Challenges in Funding for Florida Public Schools: Polk County Insights

"Explore the challenges faced by Polk County in funding its public schools, including comparisons with other districts in Florida and the nation. Learn about the unique financial struggles due to transportation costs and how the state's financing model impacts education funding."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

FUNDING FOR FLORIDA PUBLIC SCHOOLS CHALLENGES FACING POLK JASON PITTS, ACTING SENIOR DIRECTOR, FINANCE OFFICE: 863-457-4704 EXT. 706 JASON.PITTS@POLK-FL.NET 1

1 HOW DOES POLK COUNTY COMPARE TO OTHER DISTRICTS IN THE NATION? 27TH LARGEST DISTRICT IN THE NATION (# OF STUDENTS) WOULD BE THE LARGEST SCHOOL DISTRICT IN 39 STATES FUNDED 995TH OUT OF THE TOP 1,000 LARGEST SCHOOL DISTRICTS (13,588 DISTRICTS IN THE US) NEW YORK AND ILLINOIS - $24,000 PER STUDENT WEST VIRGINIA - $15,000 PER STUDENT FLORIDA - $7,500 PER STUDENT 2

2 HOW DOES POLK COMPARE TO OTHER DISTRICTS IN FLORIDA? POLK COUNTY IS THE 7TH LARGEST DISTRICT IN THE STATE POLK COUNTY IS CURRENTLY 64TH OF 67 DISTRICTS IN FUNDING PER STUDENT POLK S AVERAGE TEACHER SALARY IS 35TH IN THE STATE POLK S SPENDING ON ADMINISTRATIVE COSTS IS THE 3RD LOWEST IN THE STATE POLK IS LARGEST EMPLOYER IN THE COUNTY WITH APPROXIMATELY 12,500 EMPLOYEES (NOT INCLUDING SUBS) 3

3 CHALLENGES FACED BY POLK POLK COUNTY IS UNIQUE AS AN URBAN AND RURAL COUNTY EXTREMELY HIGH TRANSPORTATION COSTS DUE TO SIZE AND LAYOUT OF COUNTY (STATE FUNDING ONLY COVERS 60% OF COSTS) (EXAMPLE OF UNFUNDED/PARTIALLY FUNDED MANDATE) POLK COUNTY IS LARGER THAN THE STATE OF RHODE ISLAND 540 BUSES TRANSPORT OVER 51,000 STUDENTS 60,670 MILES TRAVELLED EACH DAY (24,901) 4

4 FLORIDA S FINANCING MODEL REPORTED IN THE PRESS AS DOLLARS PER STUDENT CALLED THE FEFP FLORIDA EDUCATION FINANCING PROGRAM TO RECEIVE STATE FUNDING DISTRICTS MUST USE REQUIRED LOCAL EFFORT WHEN DESIGNED, IT ATTEMPTED TO EQUALIZE FUNDING ACROSS DISTRICTS FUNDING IS PRIMARILY PROPERTY TAX AND SALES TAX 5

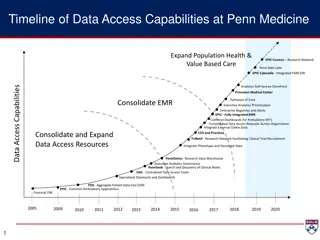

6 TRANSPORTATION FUNDING VS. EXPENSE PARTIAL/UNFUNDED MANDATES 38,000,000 Expense 33,000,000 28,000,000 Average underfunding since 2010 = $14,542,959 per year -- 10 year loss = $142,542,296 23,000,000 Funding 18,000,000 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 7

