Challenges and Risks in Launching Mandatory Covid Health Product

Explore the key challenges and risks faced by insurers in launching a mandatory Covid health product, including stakeholder perspectives, regulatory requirements, product design intricacies, sales considerations, and operational challenges. Gain insights into navigating the complex landscape of offering Covid health coverage quickly and effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Opening Remarks Archana Anoor Member, AGPEC, IAI www.actuariesindia.org

34th India Fellowship Webinar Date:29th January 2021 COVID health product Challenges, Pricing and Marketing Guide : Gopal V Kumar Presented By : 1. Phani Kandala 2. Mohit Arora 3. Shruti Shirhatti 4. Twinkle Agarwal

Problem statement The regulator instructs all insurers to issue a mandatory Covid health product within a month that covers hospital costs of up to 5 lakhs if hospitalized after a 2-week waiting period. The product is non-renewable after a year. 3 www.actuariesindia.org

Agenda Assumptions Key challenges and risks Assumptions and derivation of assumptions Estimates Sales Product preference consumer Product preference company Product promotion rationale Family floaters Impact of selection Summary Q&A 4 www.actuariesindia.org

Challenges, Risks and Assumptions 5 www.actuariesindia.org

Key Challenges different stakeholders Shareholders perspective Customers Insurer s philosophy Interests of customers Meet specific customer needs Urgent medical attention Contactless claim procedures and Grievance redressal system Choice of hospitals and medical networks Risk appetite of the company for a product catering to a global health emergency Adequate profits and return on capital Competitive pricing Marketability and sales volumes Consistency with other health products Underwriting consideration at initial and claims stage Availability of reinsurance Financing requirement for new product Accurate pricing Comply with regulation and professional guidelines 6 www.actuariesindia.org

Key Challenges different stakeholders Product Design Operational Regulatory Terms and conditions - Simplicity and clarity Anti selection Comorbidity, vulnerable groups Moral hazard Family floater option Introduction of exclusions cost of COVID test? Marketing and Sales Administration systems adequate to cope with: the product design potentially high number of claims significant increase in customer queries and grievances Further developments resulting in a change in regulatory requirements Call for additional information and reports, should the health situation deteriorate further 7 www.actuariesindia.org

Key Challenges different stakeholders Actuarial pricing & reserving Other challenges (contd.) Other challenges Limited data availability Uncertainty of how future experience unfolds Increased emphasis on actuarial expert judgment Challenges in setting assumptions for economic indicators due to financial impact Choice of model Short time-frame for product design with limited scope for alterations Choice of distribution channels Management in hospitals Soft frauds exaggeration of claim amounts Hospitals listed likely running above their capacity Potential delays due to: Social distancing & sanitization procedures Change in work pattern in case of a lockdown 8 www.actuariesindia.org

Assumption COVID General Expenses Claim administration Initial administration Medical underwriting Commission Taxes Rate of investment return and discount rate New business volume New business mix By occupation Age group Area / state Infection rate Mutation rate for projections Rate of hospitalization Mortality rate Recovery rate Claim size Severity mix and duration of hospitalization 9 www.actuariesindia.org

Assumption setting Use initial data to set assumptions and develop a decrement model for future projections Use overseas experience for future projections Consistency with other health products covering COVID Test appropriateness of assumptions using global benchmarks from countries where the pandemic may have progressed to the next stage Use different time series models (including historical models used to project for a pandemic) to estimate percentage of active cases with respect to total population Considering the level of uncertainty, allow for sufficient prudence within the assumptions Discuss and work with reinsurers, actuarial working groups and government agencies For more general assumptions, use existing assumptions as a benchmark to scale on the side of prudence for magnified impact, should this result in a pandemic 10 www.actuariesindia.org

Proportion of Policyholders to get COVID From an actuarial point of view, we can model using the following: Time Series approach Frequency Severity approach Burning cost approach We adapt a Time series approach developed by Wilkie as Health-Infectious Dead Model inspired from standard SIR model. Rationale for using this approach is to analyze trends, seasonality, cyclicity and irregularities: Healthy state age, x Infectious state, x, duration d Dead Dead 11 www.actuariesindia.org

