Challenges Faced by the No Surprises Act: Regulatory and Judicial Roadblocks

Explore the obstacles hindering the No Surprises Act implementation, such as regulatory and judicial challenges, impacting the resolution of surprise medical bills and setting payment limits. Learn about key components like Independent Dispute Resolution and Qualified Payment Amounts, along with various considerations affecting billing disputes. Discover how legal cases like Neurological Associates and Haller v. HHS are influencing the Act's progress.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

No Surprise: Regulatory and Judicial Challenges Stymie the No Surprises Act Chryssa Deliganis Visiting Assistant Professor

Surprise Medical Bills: When emergency or non- emergency care is provided by out-of- network providers and the balance remaining, after insurance has paid, is billed to the patient.

Limits the amount an insured patient will pay for out-of-network emergency medical services and certain non-emergency services by an out-of-network provider at an in- network facility. Requires insurers to reimburse out-of- network providers at the statutorily calculated out-of-network rate. Establishes a procedure to determine the payment amount. Disputes must be resolved by Independent Dispute Resolution (IDR). IDR = baseball style arbitration The No Surprises Act (NSA)

Calculated based on the amounts paid for the applicable year for items or services that are furnished in the same geographic region. Qualified Payment Amount (QPA) Typically the QPA is the median rate the insurer would have paid for the service if provided by an in-network provider or facility. While the QPA is the first consideration listed in the Act, there are other considerations enumerated as well.

Additional circumstances Additional circumstances or information pertaining to the claim The level of training level of training, experience, outcomes of the provider The market share market share held by the non-participating provider The acuity of the patient acuity of the patient receiving care The teaching status teaching status, case mix, and scope of services furnished by the provider Demonstrations of good faith efforts (or lack thereof) to good faith efforts (or lack thereof) to negotiate network agreement negotiate network agreement Other Considerations: Notably, the Act prohibits arbitrators from considering the provider s usual or customary charges, the amount they would have billed had the Act not applied, or the reimbursement rates under Medicare/Medicaid.

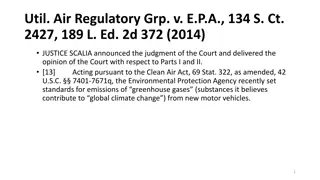

1. 1. General Challenges to Implementation General Challenges to Implementation: Neurological Associates (ED NY) and TMA III (ED TX). Regulatory Takings Attacks Regulatory Takings Attacks: Haller v. HHS (2nd Cir); Neurological Associates (ED NY) Biden Administration Regulations Struck Biden Administration Regulations Struck Down Down: TMA I, TMA II, TMA III, TMA IV, LifeNet, (all ED TX); 5thCir. opinion affirming TMA II (8/3/24); 5thCir. Aff. TMA IV in part, rev. in part (10/30/24) Availability of Judicial Review/Application of Availability of Judicial Review/Application of FAA FAA: Guardian Flight v. Health Care Service Corp. (ND TX 5/30/24, appealed to 5thCir.); Guardian Flight v. Med Evaluators of TX (SD TX); Med-Trans (MD FL, appeal dismissed) but see GPS v. Horizon Blue Cross (D. NJ) 2. 2. Judicial Challenges 3. 3. 4. 4.

Rulemaking, Round 1 Interim Final Rule: Interim Final Rule: The No Surprises Act: The No Surprises Act: Requires arbitrators to select the offer closest to the [QPA] and may deviate from that number only if credible information clearly demonstrates that the QPA is materially different from the appropriate out-of-network rate. 45 CFR 149.510(c)(4)(ii). Instructs arbitrators to consider the QPA and the five other factors in deciding which offer to accept. 300gg- 111(c)(5)(C). Outcome: Rule Vacated!

Rulemaking, Round 2 Final Rule: Final Rule: The No Surprises Act: The No Surprises Act: Arbitrators should consider the QPA first and then consider the non-QPA factors, presume the credibility of the QPA while evaluating the credibility of the other factors, and if they rely on other factors must explain why they departed from QPA in their written decision. 45 CFR 149.510(c)(4)(iii)(E) and (vi). Instructs arbitrators to consider the QPA and the five other factors in deciding which offer to accept. 300gg- 111(c)(5)(C). Outcome: Rule Vacated Again! Fifth Circuit: We agree!

Preliminary Outcomes . . . NSA PREVENTED 10 MILLION SURPRISE MEDICAL BILLS IN FIRST NINE MONTHS OF 2023 PROVIDERS APPEAR TO BE WINNING NEARLY 80% OF THE TIME MORE THAN ONE-FIFTH OF INSURERS FAILED TO PAY NO SURPRISES AWARDS LAST YEAR CMS HAS RECEIVED 12,000 COMPLAINTS OF NON-COMPLIANCE IN-NETWORK CARE INCREASED 2.3% INCREASE IN INSURANCE PREMIUMS???

Congress Should Amend the Act to Specify Factors or Issue Reimbursement Rates That Will Control Costs Alternatively, Congress Could Prohibit Surprise Bills by Requiring All Hospital Providers Be in Network What Should Be Done? Congress Must Amend the NSA to Provide for Judicial Enforcement of IDR Awards

Chryssa Deliganis cdeliganis@seattleu.edu