Growing FEFP Funding Inequity Total Dollar Loss of Funding (Difference between actual funding and state average (9,197,743) $ (10,512,427) $ (13,185,630) $ (9,663,221) $ (8,173,343) $ (4,601,000) $ (17,474,701) $ (21,292,122) $ (14,864,901) $ (16,229,615) $ (18,104,709) $ (17,901,260) $ (24,534,043) $ (31,746,541) $ (35,983,591) $ (20,158,509) $ (30,654,917) $ (27,042,787) $ (25,416,972) $ (29,967,380) $ Spread between Polk and State Avg. Spread between High and Low District Funding Rank out of 67 Highest District Funding Lowest District Funding # of Polk Unweighted FTE Funding Percentile State Average Polk Funding per Student Year 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 50 49 55 45 43 55 55 59 50 49 59 54 56 59 61 64 64 64 61 64 25% 27% 18% 33% 36% 18% 18% 12% 25% 27% 12% 19% 16% 12% 9% 4% 4% 4% 9% 4% $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 4,607 5,032 5,209 5,323 5,729 6,011 8,451 8,034 8,240 8,778 7,572 7,829 8,299 8,499 8,925 9,086 9,373 9,598 9,985 10,190 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 3,891 4,108 4,193 4,174 4,193 4,545 6,524 6,278 6,397 6,353 5,845 5,981 6,354 6,499 6,676 6,749 6,873 7,123 7,346 7,482 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 4,211 4,483 4,589 4,647 4,834 5,245 7,148 6,871 6,925 6,941 6,298 6,447 6,860 7,027 7,226 7,138 7,306 7,408 7,647 7,787 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 4,096 4,354 4,431 4,534 4,742 5,195 6,960 6,642 6,765 6,768 6,107 6,260 6,605 6,703 6,863 6,937 7,007 7,150 7,409 7,513 (114.94) $ (129.31) $ (158.50) $ (113.05) $ (92.20) $ (50.00) $ (188.00) $ (228.79) $ (159.64) $ (173.07) $ (190.74) $ (187.04) $ (254.75) $ (324.28) $ (362.92) $ (201.01) $ (298.83) $ (258.19) $ (238.00) $ (274.00) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 716 924 80,025 81,294 83,191 85,481 88,645 92,020 92,953 93,063 93,115 93,775 94,921 95,706 96,305 97,898 99,150 100,286 102,583 104,740 106,794 109,370 1,016 1,149 1,536 1,466 1,927 1,756 1,843 2,425 1,727 1,848 1,945 2,000 2,249 2,337 2,500 2,475 2,639 2,708 10-year loss $261,510,708 8

What if the millage rate was held constant at the 2011-12 rate instead of rolling back? Fiscal Year Total Millage Taxable Value Tax Revenue Constant Mills Tax Revenue Additional Revenue 2006-07 7.500 $ 30,014,236,274 $ 225,106,772 2007-08 7.000 $ 35,357,641,301 $ 247,503,489 2008-09 7.384 $ 36,847,154,973 $ 272,079,392 2009-10 7.336 $ 32,866,327,111 $ 241,107,376 2010-11 7.542 $ 29,784,001,684 $ 224,630,941 2011-12 7.670 $ 26,594,668,442 $ 203,981,107 2012-13 7.492 $ 25,439,084,096 $ 190,589,618 7.670 $ 195,117,775 $ 4,528,157 2013-14 7.547 $ 26,508,634,849 $ 200,060,667 7.670 $ 203,321,229 $ 3,260,562 2014-15 7.208 $ 27,985,171,909 $ 201,717,119 7.670 $ 214,646,269 $ 12,929,149 2015-16 7.232 $ 29,712,137,509 $ 214,878,178 7.670 $ 227,892,095 $ 13,013,916 2016-17 6.797 $ 31,609,566,863 $ 214,850,226 7.670 $ 242,445,378 $ 27,595,152 2017-18 6.514 $ 35,068,873,988 $ 228,438,645 7.670 $ 268,978,263 $ 40,539,618 2018-19 6.246 $ 38,033,022,559 $ 237,554,259 7.670 $ 291,713,283 $ 54,159,024 2019-20 6.086 $ 40,852,038,592 $ 248,625,507 7.670 $ 313,335,136 $ 64,709,629 Total additional revenue if millage was constant instead of "rolled-back" from 2013-2020 = $ 220,735,208 11