Proportion of Policyholders to get COVID H(t) healthy at time I(t,d) time and duration infected, d D(t) dead at time t. r(t) basic rate of infection time t per day. j(d) relative infectiousness of infected at duration d Transitions are straightforward except infections: Healthy to infected on day t from those infected for d days: HI(t,d) = r(t)*j(d)*g(t)*I(t,d), where g(t) = H(t)/(H(t) + I(t)) ?? ? = ??? ?,? The next day number of infections should be: I(t+1,1) = HI(t) m(d) mortality rate for infected at duration d per day f(t) fraction of infection who are recorded as new cases at duration day K (e.g. 6) New cases recorded day t: NCR(t) = f(t).I(t,k) 12 www.actuariesindia.org

Proportion of Policyholders to get COVID To estimate this proportion, we need to understand the following: National/state government measures such as compulsion of masks Trends within the country Trends worldwide Segmentation of policyholders Geographical spread of policyholders Any unusual experience Any guidance available Out of 60 lakh policyholders we can estimation a proportion of 0.8% policyholders contracting COVID during the year This observation is mainly driven by the total number of people contracted COVID across the country The proportion can go higher or lower depending on the diversification and presence of policyholders across the country 13 www.actuariesindia.org

Given COVID is contracted Number of Hospitalization cases A flow chart of transition from Infectious to Hospitalization: Recovered Quarantined Infectious Hospitalized No ICU Intensive Care Unit Severe More Severe Low 14 www.actuariesindia.org

Given COVID is contracted Number of Hospitalization cases From an actuarial point of view, this is a low frequency high severity incident, this can be modelled using: Fat tailed distributions such as Pareto or log-gamma. Exposure rating using mortality rate, No. of severe infections, available ICU beds and so on. Subjective judgement From the multiple state model, and NCBI research gives us following parameter values1: Incubation period: 5 days Infectious Period: 7 days Mean death rate: 0.43% Hospitalization rate: 0.88% ICU admission rate:4.1% Using these parameters normalizing to the policyholder database, would give us number of hospitalized cases 15 www.actuariesindia.org

Given COVID is contracted Number of Hospitalization cases (as at November 2020) We see that 7700 crores have been already paid by insurance industry with over 5 lakhs claims Avg severity of a claim is 1-2 lakhs for a normal COVID treatment and if it is a very severe case then it is averaging around 6-8 lakhs Roughly it can be 6% of the total claims This observation is mainly driven by the total number of deaths among those contracted COVID across the country The proportion can go higher or lower depending on the diversification and presence of policyholders across the country 16 https://indianexpress.com/article/business/economy/insurers-receive-covid-claims-worth-rs- 7700-cr-premiums-jump-up-to-100-7001708/ www.actuariesindia.org

Expected Claims Cost relative to Normal Health Claims To understand the current expected claims cost, we need to assess: Scenario 1: Pre- COVID Expected claims cost Scenario 2: COVID 19 Expected claims cost 17 www.actuariesindia.org

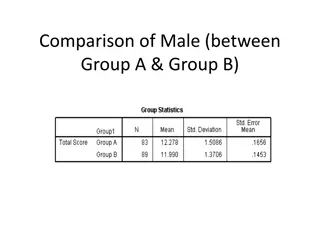

SCENARIO 01 Loss Ratios of Health Insurance in India Pre-COVID 19 Scenario 105% 91% 108% Sector Public sector Private Sector Stand-alone Industry FY 12 FY 13 FY 14 FY 15 FY 16 FY 17 FY 18 FY 19 101% 103% 106% 112% 117% 122% 108% 105% 78% 78% 87% 84% 60% 61% 67% 63% 93% 95% 97% 101% 102% 106% 94% 84% 94% 122% 80% 81% 58% 84% 58% 80% 62% 84% 63% 91% 106% 63% 84% 62% 117% 102% 58% 81% 58% 112% 101% 84% 63% 113% 102% 91% 107% 115% Public sector Private Sector Stand-alone Industry 94% 72% 125% 122% FY 15 FY 16 FY 17 FY 18 FY 19 106% 71% ClassofBusiness Govt. Business Group Business Individual Business Industry FY 12 FY 13 FY 14 FY 15 FY 16 FY 17 FY 18 FY 19 90% 87% 93% 108% 109% 122% 115% 113% 100% 104% 110% 116% 120% 125% 107% 102% 85% 83% 83% 81% 94% 94% 97% 101% 102% 106% 94% 120% 76% 109% 102% 77% 116% 108% 101% 81% 77% 76% 71% 72% 91% Govt. Business Group Business Indivudual Business Industry Overall industry LR at 91% FY 15 FY 16 FY 17 FY 18 FY 19 18 SAHI and insurers with retail portfolio have been maintaining LR at 63% Source: Annual Reports, IRDAI www.actuariesindia.org

