Chicago Hotel Outlook - Historic Trends and Future Projections

Matched against St. Louis Fed's GDP figures, hotel performance aligns closely historically. Chicago's mid-70% occupancy range surpasses its average, showing resilience during recessions. Anticipated downturn in 2017 models based on recovery timelines. Room demand changes, new hotel openings, and rumored projects in the Chicago hospitality industry highlight the evolving landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

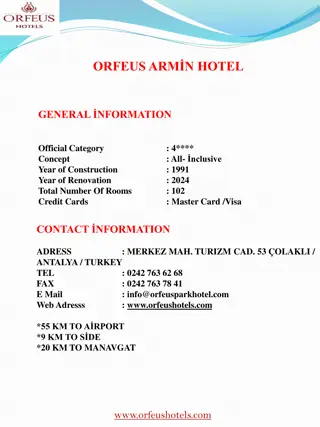

MAI Chicago Hotel Outlook: April 2018

Historic Trends from 1960 to Now We matched the St. Louis Fed s GDP %change figures against historic hotel performance: As shown below they line up almost exactly Hotels typically take a few more years to recover than the overall market Rate of growth specifically doesn t matter as much as the fact that it is better than the recessionary period This is why we anticipate a downturn in 2017 models from at least 2015. The cycle exists because recessions generally take place as a major shock to already weakened economies. Growth coming out of recession is strong, and results in overbuilding, creating weakness. 78% 76% 74% 72% 70% 68% 66% 64% 62% 60%

Chicagos mid 70% occupancy range is higher than its historic average. During the recession, it only dropped down to the mid 60 s, while everywhere else saw drops to low 50% occupancy. Chicago Dropped Rate to gain demand (by over $30), and has done so historically during recessions. Other regions operating on tighter budgets cannot do this. We have seen indications over the past year that downtown hotels have dropped or kept rates flat to maintain higher occupancy in the face of rapid development. Historic and Projected Chicago $250 80% RevPAR ADR OCCUPANCY 78% $200 76% 74% $150 72% 70% $100 68% 66% $50 64% 62% $0 60%

CHANGE IN ROOM DEMAND (000'S) 1,089 961 783 740 717 613 560 529 474 391 453 436 366 323 304 246 178 104 83 -42 2016 2011 2012 2013 2014 2015 2017 -206 Change Total Downtown Suburbs By 2019 Chicago may account for 42.5% Regionally, hotel building booms have preceded most recessions, though they are NOT a leading indicator. -On their own, overbuilding causes temporary depression of occupancy, while rates typically do not fall much; this time, we have seen more aggressive movement, due to the sheer scale of the new development.

Choose Chicago's List of hotel Openings through 2021 2017 EMC2 195 Cambria Hotel & Suites 198 Marriot Marquis 1200 Ace Hotel 150 180 Viceroy Hotel Zachary 2018April 175 Moxy Hotel June 156 Sophy Hotel August 98 Hilton Triplex @ Mc Cormick Sept. 466 Hotel Julian Sept. Dec. 156 93 Nobu Found Hotel 2019Jan 60 Navy Pier Hotel March 200 Aloft Mag Mile March 336 Home2 Suites June 185 The Hoxton August 175 Wanda Vista 2020 192 Equinox Hotel 2021 165 4380 Total

Our list of announced and rumored projects, 2017-2020 2017 Projects MPEA Marriott Marquis McCormick Place 1,206 Dec-17 McCormick Place DePaul Arena 500 2017 First Hospitality/McHugh construction Ford Center for Performing Arts Chicago City Center Cambria 210 2017 On top of Ford Theater Hilton Garden Inn Cermak Rd 200 2017 Tri-Plex Operation Hampton Inn Cermak Rd 200 2017 Tri-Plex Operation Home 2Suites Cermak Rd 66 2017 Tri-Plex Operation SoHo House New Hotel 850 W. Lake 165 2017 New Construction w/retail 11 story next to Ace and Nobu Autograph by Marriott 224 E. Ontario 195 2017 Greenberg ECD EB-5 Project EMC Squared West Loop 590 W. Madison 330 2017 Mixed use office/hotel. Waiting financing for office. Al Friedman 330 N. Clark St. 500 2017 Behind Reid Murdoch Center. (4/12/2016) Ace Hotel 311 N Morgan Street 159 2017 September opening Lincoln Park Hotel Inn on Lincoln Park 143 2017 Hotel/retail KOO design Purple Hotel/Spring Hill Suites Lincolnwood 160 2017 Fall 2017 part of mixed use, manager First hospitality Group Tishman Realty 237 E Ontario 395 2017 24 Story on Museum of Contemporary Arts Site Extended Stay Lake and Halsted sw 245 2017 Jeff Shapack/Focus Devel./Atlantic Realty Ptnrs. Grupo Posadas/Dream Hotels West Loop 250 2017 Site not specified Altera Hotels Albion and Sheridan 145 2017 Hampton Inn near Loyola Univ. Chatham Hotel 7600 S. State St. 90 2017 Independent hotel Extended stay Evan Hotel 181 N. Clark St. 175 2017 Paul Beitler on top of parking structuree. Cambria Suites 32 W. Randolph St. 198 2017 Repurpose of Oriental Theater Building Holiday Inn Express/Staybridge Suites Wells and Congress 400 2017 Dual Branded Hotel south loop 200 rooms in each. Viceroy Hotel 1118 N. State St. 180 2017 Cedar Hotel site 200 N. Michigan New Development 200 2017 Total New Rooms Total Cumulative 6,312 48,147 15.09% % Increase year over year

