Consumer & Retail Industry M&A Insights

The latest insights and trends in the Consumer & Retail industry mergers and acquisitions (M&A) landscape. Gain valuable information on transaction analysis, valuation trends, and market activity. Stay informed with key statistics and data to make strategic decisions in the industry."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Consumer & Retail Industry M&A and Valuation Insights April 2024 www.peakstone.com

Overview 25+ Years Average Years of Peakstone MD Experience 500+ $200+ Billion Capital Raised by Peakstone MDs 2008 Year Founded Transactions by Peakstone MDs 18+ 40+ 30+ Countries Global Reach $10 - $500 Million Client Revenue Profile Industries Covered Investment Banking Professionals Selected Transactions M&A Advisor Financial Advisor M&A Advisor M&A Advisor M&A Advisor M&A Advisor Majority M&A Advisor M&A Advisor M&A Advisor M&A Advisor M&A Advisor M&A Advisor Contact Information Alex Fridman Managing Partner (312) 346-7303 afridman@peakstone.com Stephen Sleigh Managing Partner (312) 346-7318 ssleigh@peakstone.com Jeff Temple Managing Partner (312) 346-7301 jtemple@peakstone.com Connor Ryan Analyst (630) 363-2601 cryan@peakstone.com Noah Robles Associate (305) 494-2035 nrobles@peakstone.com Page 2

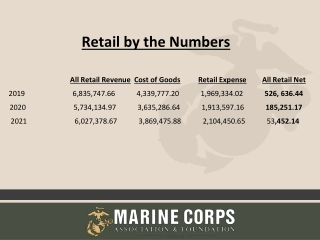

U.S. M&A Activity Consumer & Retail M&A Count Across the U.S. (2000 Mar 2024) 47 530 68 505 85 44 65 415 107 294 93 35 815 1,520 523 162 67 300 88 738 770 555 487 811 269 280 44 266 487 42 199 347 222 441 44 2,883 470 667 186 115 398 77 231 113 201 634 122 1,419 18 1,458 28 5 69 U.S. Consumer & Retail M&A Count (2000 Mar 2024) (#) 1,400 145 1,200 92 107106 104 1,000 104 95118 93 152 57 98 107 137 86 93 86 800 55 87108 44 52 1,261 63 600 1,079 9611,006880793827956879 54 871 765848 869799 454577668 686768834766 400 728 656 608 200 7 57 0 Strategic Financial Source: Capital IQ Note: As of March 31, 2024 Page 3

Transaction Analysis Median Transaction Value (2000 Mar 2024) ($ in millions) $30 $20 $10 $16 $18 $16 $30 $19 $22 $21 $12 $10 $7 $7 $8 $11 $10 $16 $13 $18 $25 $25 $16 $20 $24 $29 $20 $30 $0 Median EV Multiples (2000 Mar 2024) 15.0x 12.7x 12.8x 12.0x 10.7x 12.0x 10.8x 10.6x 10.6x 10.1x 10.0x 9.8x 9.4x 10.4x 8.0x 10.0x 9.0x 9.7x 9.6x 7.6x 9.0x 8.9x 8.6x 8.5x 8.4x 7.8x 7.7x 6.0x 5.7x 3.0x 0.7x0.6x 0.6x 0.7x0.8x0.7x 0.8x0.5x 0.6x0.5x1.1x0.7x 0.7x1.3x0.7x0.9x 0.9x 0.9x 0.9x 0.9x 1.0x 1.0x1.2x0.7x1.1x 0.0x EV/EBITDA EV/Revenue Source: Capital IQ Note: 2024 EV/EBITDA is shown as an average of the preceding years due to the presence of outliers; As of March 31, 2024 Page 4

