, followed by Zenith Bank for investors seeking efficient use of equity. 8. Return on Assets (ROA) GTB also leads in ROA at 6.24%, a sign of high profitability relative to its asset base. Zenith Bank and FBN have moderate ROA at 2.096% and 1.53%, respectively. UBA (1.11%) and Access Bank (0.77%) report lower ROAs. Recommendation: GTB stands out with the highest ROA, followed by Zenith Bank. 9. Earnings Yield GTB has the highest earnings yield at 67.62%, suggesting it is generating high returns relative to its stock price. Access Bank and Zenith Bank also show strong earnings yields at 40.05% and 49.75%, respectively. Recommendation: GTB and Zenith Bank are attractive for value investors focusing on earnings yield. Grand Towers Market Digest Sept, 2024 8

Comparable Analysis of FUGAZ 10. Price-to-Earnings (P/E) Ratio GTB has the lowest P/E ratio of 1.48, indicating it is trading at a lower price relative to its earnings, a potential value buy. Zenith Bank and Access Bank have P/E ratios of 2.00 and 2.50, respectively, while UBA and FBN have slightly higher P/E ratios of 2.58 and 2.78. Recommendation: GTB is the most attractive option based on P/E ratio for investors seeking undervalued opportunities. Final Recommendation: GTB stands out as the top choice for investors, with strong metrics across profitability (EPS, PAT), efficiency (ROE, ROA), market price, and valuation (P/E ratio). Zenith Bank is another strong contender, particularly in terms of total equity, gross earnings, and solid ROE and ROA. UBA may appeal to dividend-focused investors given its high DPS. Access Bank and FBN offer lower stock prices and potential for long-term growth but lag in some profitability metrics. Grand Towers Market Digest Sept, 2024 9

A Closer Look into Access Corporation It s clear that while the bank has shown growth in its financial metrics over the past two quarters, its performance relative to other banks in the sector warrant further analysis. Access 2024 Q2 2023 Q2 2022 Q2 Total Assets(NB) 36,596.70 20,853.27 13,199.92 Total Equity(NB) 2,837.43 1,731.48 1,072.66 Return on Equity (ROE): While Access Bank's ROE has increased from 7.82% in 2023 Q2 to 9.91% in 2024 Q2, it's essential to note that this is low when compared to industry average as depicted in the previous table. This is an indication that Access Bank is less efficient in utilizing shareholder funds. Return on Assets (ROA): Similar to ROE, Access Bank's ROA has improved, but a comparison with industry shows that assets are not well utilized. A lower ROA suggest that the bank is less effective in generating profits from its assets. Earnings Yield: The earnings yield has dropped from 45% in 2022 to 42.22% in 2024, which indicate investors are not receiving good return on their investment, especially when compared to peers. Price-to-Earnings (P/E) Ratio: The P/E ratio of 2.36 when compared to GTB of 1.48 and Zenith of 2.00 suggests that Access Bank's shares is moderately valued and may not be attractive to new investors. This could be a concern about the bank's future growth prospects. Gross Earnings (NB) PAT (NB) 2,195.74 940.31 591.80 281.33 135.41 88.73 EPS (N) 7.61 3.74 2.52 Interim DPS (N) 0.45 0.30 0.20 Market Price (N) 19.00 17.00 9.00 ROE 9.91% 7.82% 8.27% ROA 0.77% 0.64% 0.67% Earnings Yield 42.22% 56.67% 45% P/E Ratio 2.36 1.79 2.22 Source: Bank s Financials, Grand Towers Market Insight, Sept 2024 Grand Towers Market Digest Sept, 2024 5

Nigerian Equity Market: NGX Continues Its Trend Into Bullish Territory Top Gainers Top Losers Price WoW Change 59.74% Price WoW Change -27.37% ELLAH LAKES PLC 4.92 CAVERTON OFFSHORE GRP PLC MULTIVERSE MINING AND EXPLORATION PLC OKOMU OIL PALM PLC 2.68 REGENCY ASSURANCE PLC 0.69 53.33% 9.00 -19.64% FLOUR MILLS NIG. PLC. 62.00 22.89% 363.00 -13.10% STERLING FINANCIAL HOLDINGS COMPANY PLC WEMA BANK PLC. 4.90 22.19% SECURE ELECTRONIC TECHNOLOGY PLC LEARN AFRICA PLC 0.60 -10.45% 8.00 17.65% 3.25 -10.22% The Nigerian equities market extended its bullish streak this week, with the NGXASI gaining 0.21% to close at 98,458.68 points. This positive performance pushed the year-to-date(YTD) return to 31.68%. Driving this upward trend was strong buying interest in Japaul Gold, Mecure Industries and Fidelity Bank. While the Consumer Goods, Lotus II, and Industrial Goods sectors experienced slight declines, the financial services industry, the oil and gas industry and the healthcare industry recorded gains, contributing to the overall market positivity. Grand Towers Market Digest Sept, 2024 11

General Disclaimer This research report is based on publicly available information considered credible by our analysts. However, facts and views presented may not reflect information known to other Grand Towers Business. While reasonable care has been taken, Grand Towers Plc officers, and employees disclaim responsibility for any errors or omissions. Ratings, forecasts, and opinions are subject to change without notice and may not reflect future performance. Past performance is not indicative of future results, and investments may fall or rise due to various factors. Grand Towers Plc and its affiliates shall not be liable for any losses arising from the use of this report. This report provides general information only and does not constitute personal investment advice. Investors should independently evaluate investment risks and suitability, and all investment decisions are their sole responsibility. Any investment decisions should be based on public information or offering documents, not this report. Grand Towers Market Digest Sept, 2024 12