2018 Developments Sterling Bay 110 N. Carpenter LBGT Out Hotel Optima Wrigleyville Hotel Wanda Group Indigo Hyatt/McDonalds Medical District NoBu Hotel O'Brien's Site Hoxton Hotel Dana/River North Old Post Office 160 N. Morgan St. 3343 Halsted 200 E. Illinois Clark Street 401 E. Wacker Dr. Atlantic Bank Building 113 N. May Street Ogden/Damen 854 W. Randolph St 1528 N. Wells 200 N. Green St. 12-22 Erie Post Office 200 112 200 42 190 218 220 225 119 132 175 178 321 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 Extended Stay, Hyatt, 19 story, Similar design to McD HQ building Challenges with design has delayed development Adjacent buildings repurposed with 21 rooms each over F & B Operation 89 story 5 star hotel and apartment tower. Acquired by Oxford Capital to complete Adding 5 story glass tower Sterling Bay Just announced 7/22 Mixed use development Rober DeNiro/Nobu 10,000 Sq Ft Rest. 3,000 meeting/Rooftop bar 13 Story Boutique 60 parking and townhomes. Restaurant returns/rooftop bar Hoxton Hotel and Jeff Shapack Probably 2018 opening SoHo district. Announced 3/21 Crain's No new news since acquisition. Al Friedman Boutique Hotel 3,000 sq. ft retai/Restaurant lease space $28.7 MM Loan TCF Bank Proposed as a part of a $1 B redevelopment of the Union Station by Amtrack Part of two brand structure west of Best Western Grant Park Under Construction Moxy Hotel Union Station Hilton Garden Inn Midtown Athletic Club 530 N. LaSalle St Union Station 100 S Wabash 2020 W. Fullerton 158 250 132 55 2018 2018 2018 2018 Working Drawings 120 room Tryp (Wyndham) Hotel Latest 3/17 no hotel at this time 120 Timeshare Condo Hotel, also 246 condos and 30,000 sq ft retail 325 Parking Upper upscale hotel MB Development 125 room exenteded stay (medical oriented) Reschke Project Same Building as JW Marriott Expansion and refurbishing-Oxford Properties Boutique Hotel by Olympia/Smart Either Oxford or CIM group Mixed use building with retail/office/hotel/residential First Hospitality will manage. Initially 250 rooms east end of pier. Zachery Hotel and 40,000 Sq Ft Athleric Club-5 Restaurants Wabash Ave Symmetry/Fordham MB/Stroger MB/Stroger Canopy by Hilton Hotel Essex Hyde Park Tribune Tower Hard Rock Navy Pier 150/225 Sheraton/Ricketts Superior and Wabash Superior and Wabash Cook County Hospital Cook County Hospital 208 S. LaSalle 800 S. Michigan 1401 E. 53rd Replaced 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 Apr-18 216 125 125 223 271 100 400 350 250 175 5,162 53,309 W Ontario Navy Pier MEPA Wrigley Field Total Cumulative 10.72% Confirmed 2019 Developments Magellan Magellan Parcel O Columbus Dr Lake Shore Drive Total Cumulative 626 300 926 2019 2019 Crains July 3 Crains July 3 54,235 1.74%

Regional OCC 80% 75% 70% 65% 60% 55% 50% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 O'Hare South DuPage Southwest North Lake Northwest DOWNTOWN Regional ADR $150 $140 $130 $120 $110 $100 $90 $80 $70 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

DuPage Historic and Projected $120 70% $100 65% $80 $60 60% $40 55% $20 $0 50% 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 RevPAR ADR OCCUPANCY DuPage Historic and Projected $120 90 80 $100 70 $80 60 50 $60 40 $40 30 20 $20 10 $0 0 ADR RevPAR OCC 12 per. Mov. Avg. (ADR)

Cap Rates in Hotel properties 9.5% 9.3% 9.2% 9.2% 8.2% 9.1% 8.3% 9.0% 7.8% 7.7% 7.4% 7.4% 7.0% 6.7% 6.4% 6.2% 6.1% 5.8% LTD SELECT FULL CAP RATES, ACCORDING TO HVS 2011 2012 2013 2014 2015 2016 Impacted by: Expected increase in inflation Forced rebranding by Franchisors Less Overseas capital REITs have cut back Substantial supply increases in some markets

Trends in Hotels Hotels still retain a premium over other commercial real estate Limited service still highest but flat Select Service and Extended stay have increased Luxury still lowest cap but rose strongly. Chicago s cap rates are average for the nation at 7.5%. Comparatively NY is 6.3% and Houston is 8.3%

Trends in Transactions Nationally, Down significantly from 2016 Volume lower by 18% Fewer portfolio deals overall, REITS out of market Lower Foreign investment. 2016 saw several high-value deals across the country and in Chicago Anbang alone makes up the difference (InterContinental and Fairmont, 2016) $952M Also has now had its assets seized by China s Government. Union Investment RE (London House) $315M, Per key $697k Trophy sales such as these are largely done.

Trends, ctd. Rates remain flat, with active lending allowing for refinancing. Concerns about future inflation make this appealing. No major individual sales in 2017, Refinancing, renovation and brand changes continued. New openings were extremely strong, and are expected to continue, which may hurt appeal of existing property sales.

Suburban Hotel Future A growing issue in the next few years Franchises are beginning to remove branding on hotels over 20 years old. Forces new development in existing clusters to maintain a major flag, spurring construction. Forces older hotels to re-brand to lower scale flags, resulting in discounted sale prices. We expect for a cluster of 5 hotels, 1 new construction building. The end result will be a wave of downgrading similar to what happened with the roadside motels 20 years ago.