Trading Analysis Relative Stock Performance (2013 Mar 2024) 400% Retail & Services: 255% 250% S&P 500: 231% Apparel: 127% 100% Auto & Electronics: 54% Leisure: 27% (50%) 2013 2014 2015 2016 2017 2018 2019 2020 2021 2023 2024 EV/EBITDA Trend (2013 Mar 2024) 20.0x S&P 500: 16.6x Retail & Services: 12.9x Auto & Electronics: 9.6x 10.0x Leisure: 8.1x Apparel: 8.0x 0.0x 2013 2014 2015 2016 2017 2018 2019 2020 2021 2023 2024 Key Peakstone Leisure Products Index ( Leisure ) Peakstone Apparel, Accessories, Footwear & Luxury Index ( Apparel ) Peakstone Auto Components & Consumer Electronics Index ( Auto & Electronics ) Peakstone Retailing & Consumer Services Index ( Retail & Services ) S&P 500 Peakstone Apparel, Accessories, Footwear & Luxury Index: VFC, PVH, HBI, UAA, RL, NKE, GPS, LULU, SKX, TJX, DECK, WWW Peakstone Automotive Components & Consumer Electronics Index: F, GM, BWA, LEA, GT, AAPL, MSFT, HPQ, UEIC Peakstone Retailing & Consumer Services Index: AMZN, WMT, MRNA, TGT, M, URBN, HD, LOW, SHW, MCD, CCL, YUM, HLT, ARMK, Peakstone Leisure Products Index: HAS, MAT, EA, BC, PII, JAKK, PTON Source: Capital IQ Note: As of March 31, 2024 Page 5

Selected Transactions Deal Size ($mm) Date Target Buyer Target Description Transaction Comments Herbal Brands is a GMP-certified manufacturer and retail distributor of health and wellness products KAC Investments acquired Herbal Brands from Clever Leaves Holdings for $8 million on March 21, 2024 KAC Investments Mar-2024 Herbal Brands $8 Vista Outdoor designs, manufactures, and markets outdoor recreation and shooting sports products MNC Capital Partners submitted a proposal to acquire Vista Outdoor for $3.1 billion in March 2024 MNC Capital Partners Mar-2024 Vista Outdoor $3,158 ORW USA owns and operates a chain of retail stores that sell off- road motor vehicle parts and accessories across the United States ARB Corporation Limited ARB Corporation Limited acquired 30% stake in ORW USA for $5 million in February 2024 Feb-2024 ORW USA $5 Walmart entered into a definitive agreement to acquire VIZIO Holding Corp. from BlackRock, The Vanguard Group, Innolux Corporation, Q- Run Holdings and others for $2.4 billion on February 19, 2024 VIZIO Holding Corp., through its subsidiaries, provides smart televisions, sound bars, and accessories in the United States VIZIO Holding Corporation Feb-2024 Walmart $2,495 Rogan Shoes operates as an omnichannel retailer of footwear for women, men, kids, and toddlers Shoe Carnival acquired Rogan Shoes, Incorporated from family for $50 million on February 13, 2024 Feb-2024 Rogan Shoes Shoe Carnival $50 Blum Holdings entered into a binding letter of intent to acquire Operators Only for $3 million on February 9, 2024 Operators Only operates as a retail marijuana company Operators Only Corporation Feb-2024 Blum Holdings $3 Tiny Fund, managed by Tiny entered into a share purchase agreement to acquire WholesalePet.com (Retail Store Network) from Emerge US Holdings for $9 million on January 23, 2024 Retail Store Networks operates as an online retail platform for pet products Retail Store Networks Jan-2024 Tiny Limited $9 ABG Intermediate Holdings entered into a Purchase Agreement to acquire Saucony from Wolverine Worldwide, for $70 million on January 10, 2024 Saucony manufactures and sells footwear and apparel for men, women, and kids ABG Intermediate Holdings Jan-2024 Saucony $70 W.S. Badcock Corporation operates home furniture retail stores in the United States Conn s acquired W.S. Badcock Corporation from Franchise Group for $74 million on December 18, 2023 W.S. Badcock Corporation Dec-2023 Conn's $74 Source: Capital IQ Note: Selected transactions have disclosed transaction value Page 6