Colorado Education Property Tax Legislation Update and Feedback Session

Join the Joint Budget Committee for an update on proposed legislative changes to reform Colorado's property tax system in support of education. Stakeholder feedback is crucial for shaping the upcoming legislation. Stay informed and have your voice heard in this important process.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Education Property Tax Legislation Update and Stakeholder Feedback Session CRAIG HARPER JOINT BUDGET COMMITTEE STAFF OCTOBER 11, 2019 CRAIG.HARPER@STATE.CO.US 303-866-3481 Page 1

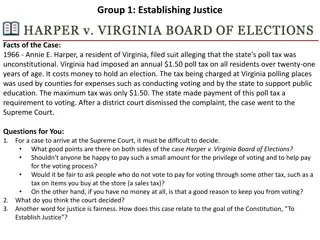

REMINDER: WHYAREWEHERE? The Joint Budget Committee is considering two legislative proposals to reform Colorado s property tax system supporting education. The Committee has asked for stakeholder input to shape and improve the legislation for introduction early in the 2020 legislative session. Uniform Mill Levy: Amend the School Finance Act to return the State to a uniform (statewide) total programmill levy with each school district s total program mill levy set at the lesser of the statewide mill levy or the mill levy necessary to fully fund the district s total program with local revenues. The mill levy would be uniform for any district receiving state aid for total program. Override Equalization: Provide a State match for mill levy override revenues raised in districts with lower property values (per pupil) to increase equity in mill levy overrides for lower-property-wealth districts. Matching system could be added to the uniform mill levy. 2

FEEDBACK PROCESS: UPDATES As many of you know, we are using an online polling tool to generate feedback to inform the Committee s discussions. We test drove that tool here at the September School Finance Project meeting. Since then, CASB has used the tool in a series of regional meetings to generate feedback from their members. Matt Cook is going to present some of the results from those discussions. I have another set of questions to follow Matt s presentation. 3

Thank You! Craig Harper Joint budget Committee staff Craig.harper@state.co.us 303-866-3481 4