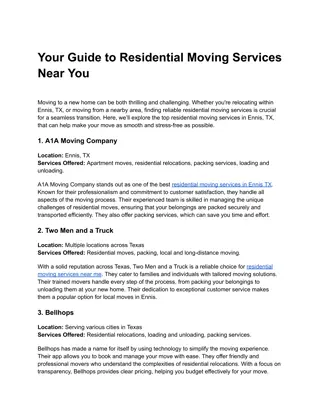

Competition in French Polynesia: Cost of Living Implications and Economic Analysis

Explore the implications of competition in French Polynesia on the cost of living through an intermediate economic report. The report delves into the methodology, diagnostic insights on import sources, cost of living comparison, and margin changes over the last 15 years across various sectors. Discover how margins have evolved amidst changing economic landscapes and sectors in the region.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

INSTITUTE FOR SMALL MARKETS LAW & ECONOMICS Competition in French Polynesia: Cost of Living Implications? Economics: Intermediate report 1

Methodology Substantive 1 Previous institutional work of sources of cost of living Economics survey, Analysis of data (sources: e.g., ISPF) 2 3 Analysis of law 4 Interviews Timing Intermediate report provisional suggestions 1 Feedback 2 3 Final report with recommendations 2

Diagnostic: Where do imports come from? Asia 42% of imports EU CMA/CGM strong position for French imports Data on shipping concentration and nature of goods transported available in CMA CGM/Bollor merger review at APC US / Canada Mostly food Australia / New Zealand South America 3

Diagnostic: Cost of living comparison Statistical Offices outcomes Basic + comparison based on products locally produced Consumer goods Value added Goods Intermediary goods Breakdown Telecoms Examples Services Banking Others Tourism Against whom to compare? France m tropolitaine 1 2 DROM COM 3 Other Pacific island economies 4

How have margins changed in last 20 years? Agriculture, sylviculture et p che Industries extractives Autres activit s de services Over last 15 years, margins relatively constant But cost of living has augmented Arts, spectacles et activit s r cr atives Activit s immobili res 2% Information et communication 3% Sant humaine et action sociale 3% Activit s sp cialis es, scientifiques et techniques 4% Activit s de services administratifs et de soutien 4% Activit s financi res et d'assurance 5% H bergement et restauration 16% Margin ratio by secteur, 2008, 2022 Activit s immobili res Sant humaine et action sociale Activit s sp cialis es, scientifiques et H bergement et restauration Commerce 15% Industrie manufacturi re Production et distribution lectricit , gaz, Construction Production et distribution lectricit , gaz, vapeur...eau, assainissemen Industries extractives Autres activit s de services Agriculture, sylviculture et p che Information et communication Enseignement Activit s financi res et d'assurance Activit s de services administratifs et de soutien Construction 10% Arts, spectacles et activit s r cr atives Transports et entreposage 15% Transports et entreposage Commerce 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 Industrie manufacturi re 14% 5 2022 2008 Source: ISPF Source: ISPF

Causes: Why would there be differences in cost of living? Structural Regulatory Market power Different categorisations By cause 1 Insularity vs regulation a b Insularity vs market power 2 Along the value chain 6

Causes: Structural Insularity 1 Transport costs (shipping, loading, stocking, etc.) a b Small economy: room for few players 2 Structure of demand Income distribution a b Europeanisation of demand Structure of supply 3 a Links with France of retailers (logistics and inputs traditionally or through contracts from France, coordination cost to change flows) b Import exclusivity c Exclusion of suppliers from some countries 7

Causes: Regulatory barriers Impact of various protectionist measures 1 Tariffs a Exclusions b Quantity limits c Differential taxation d 2 Regulation that restricts domestic competition Licenses a Business permits and training requirements b c Approvals to sell a product 8

Causes: Market power issues Entrepreneurship levels: normal 1 Entry barriers 2 a b High vertical integration (can be +ve, efficient by addressing market failures) High market share of main players High barriers to entry in a number of industries Access d c Difficulty to access land Difficulty to access finance Market power conversion into high margins OR high costs 3 Natural monopoly 4 9

Proposed Reform Objectives Proposed Reform Objectives Re-route imports (intervention could be limited in time) 1 a Advantage: lower costs and save on transport How: Change import duties, differential tax and partial or complete exclusion b Address bottlenecks 2 Stop import exclusivities and constrain contractual exclusivity a Increase access to scarce resources and vertical chains b Adapt and review protectionist measures 3 4 Review regulatory drafting for domestic restrictions in high margin sectors 10

Recommended next steps for government PPL products review 1 Competition assessment of sector regulation 7 Transport 2 a TDL and import quota International Conditional on development / pricing Domestic 3 Physical infrastructure b Food and retailing value chain Port expansion to allow larger vessels Information 4 Import rules c Price comparisons with Metropolitan France Code Digital comparison Tariffs 6 Business and product licensing Revise competition law text d Extend time for mergers & 3rd party comments Energy e Market studies information collection powers Note: macro aspects like fairness of tax system, redistribution, employment that are at play with the proposals and to assess No import exclusivity: reverse burden of proof 11