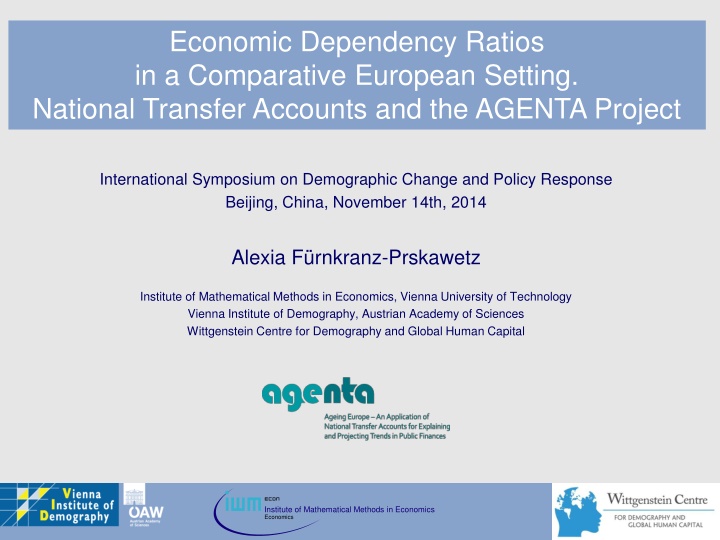

Comparative Analysis of Economic Dependency Ratios in Europe

This collection of images and data highlights the economic dependency ratios in a comparative European setting. It discusses demographic and economic dependencies, employment-based dependency, life cycle perspective, and NTA-based dependency. The content explores the age structure of the population, the division between working and non-working individuals, and the economic support needed for different age groups. Insights into life cycle deficit, NTA dependency ratio, and employment trends are provided, shedding light on the challenges and opportunities stemming from changing demographics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Economic Dependency Ratios in a Comparative European Setting. National Transfer Accounts and the AGENTA Project International Symposium on Demographic Change and Policy Response Beijing, China, November 14th, 2014 Alexia F rnkranz-Prskawetz Institute of Mathematical Methods in Economics, Vienna University of Technology Vienna Institute of Demography, Austrian Academy of Sciences Wittgenstein Centre for Demography and Global Human Capital Institute of Mathematical Methods in Economics Economics

Europe is Ageing 2013 2060 < 15: ~ 15% 15-64: 66% 57% 65+: 18% 28% 80+: 5% 12% Source: The 2015 Ageing Report, graph I.1.2 Institute for Mathematical Methods in Economics Economics

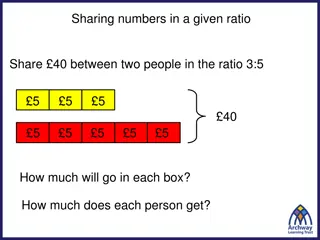

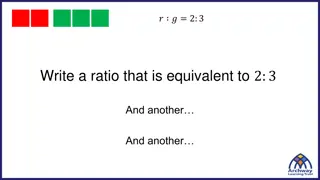

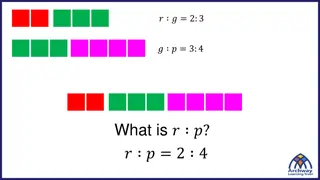

Demographic Dependency Economic Dependency < 20 + 65+ 20-64 Non-working workers Non-working: Working: children + unemployed + housewives/-men + retirees + other inactive full-time, part-time, compulsory military or civil services Institute for Mathematical Methods in Economics Economics

Employment based dependency 2011 Source: EU-Silc 2011, EUROSTAT Institute for Mathematical Methods in Economics Economics

Economic Dependency from a Life Cycle Perspective: NTA dependency ratio Need to consider also degree of dependency within dependent population degree of economic ability of those who support others age-specific difference of average consumption and income based on NTA Institute for Mathematical Methods in Economics Economics

Life Cycle Deficit comparative European setting 24(A) - 27(I) 58(Sl) - 64(SE) Institute for Mathematical Methods in Economics Economics

NTA based dependency life cycle deficit of young and elderly life cycle surplus of adult Institute for Mathematical Methods in Economics Economics

NTA based dependency 2011 2.60 IT 2.40 UK 2.20 NTA based dependency 2.00 1.80 FIFR ES HU 1.60 DE 1.40 AT SE 1.20 SI 1.00 1.00 1.10 1.20 1.30 Employment based dependency 1.40 1.50 1.60 1.70 1.80 Source: EU-Silc 2011, NTA Institute for Mathematical Methods in Economics Economics

Forecasts of employment based dependency Institute for Mathematical Methods in Economics Economics

Forecasts of employment based dependency Institute for Mathematical Methods in Economics Economics

Forecasts of NTA based dependency Institute for Mathematical Methods in Economics Economics

covering stages of dependency NTA Austria Consumption Labour income Asset Reallocation Private Transfers Public Transfers Institute for Mathematical Methods in Economics Economics

Unpaid work: the life cycle deficit by gender women produce more non-market goods and services than they consume except during teen ages The life cycle deficit is very low for men and stays positive over the whole age range in case of Italy Institute for Mathematical Methods in Economics Economics

NTTA life cycle deficit by GENDER gender differences are lower compared to only using NTA high contribution of women to production in Slovenia and Spain Institute for Mathematical Methods in Economics Economics

Conclusion/Discussion Consequence of population ageing not just determined by demographic change but to large extend by design of economic life cycle LCD as a new measure of dependency that takes into account age- specific levels of production and consumption To maintain the fiscal sustainability of the current public transfer system in many European countries requires changes in the design of the average economic life cycle Reforms of the transfer system need to take into account not only public transfers but also private transfers, particularly those in form of services to other household members through unpaid work Institute for Mathematical Methods in Economics Economics

AGENTA Ageing Europe An Application of National Transfer Accounts for Explaining and Projecting Trends in Public Finances (FP 7 Collaborative Research Project, no. 613247) http://www.agenta-project.eu/en/about-agenta.htm Institute for Mathematical Methods in Economics Economics

Thank you Institute for Mathematical Methods in Economics Economics