Central Bank Digital Currency in an Open Economy Discussion

In this discussion by Frank Westermann, the concept of Central Bank Digital Currency (CBDC) is explored within the framework of a two-country DSGE model. The addition of CBDC as a new asset in the home country to be used in the foreign country leads to new uncovered interest parity conditions and amplifies international spillovers of shocks. The presentation covers definitions, interest rate parity conditions, welfare analysis, and the technical features of CBDC.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Central bank digital currency in an open economy Discussion by Frank Westermann

Summary Extend the two-country DSGE model of Eichenbaum et al. (2017) by adding a new asset, CBDC This new asset is issued in the home country to be used in the foreign country A new uncovered interest parity condition: risk-free rate in the foreign economy=the interest rate on the CBDC adjusted for exchange rate risk + liquidity service parameters CBDC amplifies the international spillovers of shocks Intuition: stronger exchange rate movements, as foreign agents rebalance much more into CBDC than they would into bonds Simulation + Welfare analysis CBDC design + optimal monetary policy

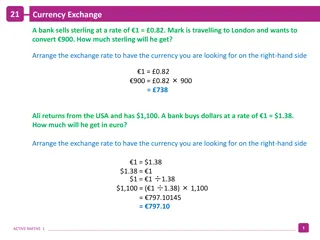

Definition of CBDC Deposits not liquid? CBDC short term, Deposits long term. Why? Bonds not liquid? Very deep markets, as eligible collateral at central bank Cash not International? (70% of the US$ and 30-40% of used abroad) Deposits not international? (FX markets trade > 5tr$ per day (BIS-Survey)). Deposits not safe? (Deposit insurance + full allotment policy) H-Perspective Folie 3 The Euro Area s Common Pool Problem Revisited

New interest rate parity condition Foreign interest rate = Interest rate on CBDC * Expected Exchange rate change * a Factor that measures the liquidity service of CBDC households, for the same remuneration, strictly prefer to hold CBDC relative to a bond given that the CBDC provides liquidity services, unlike bonds Their strong reaction to shocks amplifies the international spillovers Folie 4 The Euro Area s Common Pool Problem Revisited

DSGE model + fully modelled household optimization, labor markets etc. + Allows for welfare analysis! (example taxes) - no closed form solution - depends on parameter choices. - liquidity service of CBCD 10% higher than Cash? Why not 100% or 1%? ? Wefare (Scale: Steady state consumption *10^4) Folie 5 The Euro Area s Common Pool Problem Revisited

Calibration vs. Simulation Central Bank digital currency in an open economy

Technical features of CBDC Households exchange bank deposits against CBDC at the price P(DC), which can be 1, or larger. It can be (i) fixed interest rate (ii) flexible interest rate (iii) quantity based supply rule Questions: Why not in exchange for bonds? Or using bonds as collateral? (i.e. households are treated as little banks .) There allready exits a very large Monetary base M0. Would a natural way be to convert reserves to CBDC? Folie 7 The Euro Area s Common Pool Problem Revisited

Digital Currency vs. Reserve Deposits (Data from the ECB) Folie 8 The Euro Area s Common Pool Problem Revisited

Other questions Monetary model vs. Portfolio balance model of the exchange rate? (assets are not perfect subsitutes) Why look at the household problem, not an international representative investor? ( allocating his wealth on Bonds, Cash, Deposits, CBDC, home and foreign) Why the asymmetry between countries? (first mover advantage vs. Steady state analysis) Folie 9 The Euro Area s Common Pool Problem Revisited

Policy Implications Conclusions in the paper CBDC can amplify spillover and create challanges for (foreign)central banks Following a taylor rule can mitigate these adverse effects Other implications. A key difference between CBDC and Cash is Storage cost What is the effect of eliminating the 500 bill it increased storage cost. Interest rate: Legal under current rules? (Fed needed to ask congress). When all countries issue CBDC, is there a new form of currency wars? Folie 10 The Euro Area s Common Pool Problem Revisited

Summing up Strength of the paper Important policy question Fully modelled household optimization problem Welfare statements are possible. Critical points: Is CBDC really a new asset , or is the new aspect that standard features (liquidity) haven been taken away from other assets. open economy is not very open (deposits, cash not international) Quantitative results depend on parameter choices; effects on welfare are unclear. By construction the model is limited to the first mover advantage ; as 80% of central banks are planing to introduce it. Hard to assess if welfare effects are quantitatively important. Folie 11 The Euro Area s Common Pool Problem Revisited