Impact of Health Claims COVID 19 (Example of AB scheme) 14,000 12% 12,000 10% 10,000 8% 8,000 6% 6,000 4% 4,000 2% 2,000 - 0% August September October November December January February March April May June July Pre-Covid Covid period Severity Frequency Source: Webinar on Ayushman Bharat Health Insurance Scheme, Institute of Actuaries of India, July 24, 2020 19 www.actuariesindia.org

SCENARIO 02 Expected Claims Cost - Summary Reserving pattern would have changed increasing the average settlement time for claims and avg claims size. Earnings patterns would have been shortened hence lower investment income. Type of treatment and type of hospital also impacts the claim size. Claim Frequency would have increased owing to easing restrictions. Standard ceiling of rate indications by GI council does not factor in medical inflation (running at 10%) per annum. Co-morbidity cases also being higher, impacts the frequency and severity. Given the above view from past few slides, we see that there is an increase in expected claims cost than normal health claim scenario by at least 10%3. 20 3https://www.asiainsurancereview.com/News/View-NewsLetter-Article/id/74016/type/eDaily/India-Health-portfolio- loss-ratio-could-increase-by-10- www.actuariesindia.org

Special Risks that need consideration Claim frequency Claim size Regulatory Operational Increase in fraudulent claims aggravated with limited claim level underwriting Increased chance of multiple claims for policyholders with weak immunity Volatility and uncertainty in claim sizes as the disease progresses Government grants and schemes for COVID patients Change in regulatory requirements as more information becomes available Safety and well- being of insurer s employees and workplace Impact due to community transmission Increase in cost of medical facility due to limited supply Medically challenging to separate costs of an existing condition from COVID Increase in claim frequency in other lines of business Call for speedy claim settlement 21 www.actuariesindia.org

Special Risks that need consideration Design & business risks Economic indicators Other claims Surge in life insurance, health and other income related claims due to overall impact Limited scope to allow for exclusions due to short time frame and standardized wording Poor investment outlook resulting in reduced returns Delay in other treatments may result in potential increase in non-COVID health claims in future Difficult to cross sell other policies or provide floaters 22 www.actuariesindia.org

Sales 23 www.actuariesindia.org

Mainstream product or special purpose product Consumers perspective Already covered elsewhere? If yes then COVID related hospitalization expenses are often covered in mainstream products Subject to exceptions like PPE kit related expenses, COVID tests and others Regulator intervention in COVID related claims Inadequacy of cover for lower SI people Effect of Room rent/ICU limits and proportionate deduction Mainstream attractive coverage for other illnesses, renewable after one year, coverage for higher SI(>5L) Hence higher cost affordability? 24 www.actuariesindia.org

Mainstream product or special purpose product Consumers perspective COVID product attractive to customers with no existing cover or inadequate cover against the risk Meet short term needs of the customer Policy without room rent and ICU limits (mainstream products have 1% and 2% respective limits) Short term coverage (e.g. 3m, 6m etc.) - subject to permission by regulator Pay what you want cover for Lower cost Non-renewable after one year 25 www.actuariesindia.org

Mainstream product or special purpose product Company s perspective Mainstream products more preferable to sell? Long term relation with customer Creating long term value from customer renewal premium, cross-sell Meet other needs of the customer in the best interest of policyholders Inadequacy of premiums to cover COVID related expenses 26 www.actuariesindia.org

Mainstream product or special purpose product Company s perspective Opportunity to provide need-based product like COVID policy Depends on management attitude towards risk Opportunity to capture untapped market Opportunity to price appropriately for covid related hospitalization expenses But Limited data and information unpredictability of trends Very high risk risk of anti-selection from vulnerable group 27 www.actuariesindia.org

Mainstream product or special purpose product Promotion of Individual version Competitive market - insurer may be forced to promote COVID specific product Ensures presence and market share Aggressive promotion means higher expenses Product is also non-renewable after one year Can insurer recoup its expenses? Uncertainty, expected increasing strain on hospitals and its implications means insurer may shy away from aggressive promotion Advertise moderately - just to make people aware of the COVID specific product Advertise heavily on mainstream products highlighting that COVID related expenses are also covered Increasing fear and increased awareness of the need of health insurance Opportunity to increase penetration Mainstream renewable after one year hence preferable for both the company and consumer 28 www.actuariesindia.org