HOW HAS THE SCHOOL DISTRICTS TOTAL MILLAGE RATE AFFECTED THE AVERAGE HOMEOWNER? For a homeowner who purchased home in 2007 and qualified for homestead exemption -- School Taxes paid in 2008 = $1,255.63 School Taxes paid in 2020 = $1,017.57 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Market Value $ 175,000.00 $ 206,155.08 $214,839.79 $191,629.31 $ 173,657.60 $155,061.98 $148,324.27 $154,560.36 $163,169.41 $ 173,238.59 $ 184,301.68 $204,471.40 $ 221,754.07 $ 238,190.53 Assessed Value $ 175,000.00 $ 179,375.00 $179,554.38 $184,402.34 $ 187,168.38 $177,213.69 $148,324.27 $150,549.14 $151,753.53 $ 152,815.80 $ 156,024.93 $159,301.46 $ 162,328.19 $ 167,198.03 Save our Homes $ 26,780.08 $ 35,285.41 $ 7,226.96 $ - $ - $ - $ 4,011.22 $ 11,415.88 $ 20,422.79 $ 28,276.75 $ 45,169.94 $ 59,425.88 $ 70,992.50 Taxes Paid $ 1,255.63 $ 1,325.83 $ 1,352.78 $ 1,411.62 $ 1,359.23 $ 1,111.25 $ 1,136.19 $ 1,093.84 $ 1,105.16 $ 1,060.50 $ 1,037.69 $ 1,013.90 $ 1,017.57 Market Value vs. Property Taxes Home Purchased in 2007 With Homestead Exemption $260,000 $238,190.53 $1,450 $1,411.62 $240,000 Property Taxes $1,350 Market Value $1,255.63 $220,000 $1,250 $200,000 $206,155.08 $1,093.84 $1,150 $180,000 $1,017.57 $1,050 $160,000 $148,324.27 $140,000 $950 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 12 Market Value Taxes Paid

POLK COUNTY SCHOOL BOARD BUDGET FY2020-2021 TOTAL ADOPTED BUDGET - $1,925,764,102 GENERAL FUND - $1.005 BILLION SPECIAL REVENUE (TITLE FUNDS, FOOD SERVICE, OTHER GRANTS) - $188 MILLION DEBT SERVICE - $62 MILLION CAPITAL - $507 MILLION (TYPICALLY $182 MILLION ARTIFICIALLY HIGH DUE TO BONDING IN 2020) INTERNAL SERVICES (SELF-INSURED FUNDS) - $141 MILLION AGENCY ACCOUNTS (INTERNAL) - $23 MILLION 13

WHERE DOES GENERAL FUND DOLLARS GO? (ENDING 2019-2020) General Fund Expenditures ( In Millions) Salaries and Benefits Contracted Services Energy Services Materials and Supplies Capital Expenditures Other $ 604 $ 174 $ 14 $ 22 $ 35 $ 7 70.6% 20.3% 1.6% 2.6% 4.1% 0.8% Total $ 856 Passthrough to Charter Schools = $120 million POLK GENERAL FUND BUDGET W/O CHARTER SCHOOL PASSTHROUGH Salaries and Benefits Contracted Services Energy Services Materials and Supplies Capital Outlay Other $ 604 $ 54 $ 14 $ 22 $ 35 $ 7 82.0% 7.3% 1.9% 3.0% 4.8% 1.0% 14 Total $ 736

General Fund Expense by Type Instruction, Transportation, Counseling 3% 18% Operating and Maintenance Administration 79% 15

GENERAL FUND FINANCIAL HEALTH FUND BALANCE BOARD POLICY 5% (UNASSIGNED/ASSIGNED) STATE MINIMUM 3% STATE EMERGENCY INTERVENTION 2% STANDARD GOVERNMENT AGENCY BENCHMARK 60 DAYS OR 15% 16

CURRENT ISSUES FACING POLK SCHOOLS

BUDGET LOSS OF STUDENTS (FTE) AND LOSS OF REVENUE POLK COUNTY HAS NOT SEEN A DECLINE IN STUDENTS FROM THE PREVIOUS YEAR FOR AT LEAST 25 YEARS FUND BALANCE LEGISLATIVE INITIATIVES EXPANDING VOUCHER PROGRAMS CONTROL OF FEDERAL STIMULUS DOLLARS 18

THANK YOU, DISTRICT DAC COMMITTEE MEMBERS! *THE INFORMATION IN THIS PRESENTATION IS VALID AS OF 4/15/2021. 21