Contractor Insolvency: Challenges and Solutions in Construction Industry

Learn about the implications of contractor insolvency in the construction industry, including causes, warning signs, and mitigation measures. Explore why many contractors face financial distress and what employers can do to protect their projects. Gain insights from industry experts on navigating through insolvency risks effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

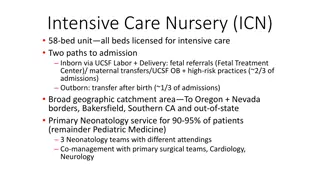

Contractor insolvency ICN Training Session 6 April 2022

Introduction Trowers & Hamlins national construction team with over 50 construction lawyers in 4 UK offices Advise on all areas of contentious and non-contentious construction Set up the ICN Framework and advise many of its members on a regular basis Today s speaker: Tom Holroyd Partner, Construction team

Agenda 1. What is going in the market? 2. Mitigation measures 3. What to do if the worst happens 4. Questions

Why so many insolvencies? In the NW alone: Bardsley, Pochin, Forrest, CPUK, Goodwin, Harry Fairclough, Marcus Worthington / Hollinwood, Cruden, Artez, Beaumont Morgan, Mulbury, Melrose, DJ Hughes Why so many insolvencies? Brexit: put pressure on material / labour prices and drove uncertainty in the market Covid: reduced the supply of already squeezed labour and, in addition, contractors carried the prelims risk during site shutdowns Ukraine: more inflation The contractor = stuck in the middle of a fixed price contract upstream and supply chain inflation downstream

Should employers be concerned about insolvency? Typical project cost overrun is 20-40% Typical delay is 12-24 months Diversion of staff in the immediate aftermath Transfer of LDI / building warranty difficult Defects common Bonds / insolvency cover / PCG will typically not pay out until the project is finished

Contractors who may be at risk Over-exposure on just 1 or 2 projects Over-exposure to a particular market sector Contractors with a limited number of clients Contractors who expanded rapidly 2017-2021 Contractors with a well-known 'problem' project Absence of a strong balance sheet

The obvious warning signs Late or non-payment of supply chain invoices or employees wages Unsatisfied court judgements Winding up petitions Rumours within the industry Late filing of accounts or annual returns at Companies House Official announcements to shareholders/the market regarding financial performance

More subtle warning signs Spurious claims for EOT or payment Surprising / uncommercial decisions on a project Termination of other contract(s) High turnover of subcontractors or staff Attempts to negotiate changes in payment terms Involvement of factoring companies Excessively aggressive approach to late payment Inability to obtain a performance bond

Mitigating the insolvency risk Contract stage

Initial considerations Is the contractor potentially at risk apply tests above Take references speak to clients on other live jobs Credit searches Companies Court searches Understand the group structure

Contractual protections the obvious ones Performance bond 10% of contract sum Reputable, creditworthy, UK-based bondsman Expires at PC or end of DLP ABI wording LDI Insolvency cover (eg NHBC) Mixed bag but better than nothing Used to be 10% but often now capped around 200K Terms vary NHBC good, others not so Insurers slow to respond

Contractual protections the obvious ones Retention 3-5% of contract sum Limited relevance early in the project but good later Increasingly unpopular option - consider retention bond? PCG Not a substitute for a bond / insolvency cover 9 times out of 10 the parent goes down with the subsidiary Do your due diligence on the parent

Contractual protections the less obvious ones Project Bank Accounts Neutral bank account established that monthly valuations are paid into by employer Sub-contractors paid directly from the PBA each month Contractor draws the surplus (if any) Ensures money flows to the supply chain Risk of slow progress / suspension reduced Step-in becomes a credible option if the contractor goes bust Can be expensive / time consuming to set up and operate

Contractual protections the less obvious ones Phasing the project Where possible, consider splitting the project and have a option to not proceed with later phases Limits exposure Incentivises the contractor Collateral warranties (with step-in) Step-in often talked about rarely used due to risk of inheriting the mess the contractor has left behind However, if a PBA has been implemented, step-in rights can be valuable

Mitigating the insolvency risk Post-contract stage

Post-contract mitigation Don't ignore the warning signs act early and prepare for the worst Accurate monthly valuations Withholding monies that are due may be counter-productive Keep your documents in order: Collateral warranties LDI policies Product guarantees

What does 'gone bust' actually mean? Administration Typically started by directors of contractor Activates a 'moratorium' Administrators take full control and will look at options, eg selling assets or pre-pack Very rare for main contractors to trade out of administration At end of administration, contractor is liquidated Administrators often cooperative not the enemy but won't have money to spend Note: administration for JCT purposes not effective until administrators appointed often around 5 days from initial notice

What does 'gone bust' actually mean? Liquidation Typically started by a creditor issuing a winding-up petition Requires a Court hearing and a winding-up Order WUPs often dismissed before the Court hearing WUPs show on public record and can cause a chain reaction before the hearing If a winding-up Order is granted, then the contractor immediately placed into compulsory liquidation No way out of liquidation Note: liquidation for JCT purposes not effective until winding-up Order is made can be long lag time (6-8 weeks) between knowledge of the WUP and Order being made

Urgent actions day 1 or 2 Site security Site protection Site insurance Payment notices

Follow-on actions first week or so Gather in contract documents Serve termination notice Site condition survey Notify LDI, PCG or bondsman Package deals / golden brick - check land ownership position

What to expect in the medium term LDI may be a pain: NHBC may control the appointment of the replacement contractor Transfer to a new contractor problematic Policy may automatically terminate Expect to find defects Expect to pay more than original contract sum Bonds and PCG typically will not pay out until the project is completed and you're at the end of the DLP

FAQs Will we get any money back from the contractor? Can we force the administrator / liquidator to help us? Who is responsible for defects now? The bondsman wants a lot of information what should we do? I want to employ the same security / scaffolding / cabins firm how should I go about that?

Contact Tom Holroyd Partner d 0161 838 2022 / 07811 409851 e tholroyd@trowers.com Follow us and join our online discussion @trowers_law @trowers Trowers & Hamlins