Convergence Process of Per Capita GDP in China, Japan, Korea: Trends and Scenarios

Analyzing the convergence process of per capita GDP in China, Japan, and Korea, this presentation highlights historical trends and future scenarios. It delves into the contributions to growth in China, social financing stock, augmented deficits, and net borrowings. Explore the dynamics shaping economic development and policy implications in the Asia-Pacific region.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Steven Barnett Division Chief The views expressed in this presentation are those of the author and do not necessarily represent those of the IMF or IMF policy. IMF Asia and Pacific Department January 2014

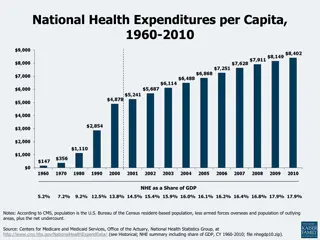

Convergence Process of Per Capita GDP: China, Japan, Korea (PPP, relative to United States) 80 80 Japan (1955 1982) Korea (1961 1997) China (1979 2012) Baseline scenario (2013-30) Rebalancing scenario 70 70 GDP per capita relative to the 60 60 50 50 United States 40 40 30 30 20 20 10 10 0 0 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 Number of years of expansion Source: IMF staff estimates. 1 4 7

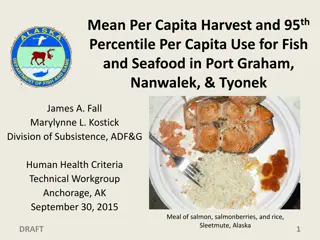

China: Contribution to Growth by Input (In percentage points) Human capital Physical capital accumulation TFP GDP growth 11 11 9 9 7 7 5.8 6.2 5 5 2.7 3 3 4.0 3.3 2.4 1 1 -1 -1 2001-2008 2009-2012 2013-30 Source:IMF staff estimates.

China: Social Financing Stock (In percent of GDP*) 2013Q3 Non-fin enterprise equity and other 200 200 200 Entrustred loans, trust loans, bank acceptance, net corporate bond financing Bank loans 10 180 180 Total 49 160 160 2008Q4 140 140 129 5 120 120 141 15 109 100 100 2003 2005 2007 2009 2011 2013 2013Q3 * In percent of 4Q rolling sum of quarterly GDP. Projected 2013Q3 GDP. Sources: CEIC; and IMF staff calculations.

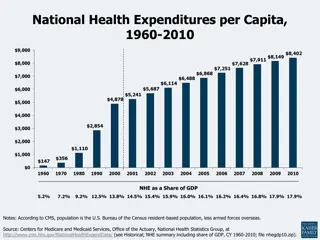

Augmented Deficits and Net Borrowings (In percent of GDP) 16 16 Augmented fiscal deficit 12 12 Net proceeds from land sales Augmented net borrowing 8 8 4 4 General government deficit 0 0 1997 Sources: CEIC, Chinabond, EUROSTAT, China Citic Press, China Trustee Association, NAO, and the Ministry of Finance, Zhang and Barnett (2013). 1999 2001 2003 2005 2007 2009 2011

Peoples Republic of China: 2013 Article IV Report http://www.imf.org/external/pubs/cat/longres.aspx?sk=40786.0 China s Growth: Why Less is More (Blog : Steven Barnett; 29-Oct-13) http://blog-imfdirect.imf.org/2013/10/29/chinas- growth-why-less-is-more/ IMF and PBC Joint Conference on Capital Flows Management: Lessons from International Experience www.imf.org/external/np/seminars/eng/2013/capitalflows/ pdf/032013.pdf