Clean Energy Transition Insights

Gain valuable insights on rate design in a 100% clean energy transition from Travis Kavulla, Director of Energy & Environmental Policy at R Street Institute. Understand the importance of good rate design in promoting renewable energy integration and learn about the potential challenges and benefits of moving towards a sustainable energy future.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

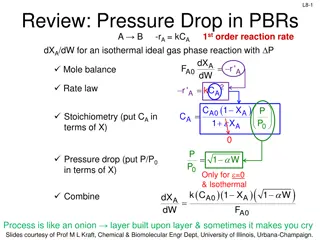

Presentation Transcript

Rate Design in a 100% Clean-Energy Transition Travis Kavulla Director, Energy & Environmental Policy R Street Institute Advanced Rate Design Workshop Honolulu, Hawaii July 15, 2019

Consider the Source Director, Energy & Environmental Policy, R Street Institute Governing Body Member, Western Energy Imbalance Market Formerly The Honorable Travis Kavulla : utility commissioner (State of Montana) and past president, National Association of Regulatory Utility Commissioners (NARUC) The views expressed here are mine alone.

Rate Design: Why should regulators care? Bad rate design leads to individuals taking actions that may be privately profitable but which may raise the cost to society to provide a reliable, clean supply of energy Example #1: Demand charges that lead batteries to be deployed for a siloed use (keeping individual consumer s demand below a certain threshold), rather than for system purposes Example #2: Supply rates that overstate marginal cost of energy, and lead to uneconomic entry of distributed energy resources Good rate design can allow demand to play an essential role in integrating a system dominated by renewable energy

Cost structure in a jurisdiction moving toward 100% Hawaii is not going green overnight, but it will happen relatively fast. The 25-year trajectory implies a few things are likely to happen: Fuel costs (variable costs) will diminish. Overall capital investment (fixed costs), whether HECO-led or customer-led, will increase. There will be more periods where the system will be oversupplied, and (unless overbuilt) there will also be more periods where energy is scarce.

If short-run variable costs were zero, customers electricity should probably be paid for like the smartphone than the gas station fill-up Rate Design at a 100% renewable end state? It d probably also look like the cell company in terms of system congestion management (e.g. throttling )

Do we want rate design to send price signals intended to accomplish investment (i.e., do we expect rate design to accomplish IRP/IGP-like objectives)? But moving to 100% poses tricky questions on rate design As renewables are added, how to reflect the value of energy during the (frequent) periods of vast oversupply and other (hopefully less frequent) periods of scarcity?

Supply Pricing in a Retail- Monopoly Marketplace If HI had many sellers & buyers Bid-based wholesale market + security-constrained network Locational Marginal Prices inform procurements/sales in a competitive retail environment. This structure gives rise to appropriate supply pricing in larger markets. Hawaii is not that. Its grids are not large and liquid enough to have a workable bid-based wholesale market. Many procurements made through a planning /RFP process although LMP-like prices should inform those procurements A second-best option to obtain accurate, useful supply prices is a cost-based market. (Wolak, 2018)* *Frank Wolak, Stanford University How should the Public Utilities Commission regulate the Hawaiian Electric Company for better integration of renewable energy?

Cost-Based Market The cost of generator units to HECO is known and approved by regulator, allowing a supply stack to be created (periodically modified by outages, fuel price increases, etc.) A day-ahead market model can estimate consumer load in order to create a day-ahead schedule of supply resources, and a measurement of the locational marginal cost of grid-delivered energy

Why a Market if HECO is a Monopoly? Uses a system model to project both a Day-Ahead system (not locational) marginal cost, or , for each hour of next day. Customers buy a baseline of usage based on existing rates. They may use more than or less than their baseline usage by paying/being credited . Pro tip: call it a rate design tool if you don t like the word market

Getting the Baseline Right The Customer Baseline Load (CBL) is important because it is the billing determinant for fixed-cost recovery Existing Customers CBL developed either actual historical metered half-hourly interval data for a customer s specific location, or from a template scaled to the actual historical monthly energy and monthly peak demands New Customers 100% of commercial projected load; 60% or greater of industrial customer s projected load Requirement to demonstrate actual peak load to avoid gaming

Uses of a Cost-Based Market A price within rate design to encourage demand participation: Georgia Power has 2,400 customers on this or its HA dynamic tariff (2/3 commercial; 1/3 industrial) Conceivable to have retail aggregators certified and responding to this price signal on behalf of residential customers Provides DERs a price signal for the economic substitution of offered generation from Day Ahead The market s two-part settlement (Day Ahead to Real Time) encourages forward hedging and reliability of supply, because (depending on design of IPP contracts & DER payment schemes) it is an economic resolution to generation & demand imbalances.

Some Possible Objections to this Approach It s a 100% renewable system, so it won t have any marginal costs Response: This is a system that is going to have huge excursions of oversupply and scarcity unless & until load is covered in each hour by 100% zero-marginal-cost resources. Is that really going to happen? Indeed, it may always have these characteristics (vacillating oversupply and scarcity) if the last increment of supply in scarcer times is price-responsive demand. Which, in a market where the value of lost load < marginal of storage storage, is quite likely. A postcard from the future: Imagine a Hawaii marketplace which is more a reverse curtailment auction than a supply the last unit of demand auction

Objections, Part Deux The prices won t rise high enough to get DER built Response: Not sure about that! In any case, using rate design to organically achieve significant sources of long-term supply in a monopoly market is odd, given that they are competing with a central procurer with a tendency to overbuild. Probably better that DER aggregators should sign contracts for energy/capacity obligations to HECO, like IPPs, and be responsible for imbalance in cost-based market s real-time settlement. (Again, using the market as a rate design tool.) If you want to test drive organic behavioral reactions, then relax the reserve margin in order to drive part of the portfolio to come from voluntary load curtailment/ merchant DER.

Finally: A Plea for Regulatory Flexibility Does every rate need to be spelled out precisely? In order to get significant DER/DR into a more predictable regime of procurement, there probably needs to be some contractual latitude on the part of HECO to achieve deals that match a customer s peculiar situation, or which relieve problematic points of congestion on network. Examples exist of customer protections in a more deregulated regime of rate design (special rates for poor or rural telecommunications customers)

Mahalo Questions? Travis Kavulla R Street Institute (406) 788-3419 tkavulla@rstreet.org