Community Foundation Operational Sustainability: Revenue Sources and Asset Management

Explore operational sustainability for community foundation board members, focusing on revenue sources, asset expense mismatch, fund types, and workload distribution. Learn about effective revenue sources, the myth of asset size in sustainability, and fund analysis examples.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

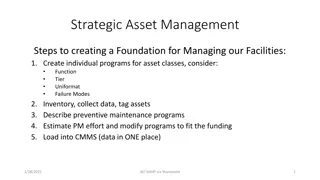

COMMUNITY FOUNDATION BASICS FORBOARD MEMBERS UNIT 7 OPERATIONAL SUSTAINABILITY

REVENUE SOURCES BEST Administrative Fees on Endowed Funds Payout from Operating Endowment GOOD Administrative Fees from Pass-through Funds Annual fundraising for Operating Funds NOT SO GOOD Grant from Unrestricted Fund Draw on Operating Reserve

The Big Myth About Community Foundation Sustainability SUSTAINABILITY IS NOT DETERMINED BY ASSET SIZE IT S ALL ABOUT ASSET MIX ASSET MIX = NUMBER, TYPEAND SIZEOF FUNDS

ASSET EXPENSE MISMATCH Total Assets Revenue Asset Mix Workload Expenses

Think of Fund Types as Different Products. Which Types of Funds ( Products ) Have the Largest Workload? SCHOLARSHIP FUNDS Law governing scholarship is very specific; you need to accept applications, manage a selection process; involves working with schools, individual applicants FIELD-OF-INTEREST FUNDS Variable workload depending on purpose, process DONOR ADVISED FUNDS Some donors require a lot of attention; some make lots of small grants UNRESTRICTED FUNDS Managing a competitive grant process requires reviewing proposals, site visits, committee process and reporting AGENCY ENDOWMENT FUNDS Generally involves cutting one check annually; can require meeting with agency leadership periodically; can be extremely challenging if agency runs into serious financial trouble COMMUNITY PROJECT FUNDS Generally lots of transactions because of small gifts; can involve more reporting if CF takes expenditure responsibility DESIGNATED FUNDS Generally involves cutting one check annually So, workload varies dramatically by fund type; fees generally are 1-2%

SAMPLE FUND ANALYSIS CHART (DOSIMPLERCHART) Assumptions: each fully loaded staff hour = $50; each fund has a 1% fee Fund Assets Fee Cost Situation Donor Advised $20,000 $200 Donor calls all the time asking for information on agencies Scholarship $5,000 $50 Committee process to award scholarship Community Fund (unrestricted) Donor Advised $300,000 $3,000 2 grant rounds per year $25,000 $250 Donor gives most of payout to her church Field of Interest $12,000 $120 Lots of small gifts requiring gift entry and acknowledgment letters; requires staff time to determine best use of fund Committee process to award scholarship Scholarship $40,000 $400 Agency endowment $10,000 $100 One check per year Designated $15,000 $150 One check per year Agency endowment $30,000 $300 Agency having financial problems and wants $$ back; lots of meetings to address this issue Wants to fund charitable activities of non 501c3 organizations Donor advised $2,000 $20 Designated $50,000 $500 Donor requests change of beneficiary

SUSTAINABILITY FORMULA SUSTAINABLE REVENUE OPERATING EXPENSE SUSTAINABILITY NUMBER

GIFT Community Foundation Statistics Based on 2012 CF Insights Data Information 66 community foundations reporting* SUSTAINABILITY STATUSOF GIFT COMMUNITY FOUNDATIONS SUSTAINABILITY RATE NUMBEROF GIFT CFS PERCENTOF GIFT CFS 100% or more 90-99% 80-89% 70-79% 60-69% 50-59% 40-49% 30-39% 0% - 29% 9 14% 18% 20% 12% 18% 7% 5% 6% 12 13 8 12 5 3 4 none NOTE: Sustainability rate is calculated by the following formula: Administrative Fee Income + Operating Endowment Distribution Divided by Total Operating Expenses *Affiliate community foundations were counted as one organization.

SO WHAT DO WE DO? A board needs to make a policy decision as to the appropriate balance of sustainable and other revenue and make decisions that, OVER TIME, will move in that direction A community foundation needs to educate donors about the costs of fund management. Expenses in excess of fees must come from somewhere the unrestricted fund, annual campaign, operating reserve. If you have some challenges with sustainability you need to create a long term plan to achieve sustainability OR If you are currently in a sustainable situation, develop organizational decision making structures can ensure you stay that way

STAFF TIME & SUSTAINABILITY Increase efficiency Recapture staff time Redeploy staff time to activities that support asset development Laser-like focus on asset development

IDEAS Understand your asset mix. Learn how to say no ; learn how to explain why you have to say no Develop products that work; put time limits on non-productive funds Consider a major overhaul of scholarships, the most time-consuming funds. Raise fund minimums or establish minimum fees or services for products Spend time cultivating large funds; find efficient ways to involve small donors Diversify the fee structure to include other types of fees beyond asset fees Review your grant process; can you eliminate steps or reduce paperwork? Review your event activities is the net income is worth the time and expense? Evaluate your services and communications with current donors. 75% of gifts to Indiana community foundations in 2011 went into existing funds. It all adds up a small change implemented rigorously over time can make a big difference

The Balancing Act Meeting individual donor expectations Providing something for everyone Being a leader in the community All things to all people The fund STORY Providing responsible stewardship Long-term commitment to community Adding real value to community Building charitable assets for the future Creating the structure of a permanent institution

Has your board ever discussed the different workload involved in managing different types of funds? What information would be helpful to you? After calculating your sustainability are you pleased? Concerned? What steps do you need to take to become more sustainable or maintain sustainability?