Mainstream product or special purpose product Promotion of Family floater cover Not advisable to advertise floater cover At least for low SI Utilization adds value to customer? 29 www.actuariesindia.org

Family Floater 30 www.actuariesindia.org

Coverage and Benefits of Family Floater Benefits of Family Floater to policyholder Covers an entire family under a single sum insured Covers multiple hospitalizations of all the members of family until the sum insured is exhausted Calculation of Floater discount for Insurer Premium is calculated such that single premium charged is lesser than the sum of premium for each individual member covered in floater Floater discount takes into account that the maximum liability of the Company is limited to sum insured and there are savings in operational and administrative costs 31 www.actuariesindia.org

Whether to Offer Family Floater for Special purpose COVID Product? Concern from Policyholder s Perspective High average severity of around 2 to 2.5 lakhs (incl. severe cases)* Likelihood of being utilized by one member defeats the purpose of floater Not adequate cover for members of family-Prejudice the interests of policyholders Value addition to customer is lesser esp. for lower sum insureds Steps to be taken to ensure that during policy solicitation and sale stages, the prospects are fully informed and made aware of the benefits of the product being sold vis- -vis the product features attached thereto and the terms and conditions of the product so that the benefits/returns of the product are not mis-stated/mis-represented. IRDAI REGULATIONS relating to Protection of Policyholder s interests An insurer or its agent or other intermediary shall provide all material information in respect of a proposed cover to the prospect to enable the prospect to decide on the best cover that would be in his or her interest *Calculated based on Report by GI Council-Proposed charges for COVID CASES Article by Hindustan Times- https://www.hindustantimes.com/india-news/what-does-it-cost-to-treat-a- coronavirus-patient-here-s-a-break-up/story-qwOzwoaJKj39AAxb2U58oO.html 32 www.actuariesindia.org

Algebraic Formula for claims savings due to Family Floater cap Formula Dependants For higher sum insureds, >3lakhs In lieu of savings in issuance expenses and operational costs Liability being limited to floater sum insured for entire family Number of members, independent of the relative ages Formula Family floater premium= ??? ?? ??????? ??? ??? ??????? (1 ?????? ??????? ???????? %), where family floater discount is as : No. of members Family Floater discount* 15% 20% 25% *Discounts are estimates based on expected savings in issuance expenses and operational costs 2 members 3 members 4+ members 33 www.actuariesindia.org

Algebraic Formula for claims savings due to Family Floater cap Illustration For sum insured for 5 lakhs covering 4 members: Age of member 65 60 35 30 Premium 7660 7660 3419 3419 Total premium Floater Discount % based on 4 members Premium according to formula Floater Premium charged 22,158 25% 22,158*(1-25%) 16,619 34 www.actuariesindia.org

Comparison of Favorable selection by families in COVID V/S Mainstream product COVID Mainstream Less discount Contagious disease so increased likelihood of utilization Risk of selling to families who are more susceptible Generally bought by people who do not have any health cover Lockdown has led people to live with their families, than away from them More discount Lesser chance of more than one individual contracting Based on this comparison, the factors of being contagious and risk of anti- selection in COVID product, we think that the impact of favorable selection by families will be more for COVID product 35 www.actuariesindia.org

Floater discount low for COVID product Accumulation of Risk due to COVID being contagious disease Increase in likelihood of being infected if one member of the family is infected Risk of utilizing the sum insured is higher Floater discount is only for savings in operational costs and administrative expenses Higher risk of anti-selection by families living in communities where there are greater number of COVID cases Lack of data to accurately predict the impact on frequency and severity so prudent assumption of low discount Due to Protection of policyholders interests, Floater discount not offered for lower sum insureds till 3 lakhs where according to us, providing floater does not add to value for the customer 36 www.actuariesindia.org

Summary Initial stage of COVID in India - exorbitantly high uncertainty Limited data available to price the product Challenges for actuaries in terms of data, assumptions setting, model selection and pricing Special risks, e.g Chances of lockdown, likely increased strain on hospitals Operational challenges due to nature of the health hazard. Challenges in sales and promotion Mainstream products vs COVID specific product Insurers perspective and consumers perspective Floater cover level of discount, selection risk by families, value addition for customers? 37 www.actuariesindia.org

THANK YOU 38 www.actuariesindia.org

Wrap Up Additional Sessions Feedback www.actuariesindia.org